Form it 201 V Payment Voucher for Income Tax Returns

What is the Form IT 201 V Payment Voucher For Income Tax Returns

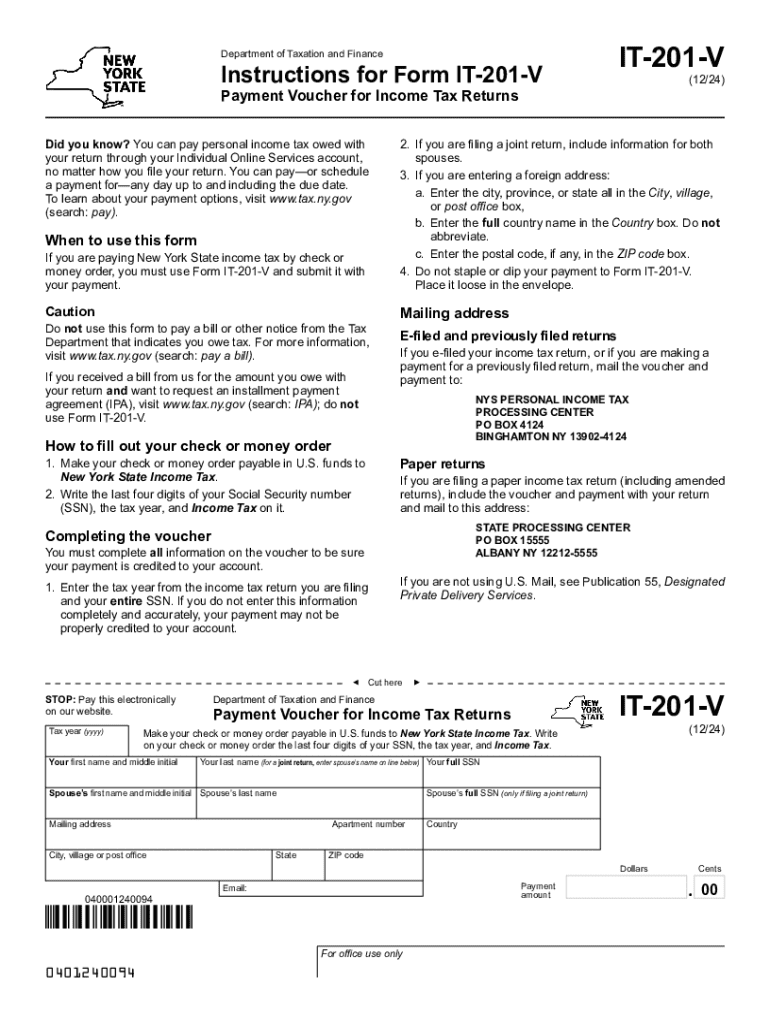

The Form IT 201 V is a payment voucher used by taxpayers in New York State to submit their income tax payments. This form is specifically designed for individuals who are filing their income tax returns and need to make a payment. It is essential for ensuring that payments are properly credited to the taxpayer's account. The IT 201 V form helps streamline the payment process and provides a clear record of the transaction for both the taxpayer and the state.

How to use the Form IT 201 V Payment Voucher For Income Tax Returns

To use the Form IT 201 V, taxpayers must first complete their income tax return. Once the tax amount due is determined, the taxpayer should fill out the payment voucher with the necessary information, including their name, address, and the amount being paid. It is important to ensure that the information matches what is on the tax return to avoid any processing issues. After completing the form, the taxpayer can submit it along with their payment to the appropriate address provided on the form.

Steps to complete the Form IT 201 V Payment Voucher For Income Tax Returns

Completing the Form IT 201 V involves several straightforward steps:

- Obtain the form from the New York State Department of Taxation and Finance website or through tax preparation software.

- Fill in your personal details, including your name, address, and taxpayer identification number.

- Indicate the amount of tax payment you are submitting.

- Double-check all information for accuracy to prevent delays in processing.

- Sign and date the voucher where indicated.

Key elements of the Form IT 201 V Payment Voucher For Income Tax Returns

The Form IT 201 V contains several key elements that are crucial for proper processing:

- Taxpayer Information: This includes your name, address, and identification number.

- Payment Amount: Clearly state the amount of tax you are paying.

- Signature: A signature is required to validate the payment voucher.

- Date: The date of the payment is essential for record-keeping and compliance.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Form IT 201 V. Payments can be made online through the New York State Department of Taxation and Finance website, allowing for quick processing. Alternatively, taxpayers can mail the completed form along with their payment to the designated address. For those who prefer a personal touch, in-person submissions may also be possible at local tax offices, although this option may vary by location.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Form IT 201 V. Typically, the payment voucher must be submitted by the same deadline as the income tax return, which is usually April fifteenth for most taxpayers. However, if the due date falls on a weekend or holiday, the deadline may be extended. Taxpayers should always verify the specific deadlines for the current tax year to ensure compliance and avoid penalties.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 201 v payment voucher for income tax returns

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is it 201 v and how does it benefit my business?

it 201 v is a powerful feature within airSlate SignNow that streamlines the document signing process. By utilizing it 201 v, businesses can enhance efficiency, reduce turnaround times, and improve overall workflow. This feature is designed to simplify eSigning, making it accessible for all users.

-

How much does it cost to use airSlate SignNow with it 201 v?

The pricing for airSlate SignNow with it 201 v is competitive and tailored to fit various business needs. We offer flexible subscription plans that cater to different team sizes and usage levels. You can choose a plan that best suits your budget while enjoying the full benefits of it 201 v.

-

What features are included with it 201 v in airSlate SignNow?

With it 201 v, users gain access to a suite of features including customizable templates, real-time tracking, and secure cloud storage. These features are designed to enhance the eSigning experience and ensure that your documents are managed efficiently. Additionally, it 201 v supports multiple file formats for added convenience.

-

Can I integrate it 201 v with other software applications?

Yes, airSlate SignNow with it 201 v offers seamless integrations with various software applications such as CRM systems, project management tools, and cloud storage services. This flexibility allows businesses to incorporate it 201 v into their existing workflows effortlessly. Integration enhances productivity and ensures a smooth document management process.

-

Is it 201 v secure for handling sensitive documents?

Absolutely! it 201 v prioritizes security, employing advanced encryption and compliance with industry standards to protect your sensitive documents. With airSlate SignNow, you can trust that your data is safe during the eSigning process. Our commitment to security ensures peace of mind for all users.

-

How does it 201 v improve the document signing process?

it 201 v simplifies the document signing process by allowing users to send, sign, and manage documents electronically. This reduces the need for physical paperwork and speeds up the entire workflow. By leveraging it 201 v, businesses can achieve faster approvals and enhance collaboration among team members.

-

What types of businesses can benefit from it 201 v?

it 201 v is designed to benefit a wide range of businesses, from small startups to large enterprises. Any organization that requires efficient document management and eSigning can leverage the capabilities of airSlate SignNow. Its versatility makes it an ideal solution for various industries, including finance, healthcare, and real estate.

Get more for Form IT 201 V Payment Voucher For Income Tax Returns

Find out other Form IT 201 V Payment Voucher For Income Tax Returns

- How Do I Electronic signature Colorado Promissory Note Template

- Can I Electronic signature Florida Promissory Note Template

- How To Electronic signature Hawaii Promissory Note Template

- Electronic signature Indiana Promissory Note Template Now

- Electronic signature Kansas Promissory Note Template Online

- Can I Electronic signature Louisiana Promissory Note Template

- Electronic signature Rhode Island Promissory Note Template Safe

- How To Electronic signature Texas Promissory Note Template

- Electronic signature Wyoming Indemnity Agreement Template Free

- Electronic signature Iowa Bookkeeping Contract Safe

- Electronic signature New York Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Computer

- Electronic signature South Carolina Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Easy

- How To Electronic signature South Carolina Bookkeeping Contract

- How Do I eSignature Arkansas Medical Records Release

- How Do I eSignature Iowa Medical Records Release

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple