Form it 257 Claim of Right Credit Tax Year 2024-2026

What is the Form IT-257 Claim of Right Credit?

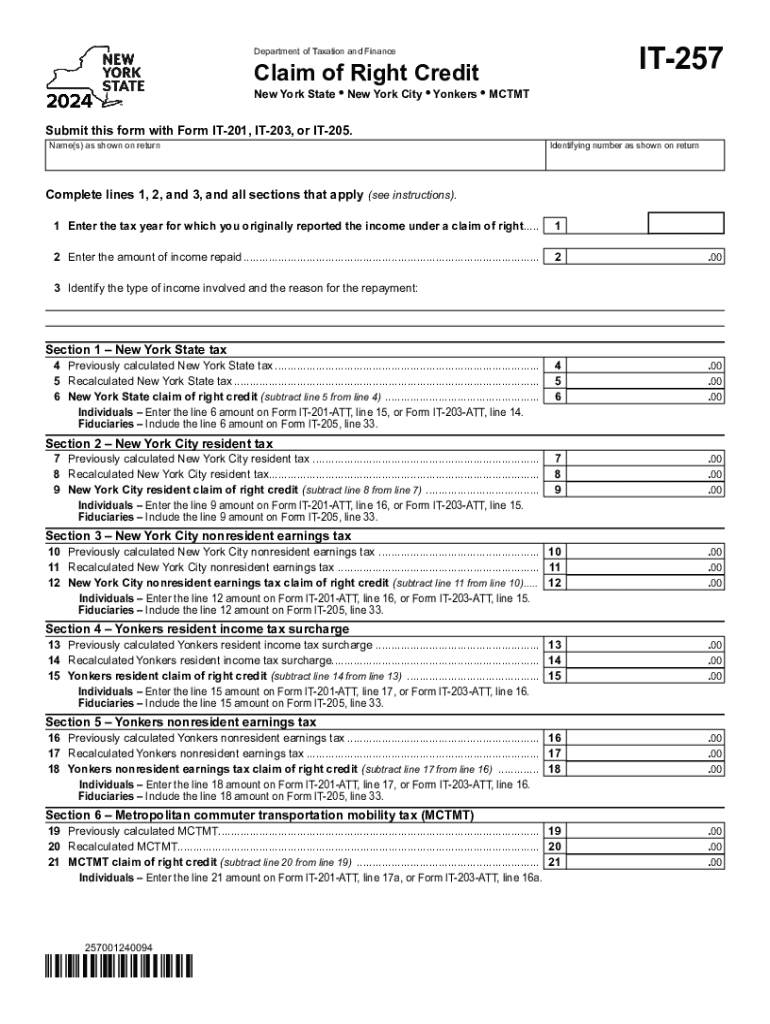

The Form IT-257 Claim of Right Credit is a tax form used in New York State that allows taxpayers to claim a credit for income that was previously reported and then later returned. This form is particularly relevant for individuals who have had to repay income that they received in prior years. The credit is designed to alleviate the tax burden associated with repaying this income, ensuring that taxpayers are not penalized for circumstances beyond their control.

Steps to Complete the Form IT-257 Claim of Right Credit

Completing the Form IT-257 involves several key steps:

- Gather necessary documentation, including any records of the income that was repaid.

- Fill out your personal information at the top of the form, including your name, address, and Social Security number.

- Report the amount of income that was repaid in the appropriate section of the form.

- Calculate the credit amount based on the repayment and your tax situation.

- Review the completed form for accuracy before submission.

Eligibility Criteria for the Form IT-257 Claim of Right Credit

To qualify for the Claim of Right Credit, taxpayers must meet specific eligibility criteria:

- Income must have been reported in a prior tax year.

- The taxpayer must have repaid the income in the current tax year.

- Documentation of the repayment must be provided with the form.

- The repayment must exceed a certain threshold to qualify for the credit.

How to Obtain the Form IT-257 Claim of Right Credit

The Form IT-257 can be obtained through several convenient methods:

- Visit the New York State Department of Taxation and Finance website to download the form.

- Request a physical copy by contacting the department directly.

- Access the form through tax preparation software that supports New York State tax filings.

Filing Deadlines for the Form IT-257 Claim of Right Credit

It is important to be aware of the filing deadlines associated with the Form IT-257. Generally, the form must be submitted by the same deadline as your annual tax return. Taxpayers should ensure they file on time to avoid penalties and interest on any unpaid taxes.

Examples of Using the Form IT-257 Claim of Right Credit

There are various scenarios where the Form IT-257 may be applicable:

- A taxpayer who received a bonus in one year and had to return it in the following year.

- An individual who had to repay unemployment benefits after an overpayment was discovered.

- A business owner who returned income due to a contractual dispute.

Create this form in 5 minutes or less

Find and fill out the correct form it 257 claim of right credit tax year 772083504

Create this form in 5 minutes!

How to create an eSignature for the form it 257 claim of right credit tax year 772083504

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it work?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and eSign documents quickly and securely. With its user-friendly interface, you can easily manage your documents and workflows, ensuring that your signing process is efficient and compliant. This makes it a great choice for businesses looking to streamline their operations in New York and beyond.

-

How much does airSlate SignNow cost?

The pricing for airSlate SignNow is competitive and designed to fit various business needs. Plans start at an affordable rate, making it accessible for small businesses in New York right through to larger enterprises. You can choose from monthly or annual subscriptions, allowing you to select the option that best suits your budget.

-

What features does airSlate SignNow offer?

airSlate SignNow offers a range of features including document templates, real-time tracking, and advanced security options. These features are designed to enhance your document management process, making it easier for businesses in New York to get documents signed quickly and securely. Additionally, the platform supports multiple file formats, ensuring versatility in your document handling.

-

Is airSlate SignNow compliant with legal standards?

Yes, airSlate SignNow is fully compliant with legal standards such as ESIGN and UETA, ensuring that your eSignatures are legally binding. This compliance is crucial for businesses operating in New York right, as it provides peace of mind when handling sensitive documents. You can trust that your signed documents will hold up in court if necessary.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow offers seamless integrations with popular applications like Google Drive, Salesforce, and Microsoft Office. This allows businesses in New York right to enhance their workflows by connecting their existing tools with SignNow, making document management even more efficient.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow can signNowly reduce the time and costs associated with traditional document signing processes. Businesses in New York right can benefit from faster turnaround times, improved accuracy, and enhanced security. Additionally, the platform's ease of use means that your team can quickly adapt to the system, maximizing productivity.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows you to explore its features without any commitment. This is an excellent opportunity for businesses in New York right to test the platform and see how it can meet their document signing needs. You can experience firsthand how easy it is to send and eSign documents.

Get more for Form IT 257 Claim Of Right Credit Tax Year

- Intermountain healthcare doctors note template form

- Form 541 illinois

- Taj tarik bey pdf form

- This invoice must be completed in english esta factura se debe llenar en ingles form

- Social security administration employment history report ab 1346 form

- Affidavit to offer copy of lost or destroyed will form

- 711 application name change state of illinois state il form

- 2297 rev form

Find out other Form IT 257 Claim Of Right Credit Tax Year

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself