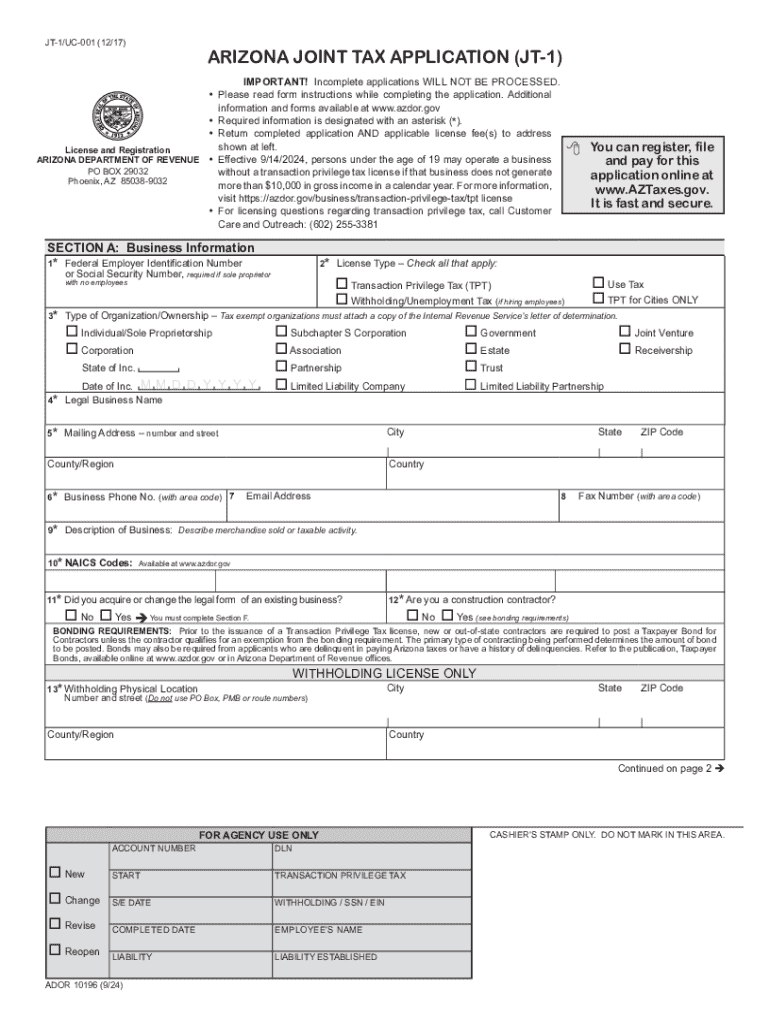

Arizona Tax Applications Printable Form

What is the Arizona Joint Tax Application JT 1?

The Arizona Joint Tax Application JT 1 is a specific form used by couples who wish to file their state taxes jointly in Arizona. This application allows both spouses to report their combined income, deductions, and credits, which can lead to potential tax benefits. By filing jointly, couples may qualify for a lower tax rate and increased deductions compared to filing separately. The JT 1 form is essential for ensuring compliance with state tax laws while maximizing financial advantages.

Steps to Complete the Arizona Joint Tax Application JT 1

Completing the Arizona Joint Tax Application JT 1 involves several key steps:

- Gather necessary documents, including income statements, previous tax returns, and any relevant deductions.

- Fill out personal information for both spouses, including Social Security numbers and filing status.

- Report total income, including wages, interest, and any other sources of income.

- Detail deductions and credits applicable to your situation, ensuring all information is accurate.

- Review the completed form for any errors before submission.

Legal Use of the Arizona Joint Tax Application JT 1

The Arizona Joint Tax Application JT 1 is legally recognized by the Arizona Department of Revenue. It must be completed accurately and submitted by the designated filing deadline to avoid penalties. Couples must ensure that all information provided is truthful and complete, as discrepancies can lead to audits or legal consequences. Understanding the legal implications of filing jointly is crucial for compliance with state tax regulations.

Form Submission Methods for the Arizona Joint Tax Application JT 1

The Arizona Joint Tax Application JT 1 can be submitted through various methods:

- Online Submission: Couples can file their application electronically through the Arizona Department of Revenue's online portal.

- Mail: The completed form can be printed and mailed to the appropriate address as specified by the Arizona Department of Revenue.

- In-Person: Taxpayers may also choose to submit their application in person at designated state tax offices.

Required Documents for the Arizona Joint Tax Application JT 1

To successfully complete the Arizona Joint Tax Application JT 1, couples need to gather several key documents:

- W-2 forms from employers for both spouses.

- 1099 forms for any additional income sources.

- Records of deductions such as mortgage interest, property taxes, and charitable contributions.

- Previous year’s tax return for reference.

Eligibility Criteria for the Arizona Joint Tax Application JT 1

To be eligible to file the Arizona Joint Tax Application JT 1, couples must meet certain criteria:

- Both spouses must agree to file jointly.

- Couples must be legally married as of the end of the tax year.

- Both spouses must provide valid Social Security numbers.

- Couples cannot file jointly if either spouse is a non-resident alien.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona tax applications printable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is jt 1 and how does it benefit my business?

JT 1 is a powerful feature within airSlate SignNow that streamlines the document signing process. It allows businesses to send and eSign documents quickly and efficiently, reducing turnaround time and improving productivity. By utilizing jt 1, companies can enhance their workflow and ensure that important documents are signed promptly.

-

How much does jt 1 cost for businesses?

The pricing for jt 1 varies based on the plan you choose with airSlate SignNow. We offer flexible pricing options that cater to businesses of all sizes, ensuring that you get the best value for your investment. For detailed pricing information, visit our pricing page or contact our sales team.

-

What features are included with jt 1?

JT 1 includes a range of features designed to simplify document management, such as customizable templates, real-time tracking, and secure cloud storage. These features work together to provide a seamless eSigning experience, making it easier for businesses to manage their documents efficiently. With jt 1, you can also integrate with other tools to enhance your workflow.

-

Can I integrate jt 1 with other software?

Yes, jt 1 is designed to integrate seamlessly with various software applications, including CRM systems, project management tools, and cloud storage services. This integration capability allows businesses to streamline their processes and improve overall efficiency. By connecting jt 1 with your existing tools, you can create a more cohesive workflow.

-

Is jt 1 secure for handling sensitive documents?

Absolutely! JT 1 prioritizes security and compliance, ensuring that all documents are protected with advanced encryption and secure access controls. This makes it a reliable choice for businesses that handle sensitive information. With jt 1, you can confidently send and eSign documents without compromising security.

-

How does jt 1 improve the eSigning process?

JT 1 enhances the eSigning process by providing an intuitive interface that simplifies document preparation and signing. Users can easily navigate through the steps, reducing the time it takes to get documents signed. This efficiency not only saves time but also improves the overall user experience for both senders and signers.

-

What types of documents can I send using jt 1?

With jt 1, you can send a wide variety of documents, including contracts, agreements, and forms. The platform supports multiple file formats, making it versatile for different business needs. Whether you need to send a simple document or a complex agreement, jt 1 can handle it all with ease.

Get more for Arizona Tax Applications Printable

- Request for production mississippi 497315435 form

- Petition for authority to bring suit and for approval of contingent fee contract mississippi form

- Petition for authority to settle doubtful claim with joinder apartment complex injury mississippi form

- Joinder form

- Complaint with pregnant plaintiff involved in accident mississippi form

- Mississippi jury instructions 497315440 form

- Dismissal without prejudice mississippi 497315441 form

- Motion enlargement form

Find out other Arizona Tax Applications Printable

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word