CALL 1 877 423 6711 Form

What is the crf?

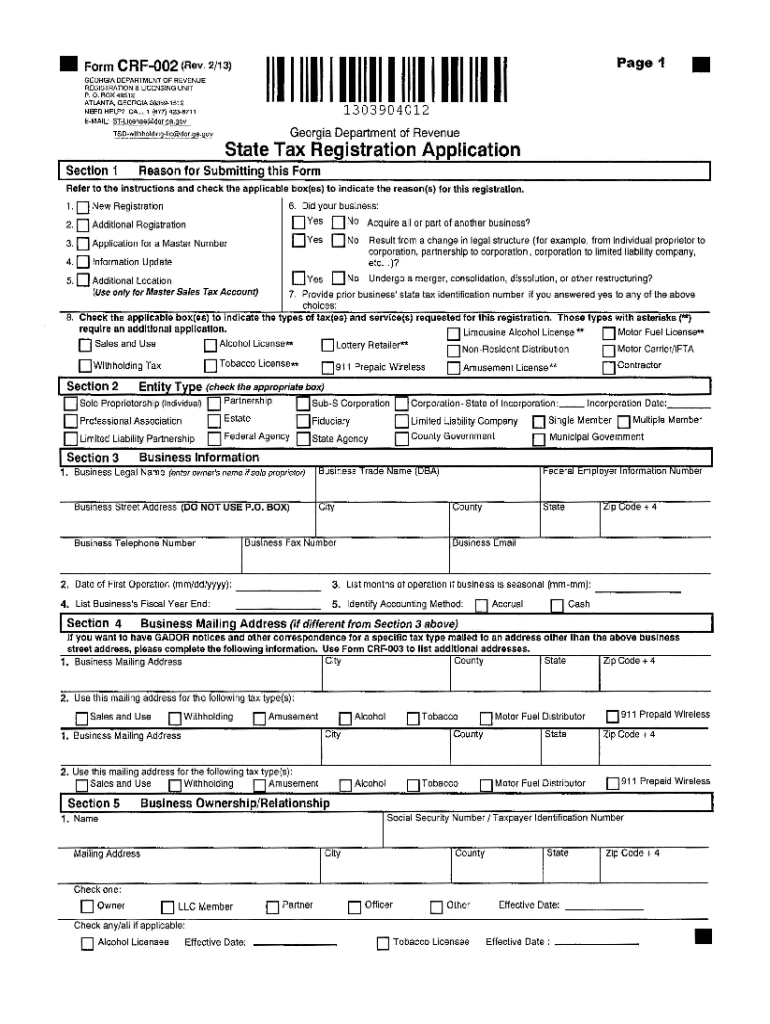

The crf, or the Georgia Form CRF 002, is a crucial document used for state registration in Georgia. This form is primarily utilized by businesses and organizations to register with the Georgia Department of Revenue. It ensures compliance with state regulations and helps maintain accurate records for tax purposes. Understanding the specifics of this form is essential for any entity looking to operate legally within the state.

Key elements of the crf

The crf includes several key elements that must be completed accurately. These elements typically involve the business name, address, and type of entity, such as a corporation or limited liability company. Additionally, the form may require information about the owners or officers of the business, as well as their social security numbers or tax identification numbers. Providing complete and accurate information is vital to avoid delays in processing.

Steps to complete the crf

Completing the crf involves a series of straightforward steps:

- Gather necessary information about your business, including its legal name and address.

- Identify the type of business entity you are registering.

- Fill out the form with accurate details, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate state agency, either online or by mail.

Filing Deadlines / Important Dates

It is essential to be aware of filing deadlines associated with the crf. Typically, businesses must submit this form within a specific timeframe after establishing their operations in Georgia. Missing these deadlines can result in penalties or complications with business registration. Keeping track of important dates ensures compliance and smooth operation.

Required Documents

When filing the crf, certain documents may be required to support your application. These can include:

- Proof of business address, such as a lease agreement.

- Identification documents for the business owners or officers.

- Any previous registration documents if applicable.

Having these documents ready can facilitate a smoother application process.

Legal use of the crf

The crf must be used in accordance with Georgia state laws. This means that businesses should ensure they are eligible to register and that they comply with all relevant regulations. Legal use of this form not only protects the business from potential legal issues but also ensures that it operates within the framework of state requirements.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the call 1 877 423 6711

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is CRF in the context of airSlate SignNow?

CRF stands for 'Customer Relationship Form,' which is a crucial component in managing customer interactions. With airSlate SignNow, CRF allows businesses to streamline their document signing processes, ensuring that customer data is collected efficiently and securely.

-

How does airSlate SignNow enhance the CRF process?

airSlate SignNow enhances the CRF process by providing an intuitive platform for creating, sending, and signing documents electronically. This not only speeds up the workflow but also reduces the chances of errors, making it easier for businesses to manage customer relationships effectively.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to different business needs. Whether you are a small business or a large enterprise, you can find a plan that fits your budget while still benefiting from the powerful CRF features that streamline document management.

-

Can airSlate SignNow integrate with other software for CRF management?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing your CRF management capabilities. This integration allows you to connect with CRM systems, project management tools, and more, ensuring a cohesive workflow across your business operations.

-

What are the key benefits of using airSlate SignNow for CRF?

Using airSlate SignNow for CRF provides numerous benefits, including increased efficiency, reduced turnaround times, and improved customer satisfaction. The platform's user-friendly interface makes it easy for teams to adopt, leading to faster document processing and enhanced customer interactions.

-

Is airSlate SignNow secure for handling CRF data?

Absolutely, airSlate SignNow prioritizes security, ensuring that all CRF data is protected with advanced encryption and compliance with industry standards. This commitment to security helps businesses maintain trust with their customers while managing sensitive information.

-

How can I get started with airSlate SignNow for my CRF needs?

Getting started with airSlate SignNow for your CRF needs is simple. You can sign up for a free trial to explore the platform's features and see how it can streamline your document signing process. Once you're ready, you can choose a pricing plan that suits your business.

Get more for CALL 1 877 423 6711

Find out other CALL 1 877 423 6711

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document