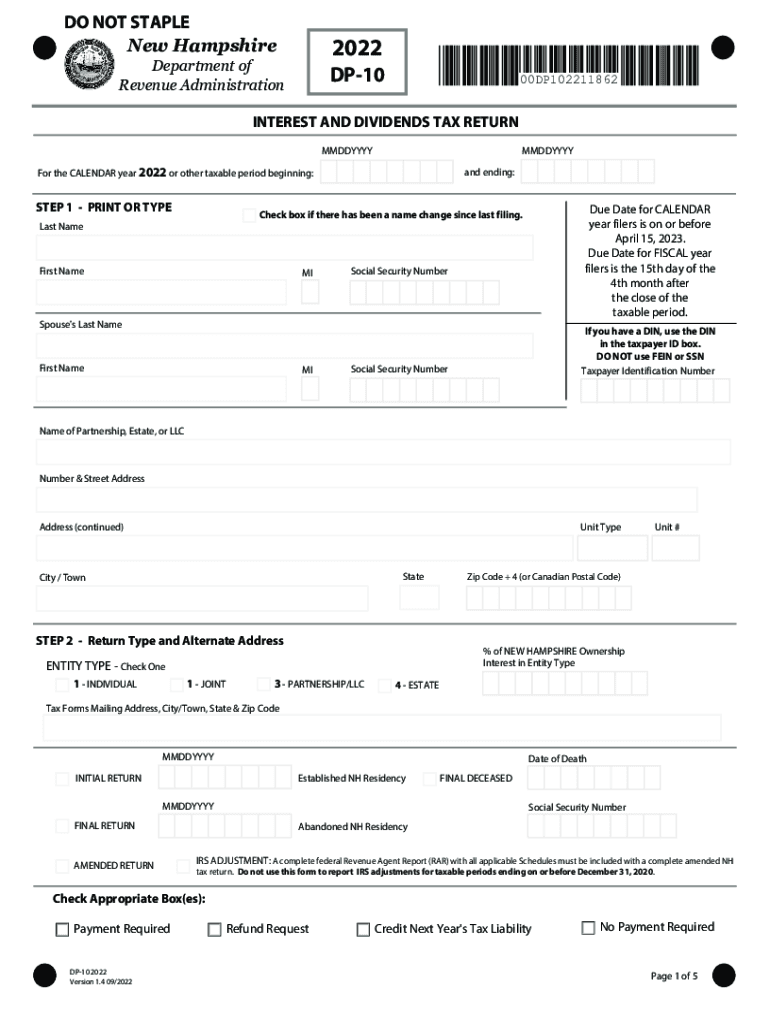

DP 10 NH Department of Revenue Administration 2022

What is the DP 10 NH Department Of Revenue Administration

The DP 10 is a form issued by the New Hampshire Department of Revenue Administration. It is primarily used for reporting and documenting the revenue of certain entities, ensuring compliance with state tax regulations. This form is essential for businesses and individuals who need to accurately report their income and maintain transparency with the state authorities.

Steps to complete the DP 10 NH Department Of Revenue Administration

Completing the DP 10 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense reports. Next, fill out the form with precise information regarding revenue sources and amounts. It is crucial to double-check all entries for accuracy before submission. Finally, ensure that the form is signed and dated appropriately, as this validates the submission.

Legal use of the DP 10 NH Department Of Revenue Administration

The legal use of the DP 10 form is governed by state tax laws. To be considered valid, the form must be completed in accordance with the guidelines set forth by the New Hampshire Department of Revenue Administration. This includes providing accurate and truthful information, as any discrepancies may lead to penalties or legal ramifications. Utilizing a reliable eSignature solution can help ensure that the form is executed legally and securely.

Form Submission Methods

The DP 10 can be submitted through various methods to accommodate different preferences. These methods include online submission via the New Hampshire Department of Revenue Administration's portal, mailing the completed form to the designated address, or delivering it in person at a local office. Each method has its own timeline for processing, so it is advisable to choose the one that best fits your needs.

Filing Deadlines / Important Dates

Staying informed about filing deadlines is crucial for compliance with state regulations. The DP 10 must be filed by specific dates, which are typically outlined by the New Hampshire Department of Revenue Administration. Missing these deadlines can result in penalties or interest charges, so it is important to mark these dates on your calendar and prepare your documents in advance.

Required Documents

To complete the DP 10, several documents are required to support the information provided. These may include financial statements, tax returns from previous years, and any relevant receipts or invoices that substantiate reported income. Having these documents readily available will facilitate a smoother completion process and help ensure accuracy in reporting.

Quick guide on how to complete dp 10 2022 nh department of revenue administration

Effortlessly Prepare DP 10 NH Department Of Revenue Administration on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal sustainable substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents quickly and without delay. Handle DP 10 NH Department Of Revenue Administration on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The Easiest Way to Edit and Electronically Sign DP 10 NH Department Of Revenue Administration Stress-Free

- Locate DP 10 NH Department Of Revenue Administration and select Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes only seconds and carries the same legal authority as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, text (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your selected device. Edit and electronically sign DP 10 NH Department Of Revenue Administration to ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dp 10 2022 nh department of revenue administration

Create this form in 5 minutes!

How to create an eSignature for the dp 10 2022 nh department of revenue administration

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'form dp 10' and how does it work?

The 'form dp 10' is a specific document used for detailed data submissions. With airSlate SignNow, you can easily fill out and eSign the form dp 10, streamlining your document management and ensuring compliance with submission requirements.

-

How can I ensure my 'form dp 10' is secure?

airSlate SignNow provides robust security features for your documents, including the 'form dp 10.' With encrypted storage and secure sharing options, you can be confident that your sensitive data is protected throughout the signing process.

-

What features does airSlate SignNow offer for the 'form dp 10'?

airSlate SignNow includes a variety of features for the 'form dp 10' such as easy editing, form templates, and automated workflows. These tools help you manage your documents efficiently while ensuring a user-friendly experience for all parties involved.

-

Is there a cost associated with using the 'form dp 10' on airSlate SignNow?

Yes, there are pricing plans for using the 'form dp 10' and other document services on airSlate SignNow. The platform offers flexible pricing options tailored to fit the needs of businesses, whether large or small, allowing you to choose a plan that best suits your budget.

-

Can I integrate the 'form dp 10' with other software solutions?

Absolutely! airSlate SignNow offers integrations with various software solutions, making it easy to incorporate the 'form dp 10' into your existing workflows. This ensures a seamless experience when managing documents across different platforms.

-

What are the benefits of using airSlate SignNow for the 'form dp 10'?

Using airSlate SignNow for the 'form dp 10' offers numerous benefits including time savings, increased efficiency, and reduced paper usage. By digitizing your document processes, you can enhance your operations while contributing to a more sustainable environment.

-

Is it easy to eSign the 'form dp 10' through airSlate SignNow?

Yes, eSigning the 'form dp 10' using airSlate SignNow is straightforward and user-friendly. Simply upload the document, add the necessary fields, and invite signers to complete the process with just a few clicks.

Get more for DP 10 NH Department Of Revenue Administration

- Sample letter to judge asking for compassionate release letter sample form

- Appointment of any person resolution form corporate resolutions

- Or public place form

- Assumption agreement form

- Membership agreement template form

- Medical records release form printable

- License agreement between form

- Merger agreement sample form

Find out other DP 10 NH Department Of Revenue Administration

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free