Another Affidavit of Support Question Form

Understanding the AZ Form 82514

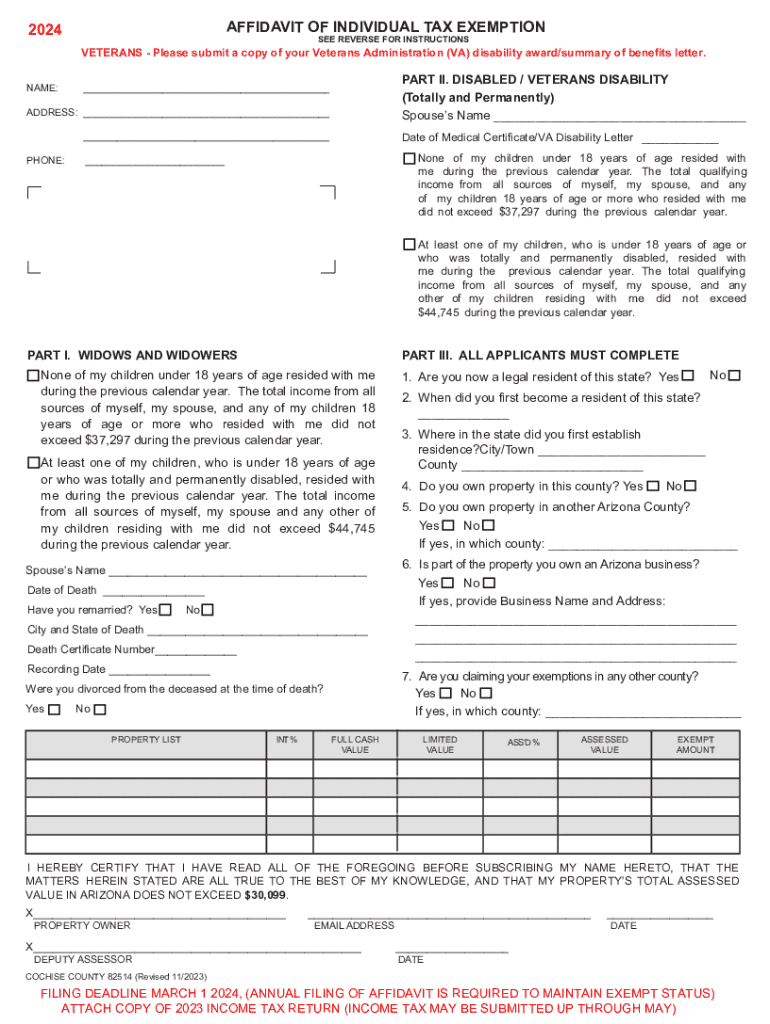

The AZ Form 82514, also known as the DOR Form 82514, is an affidavit used in Arizona for various legal and tax purposes. This form is primarily utilized to claim an exemption from certain taxes, making it essential for individuals and businesses seeking to navigate Arizona's tax regulations effectively. Understanding the purpose and implications of this form can help ensure compliance and avoid potential penalties.

Steps to Complete the AZ Form 82514

Completing the AZ Form 82514 involves several key steps:

- Gather necessary information, such as your personal details, tax identification number, and any relevant financial data.

- Clearly indicate the reason for the exemption you are claiming on the form.

- Ensure all sections of the form are filled out accurately to prevent delays in processing.

- Review the completed form for any errors or omissions before submission.

Legal Use of the AZ Form 82514

The AZ Form 82514 serves as a legal document that must be completed in accordance with Arizona state laws. It is crucial for individuals and entities to understand the legal implications of submitting this form, as it may affect tax obligations and compliance status. Misuse or incorrect submission of the form can lead to legal consequences, including penalties or fines.

Required Documents for the AZ Form 82514

When submitting the AZ Form 82514, certain documents may be required to support your claim for exemption. These documents can include:

- Proof of identity, such as a driver's license or state ID.

- Financial statements or tax returns that demonstrate eligibility for the exemption.

- Any additional documentation specified by the Arizona Department of Revenue.

Form Submission Methods

The AZ Form 82514 can be submitted through various methods to accommodate different preferences:

- Online submission via the Arizona Department of Revenue's website.

- Mailing the completed form to the designated address provided on the form.

- In-person submission at local Department of Revenue offices.

Eligibility Criteria for the AZ Form 82514

To qualify for the exemption claimed on the AZ Form 82514, applicants must meet specific eligibility criteria. These criteria often include:

- Residency status in Arizona.

- Compliance with state tax laws.

- Demonstration of financial need or other qualifying factors as outlined by the Arizona Department of Revenue.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the another affidavit of support question

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the az form 82514 and how can airSlate SignNow help?

The az form 82514 is a specific document used in Arizona for various administrative purposes. airSlate SignNow simplifies the process of completing and signing this form by providing an intuitive platform that allows users to eSign documents securely and efficiently.

-

How much does it cost to use airSlate SignNow for the az form 82514?

airSlate SignNow offers competitive pricing plans that cater to different business needs. Users can choose from monthly or annual subscriptions, ensuring that they can manage the az form 82514 and other documents without breaking the bank.

-

What features does airSlate SignNow offer for managing the az form 82514?

airSlate SignNow provides a range of features including customizable templates, real-time tracking, and secure cloud storage. These features make it easy to manage the az form 82514 and ensure that all signatures are collected promptly and securely.

-

Can I integrate airSlate SignNow with other applications for the az form 82514?

Yes, airSlate SignNow offers seamless integrations with various applications such as Google Drive, Dropbox, and CRM systems. This allows users to easily access and manage the az form 82514 alongside their other business tools.

-

Is airSlate SignNow compliant with legal standards for the az form 82514?

Absolutely! airSlate SignNow complies with all relevant legal standards for electronic signatures, ensuring that the az form 82514 is legally binding. This compliance provides peace of mind for businesses and individuals using the platform.

-

How does airSlate SignNow enhance the signing experience for the az form 82514?

airSlate SignNow enhances the signing experience by offering a user-friendly interface and mobile accessibility. This means that users can easily complete and sign the az form 82514 from anywhere, at any time, making the process more convenient.

-

What are the benefits of using airSlate SignNow for the az form 82514?

Using airSlate SignNow for the az form 82514 streamlines the document signing process, reduces turnaround time, and minimizes paperwork. Additionally, it helps businesses save costs associated with printing and mailing documents.

Get more for Another Affidavit Of Support Question

- Mississippi reconsideration form

- Motion in limine mississippi 497315428 form

- Mississippi plaintiff form

- Ms motor vehicle 497315430 form

- Request for admissions medical malpractice mississippi form

- Interrogatories and request for production mississippi form

- Mississippi injury form

- Request for production of documents and request for admissions mississippi form

Find out other Another Affidavit Of Support Question

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form

- Can I eSign Utah Lease agreement form