How to Give a Employee a 1099 Form

What is the 1099-C Form?

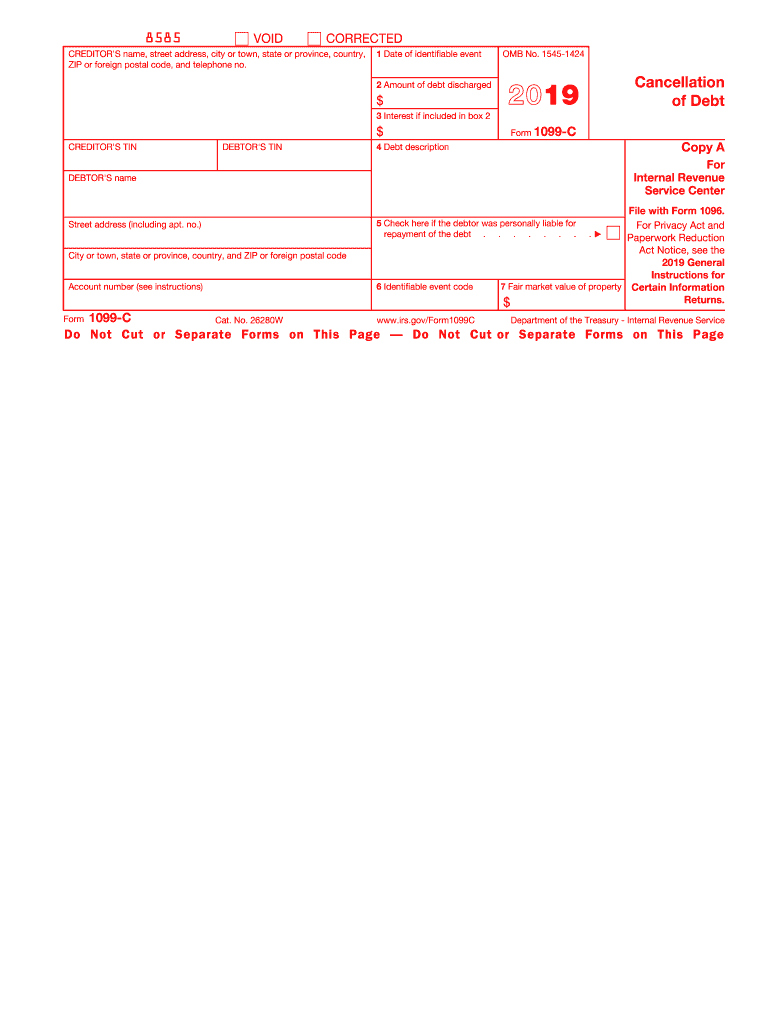

The 1099-C form, officially known as the Cancellation of Debt, is used by lenders to report the cancellation of a debt of $600 or more. This form is significant for taxpayers because the IRS considers canceled debt as taxable income. In the context of the 2019 tax year, the 1099-C 2019 serves as an essential document for individuals who have had debts written off, such as credit card balances or loans. Understanding the implications of this form is crucial for accurate tax reporting and compliance.

Steps to Complete the 1099-C Form

Completing the 1099-C form involves several steps to ensure accuracy and compliance with IRS guidelines. Follow these steps:

- Gather necessary information, including the debtor's name, address, and taxpayer identification number.

- Enter the lender's information, including name, address, and taxpayer identification number.

- Report the amount of canceled debt in Box 2, ensuring it reflects the correct figure.

- Complete additional boxes as needed, such as the date of cancellation and any applicable codes.

- Review the form for accuracy before submission.

IRS Guidelines for 1099-C Reporting

The IRS has specific guidelines regarding the reporting of canceled debts using the 1099-C form. It is essential to adhere to these guidelines to avoid penalties. Key points include:

- Form 1099-C must be issued by January 31 of the year following the cancellation of the debt.

- Taxpayers should report the canceled debt on their tax return, typically on Form 1040.

- Exceptions exist for certain types of canceled debts, such as those discharged in bankruptcy.

Filing Deadlines for the 1099-C Form

Filing deadlines for the 1099-C form are crucial for compliance. The IRS requires that the form be sent to the debtor by January 31 of the year following the cancellation. Additionally, the form must be filed with the IRS by February 28 if filing by paper, or by March 31 if filing electronically. Missing these deadlines can result in penalties for the issuer.

Penalties for Non-Compliance

Failure to comply with IRS regulations regarding the 1099-C form can lead to significant penalties. These may include:

- Fines for late filing or failure to file, which can range from $50 to $550 per form, depending on how late the form is submitted.

- Potential audits by the IRS if discrepancies arise from unreported canceled debts.

- Interest on any unpaid taxes resulting from the cancellation of debt.

Who Issues the 1099-C Form?

The 1099-C form is typically issued by financial institutions, credit card companies, or other lenders that have canceled a debt. It is important for both the issuer and the debtor to understand their responsibilities regarding this form. Debtors should expect to receive this form if they have had any significant debts canceled during the tax year, ensuring they can report it accurately on their tax returns.

Quick guide on how to complete form 1099 c cancellation of debt internal revenue service

Complete How To Give A Employee A 1099 effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without hindrances. Manage How To Give A Employee A 1099 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The easiest method to modify and eSign How To Give A Employee A 1099 effortlessly

- Locate How To Give A Employee A 1099 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign How To Give A Employee A 1099 and ensure outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1099 c cancellation of debt internal revenue service

How to make an eSignature for your Form 1099 C Cancellation Of Debt Internal Revenue Service in the online mode

How to generate an electronic signature for the Form 1099 C Cancellation Of Debt Internal Revenue Service in Chrome

How to generate an electronic signature for putting it on the Form 1099 C Cancellation Of Debt Internal Revenue Service in Gmail

How to create an eSignature for the Form 1099 C Cancellation Of Debt Internal Revenue Service from your mobile device

How to create an eSignature for the Form 1099 C Cancellation Of Debt Internal Revenue Service on iOS devices

How to create an eSignature for the Form 1099 C Cancellation Of Debt Internal Revenue Service on Android devices

People also ask

-

What is the 2019 1099c IRS form used for?

The 2019 1099C IRS form is used to report cancellation of debt. If a lender cancels a debt of $600 or more, they are required to issue this form to the debtor and the IRS. It's essential for taxpayers to include this information when filing their taxes, as it may affect their tax liability.

-

How can airSlate SignNow assist with 2019 1099c IRS documents?

airSlate SignNow provides an efficient way to send and eSign 2019 1099C IRS documents securely. You can create, manage, and store these forms digitally, ensuring compliance and easy access whenever needed. Our platform enhances the workflow for businesses dealing with tax documents.

-

What are the costs associated with using airSlate SignNow for 2019 1099c IRS forms?

airSlate SignNow offers flexible pricing plans that start at a cost-effective rate, making it accessible for businesses of all sizes. Each plan includes features essential for managing documents like the 2019 1099C IRS form. Explore our options to find the best fit for your business needs.

-

Can I integrate airSlate SignNow with other applications when handling 2019 1099c IRS forms?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing your ability to manage 2019 1099C IRS forms alongside your existing tools. These integrations allow for improved document workflows and data synchronization, making compliance easier.

-

What features does airSlate SignNow provide for managing 2019 1099c IRS documents?

airSlate SignNow includes features like template creation, secure eSigning, and document tracking for the 2019 1099C IRS forms. This ensures that all parties can sign documents efficiently while maintaining compliance. The user-friendly interface simplifies the entire process.

-

Is airSlate SignNow compliant with IRS regulations for 2019 1099c forms?

Absolutely, airSlate SignNow is designed to comply with IRS regulations regarding the 2019 1099C forms. Our electronic signatures are legally binding and adhere to the necessary standards, ensuring that your documents meet compliance requirements without hassle.

-

How does eSigning improve the process of handling 2019 1099c IRS forms?

eSigning with airSlate SignNow speeds up the process of handling 2019 1099C IRS forms by allowing documents to be signed from anywhere, at any time. This convenience reduces turnaround times and eliminates the need for physical signatures, improving overall efficiency.

Get more for How To Give A Employee A 1099

Find out other How To Give A Employee A 1099

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online