1099 Div Instructions Form

What is the 1099 Div Instructions

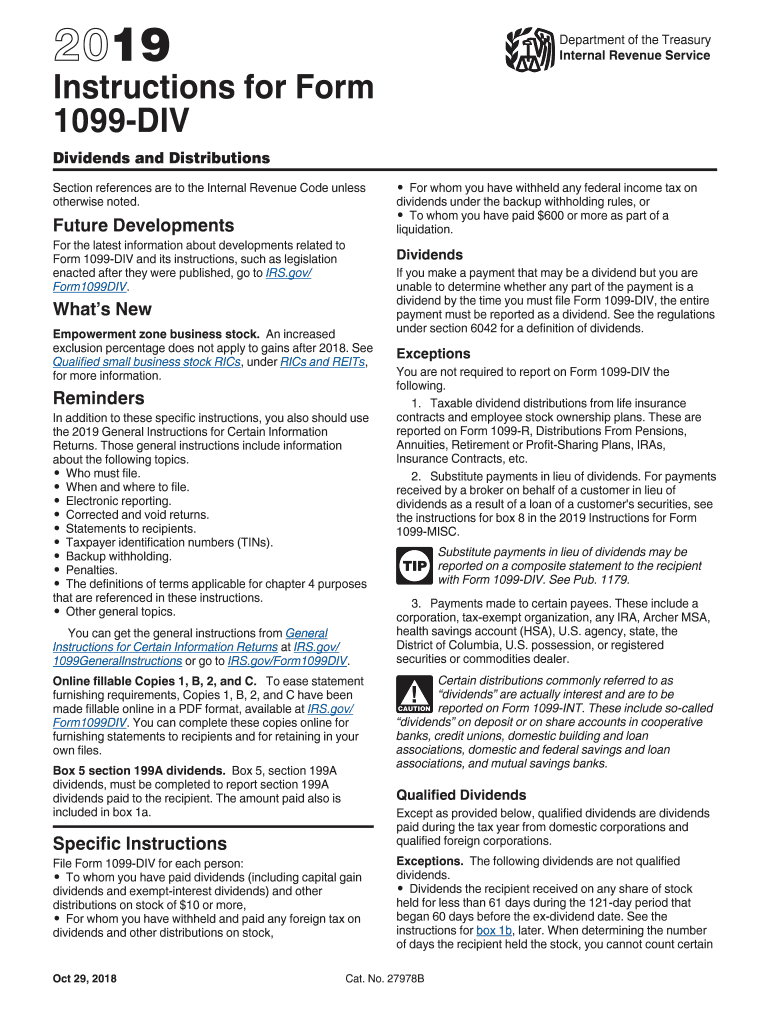

The 1099 Div form is used to report dividends and distributions to shareholders. It is essential for individuals and entities that receive dividends from stocks, mutual funds, or other investments. The instructions for this form provide guidance on how to accurately report these earnings to the Internal Revenue Service (IRS). The 1099 Div instructions detail the necessary information that must be included, such as the payer's details, the recipient's information, and the amounts received. Understanding these instructions ensures compliance with tax regulations and helps avoid potential penalties.

Steps to Complete the 1099 Div Instructions

Completing the 1099 Div form involves several key steps:

- Gather all necessary information, including the payer's name, address, and taxpayer identification number (TIN).

- Collect the recipient's details, such as their name, address, and TIN.

- Determine the total dividends and distributions to report, ensuring accurate calculations.

- Fill out the form, ensuring all fields are completed according to the IRS guidelines.

- Review the completed form for accuracy before submission.

How to Obtain the 1099 Div Instructions

To obtain the 1099 Div instructions, individuals can access the IRS website, where the form and its accompanying instructions are available for download. These documents are typically updated annually, so it is important to ensure that you are using the most current version. Additionally, financial institutions that issue 1099 Div forms may provide their own instructions or guidance for recipients.

Key Elements of the 1099 Div Instructions

The key elements of the 1099 Div instructions include:

- Information on who must file the form and who receives it.

- Details on the types of dividends that must be reported.

- Guidance on how to report foreign taxes paid on dividends.

- Instructions for correcting errors on previously filed forms.

IRS Guidelines

The IRS guidelines for the 1099 Div form outline the requirements for reporting dividends and distributions. These guidelines specify the thresholds for reporting, the types of payments that must be included, and the deadlines for submission. Compliance with these guidelines is crucial to avoid penalties and ensure proper tax reporting.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 Div form are critical for compliance. Typically, the form must be submitted to the IRS by the end of January for the previous tax year. Recipients should also receive their copies by this date. It is essential to keep track of these deadlines to avoid late filing penalties.

Quick guide on how to complete 2019 instructions for form 1099 div instructions for form 1099 div dividends and distributions

Complete 1099 Div Instructions effortlessly on any device

Web-based document management has surged in popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents promptly without delays. Manage 1099 Div Instructions on any device using the airSlate SignNow Android or iOS applications and improve any document-related process today.

The easiest way to modify and eSign 1099 Div Instructions with minimal effort

- Obtain 1099 Div Instructions and click Get Form to begin.

- Utilize the tools we provide to submit your document.

- Emphasize important sections of your documents or redact sensitive information with the tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to distribute your form, whether by email, text message (SMS), invite link, or download it to your computer.

Put an end to missing or lost documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and eSign 1099 Div Instructions and guarantee seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 instructions for form 1099 div instructions for form 1099 div dividends and distributions

How to create an eSignature for the 2019 Instructions For Form 1099 Div Instructions For Form 1099 Div Dividends And Distributions in the online mode

How to make an electronic signature for the 2019 Instructions For Form 1099 Div Instructions For Form 1099 Div Dividends And Distributions in Chrome

How to create an eSignature for signing the 2019 Instructions For Form 1099 Div Instructions For Form 1099 Div Dividends And Distributions in Gmail

How to generate an eSignature for the 2019 Instructions For Form 1099 Div Instructions For Form 1099 Div Dividends And Distributions right from your smartphone

How to generate an electronic signature for the 2019 Instructions For Form 1099 Div Instructions For Form 1099 Div Dividends And Distributions on iOS

How to generate an eSignature for the 2019 Instructions For Form 1099 Div Instructions For Form 1099 Div Dividends And Distributions on Android

People also ask

-

What is a 1099 DIV and why is it important?

A 1099 DIV is a tax form used to report dividends and distributions to shareholders. Understanding what is a 1099 div is crucial for accurate tax reporting, as it affects how income is declared on your tax return. It ensures compliance with IRS regulations, making sure you don't overlook any taxable income.

-

How does airSlate SignNow simplify the 1099 DIV signing process?

airSlate SignNow simplifies the signing process for a 1099 DIV by allowing users to send and eSign documents quickly and securely. By providing an easy-to-use platform, airSlate SignNow ensures that your important tax documents are signed and stored efficiently, thus saving you time and hassle during tax season.

-

What are the costs associated with using airSlate SignNow for 1099 DIV management?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Understanding what is a 1099 div management costs can help you choose the right plan to meet your needs while benefiting from features like unlimited document templates and secure cloud storage. Pricing is designed to be budget-friendly, making it a cost-effective solution.

-

Can I integrate airSlate SignNow with accounting software for 1099 DIV-related tasks?

Yes, airSlate SignNow can be seamlessly integrated with various accounting software tools to manage 1099 DIV tasks efficiently. Integrating these platforms allows for better tracking and organization of your tax documents, ensuring that you always have your information at hand when needed. This is particularly useful for streamlining your accounting processes.

-

What features does airSlate SignNow offer for electronic signing of a 1099 DIV?

airSlate SignNow offers essential features like audit trails, customizable templates, and advanced security measures specifically for electronic signing of a 1099 DIV. These features ensure that your documents are not only legally binding but also protected against unauthorized access, providing peace of mind for your financial dealings.

-

How does airSlate SignNow help with compliance regarding 1099 DIV submissions?

Compliance is crucial when handling tax documents, and airSlate SignNow helps ensure you are compliant with 1099 DIV submissions by offering features like automatic notifications and document tracking. Understanding what is a 1099 div compliance will allow you to benefit from these features, making sure all your important tax-related documents are submitted on time.

-

Is customer support available for questions about 1099 DIV documents in airSlate SignNow?

Absolutely! airSlate SignNow provides dedicated customer support to assist users with any inquiries about 1099 DIV documents. Our team is trained to help you understand what is a 1099 div and can guide you through the signing and submission processes, ensuring you have all the information you need.

Get more for 1099 Div Instructions

- Iowa and crime victims compensation program and subrogation form

- Iowa medicaid 470 2917 form

- Iowa controlled substance renewal 2011 form

- Application for crime victim compensation state of iowa iowa form

- Openup iowa form

- Office of state examiner of the louisiana municipal ose louisiana form

- Ci sammamish wa usfilesdocument7444 pdf the form

- Sample disengagement termination letters letter form

Find out other 1099 Div Instructions

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement