Taxpayer Information Refer to the Instructions Before Completing Part 1

Understanding the Taxpayer Information for Arizona Quarterly Tax

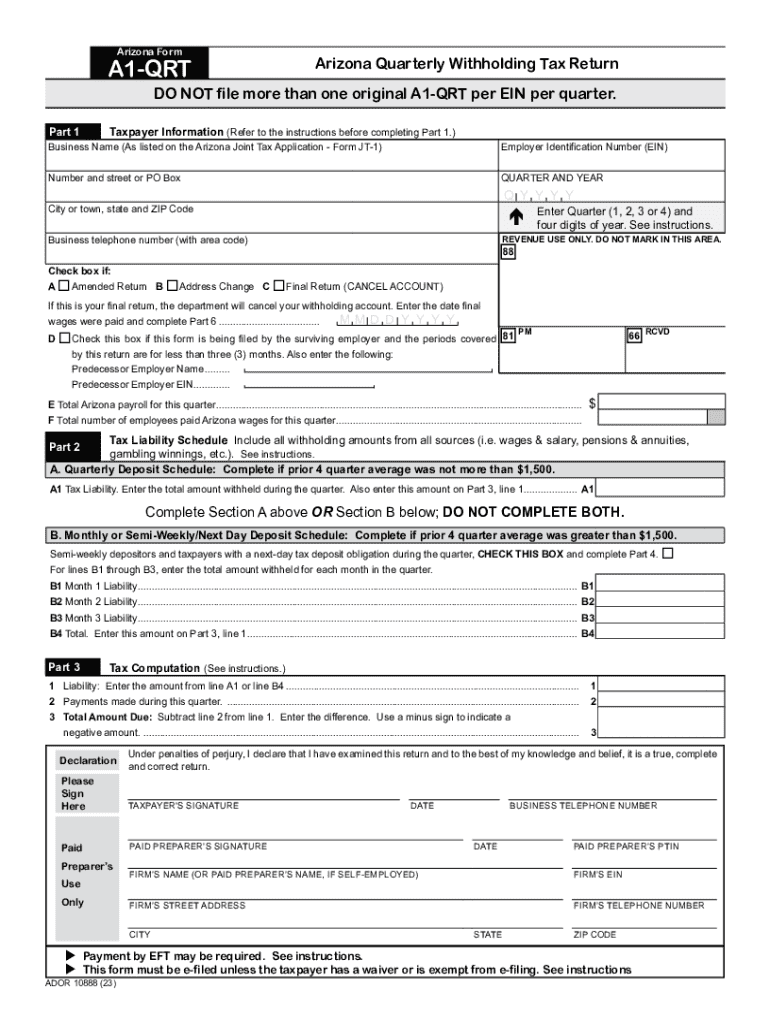

The taxpayer information section of the Arizona quarterly tax form is crucial for accurate filing. It typically requires details such as the taxpayer's name, address, and identification number. This information helps the Arizona Department of Revenue (ADOR) process the return correctly and ensures that the taxpayer's account is properly credited. It is essential to refer to the instructions provided with the form to ensure all information is filled out correctly, as any discrepancies can lead to processing delays or penalties.

Steps to Complete the Taxpayer Information Section

To complete the taxpayer information section of the Arizona quarterly tax form, follow these steps:

- Begin by entering your legal name as it appears on your tax documents.

- Provide your business name if applicable, especially for LLCs or corporations.

- Fill in your complete mailing address, including city, state, and ZIP code.

- Include your taxpayer identification number (TIN), which may be your Social Security number (SSN) or Employer Identification Number (EIN).

- Double-check all entries for accuracy before proceeding to the next section of the form.

Filing Deadlines for Arizona Quarterly Tax

Filing deadlines for the Arizona quarterly tax are important to avoid penalties. Typically, the due dates for filing are as follows:

- First quarter: April 30

- Second quarter: July 31

- Third quarter: October 31

- Fourth quarter: January 31 of the following year

It is advisable to submit your quarterly tax return by these dates to ensure compliance with state regulations.

Required Documents for Filing Arizona Quarterly Tax

When preparing to file the Arizona quarterly tax, ensure you have the following documents ready:

- The completed Arizona A1 QRT form.

- Records of all income and expenses for the quarter.

- Any relevant withholding tax documentation.

- Previous quarter tax returns for reference.

Having these documents organized will streamline the filing process and help ensure accuracy.

Form Submission Methods for Arizona Quarterly Tax

There are several methods available for submitting the Arizona quarterly tax form:

- Online: You can file your Arizona quarterly tax return electronically through the ADOR website.

- By Mail: Print the completed form and send it to the designated address provided in the instructions.

- In-Person: You may also choose to deliver your form directly to an ADOR office.

Each method has its own advantages, so choose the one that best fits your needs for convenience and efficiency.

Penalties for Non-Compliance with Arizona Quarterly Tax

Failing to comply with Arizona quarterly tax filing requirements can result in penalties. Common penalties include:

- Late filing penalties, which can accrue if the return is submitted after the due date.

- Interest on unpaid taxes, which accumulates until the tax is paid in full.

- Potential legal action for continued non-compliance.

It is essential to file on time and ensure all information is accurate to avoid these consequences.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the taxpayer information refer to the instructions before completing part 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Arizona quarterly tax and how does it affect my business?

Arizona quarterly tax refers to the estimated tax payments that businesses must make to the state of Arizona on a quarterly basis. This tax is based on the income generated by your business and is essential for maintaining compliance with state tax laws. Understanding Arizona quarterly tax is crucial for effective financial planning and avoiding penalties.

-

How can airSlate SignNow help with managing Arizona quarterly tax documents?

airSlate SignNow simplifies the process of managing documents related to Arizona quarterly tax by allowing you to easily send, sign, and store important tax forms electronically. This not only saves time but also ensures that your documents are securely stored and easily accessible when needed. With airSlate SignNow, you can streamline your tax documentation process.

-

What features does airSlate SignNow offer for Arizona quarterly tax management?

airSlate SignNow offers features such as customizable templates, automated reminders, and secure eSigning, which are particularly beneficial for managing Arizona quarterly tax documents. These features help ensure that you never miss a deadline and that your documents are completed accurately. Additionally, the platform provides a user-friendly interface that makes tax management straightforward.

-

Is airSlate SignNow cost-effective for handling Arizona quarterly tax?

Yes, airSlate SignNow is a cost-effective solution for handling Arizona quarterly tax. With various pricing plans available, businesses can choose an option that fits their budget while still benefiting from robust features. The savings in time and resources when managing tax documents electronically can also contribute to overall cost efficiency.

-

Can I integrate airSlate SignNow with my accounting software for Arizona quarterly tax?

Absolutely! airSlate SignNow offers integrations with popular accounting software, making it easier to manage your Arizona quarterly tax documents alongside your financial records. This seamless integration allows for better tracking of tax obligations and ensures that all relevant information is readily available when preparing your quarterly tax filings.

-

What are the benefits of using airSlate SignNow for Arizona quarterly tax?

Using airSlate SignNow for Arizona quarterly tax provides numerous benefits, including enhanced efficiency, improved accuracy, and reduced paperwork. The platform allows for quick document turnaround times, which is essential for meeting tax deadlines. Additionally, the secure eSigning feature ensures that your tax documents are legally binding and compliant with state regulations.

-

How does airSlate SignNow ensure the security of my Arizona quarterly tax documents?

airSlate SignNow prioritizes the security of your Arizona quarterly tax documents by employing advanced encryption and secure cloud storage. This means that your sensitive tax information is protected from unauthorized access. Furthermore, the platform complies with industry standards to ensure that your documents remain confidential and secure.

Get more for Taxpayer Information Refer To The Instructions Before Completing Part 1

Find out other Taxpayer Information Refer To The Instructions Before Completing Part 1

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease