Form 05 359, Request for Certificate of Account Status Form 05 359, Request for Certificate of Account Status

Overview of Form 05 305

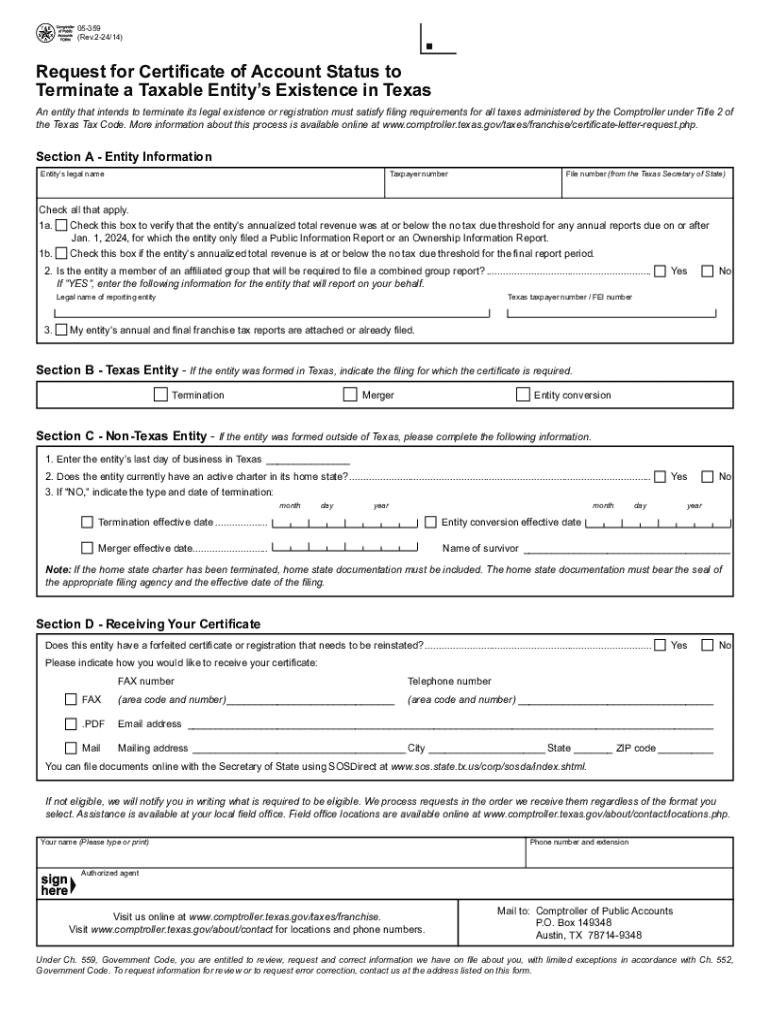

The Form 05 305, also known as the Request for Certificate of Account Status, is a document used primarily in Texas to verify the status of a business's franchise tax account. This form is essential for entities that need to demonstrate their compliance with state tax obligations, particularly when applying for loans, contracts, or other business opportunities. The certificate serves as proof that a business is in good standing with the Texas Comptroller's office.

How to Complete Form 05 305

Completing Form 05 305 involves several straightforward steps. First, gather all necessary information about your business, including your taxpayer identification number and any relevant account details. Next, accurately fill out the form, ensuring that all sections are completed to avoid delays. After completing the form, review it for accuracy before submission. This careful attention to detail helps facilitate a smoother approval process.

Obtaining Form 05 305

Form 05 305 can be obtained directly from the Texas Comptroller's website or through their offices. It is available in a downloadable format, allowing for easy access and printing. Businesses can also request the form via mail or in person at designated locations. Ensuring you have the most current version of the form is crucial for compliance and accuracy.

Submission Methods for Form 05 305

Once Form 05 305 is completed, it can be submitted through various methods. Businesses have the option to submit the form online through the Texas Comptroller's eSystems, which offers a convenient and efficient way to process requests. Alternatively, the form can be mailed to the appropriate address or delivered in person to a local Comptroller office. Each submission method has its own processing times, so it is advisable to choose the one that best suits your needs.

Key Elements of Form 05 305

Understanding the key elements of Form 05 305 is essential for successful completion. The form typically requires information such as the business name, address, and taxpayer number. Additionally, it may ask for specific details regarding the type of business entity and any outstanding tax obligations. Providing accurate and complete information helps ensure that the request for a certificate is processed without unnecessary delays.

Legal Uses of Form 05 305

Form 05 305 serves several legal purposes. It is often required when businesses seek to establish their credibility with financial institutions or governmental agencies. The certificate of account status can also be necessary for bidding on contracts or obtaining permits. Understanding the legal implications of this form can help businesses navigate compliance and maintain good standing with state authorities.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 05 359 request for certificate of account status form 05 359 request for certificate of account status

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 05 305 and how can it benefit my business?

Form 05 305 is a crucial document for various business processes, and using airSlate SignNow can streamline its completion and signing. By utilizing our platform, you can ensure that your form 05 305 is filled out accurately and signed electronically, saving time and reducing errors. This efficiency can enhance your overall workflow and improve compliance.

-

How much does it cost to use airSlate SignNow for form 05 305?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. The cost to use our platform for managing form 05 305 depends on the features you need and the number of users. We provide a free trial, allowing you to explore our services before committing to a plan.

-

Can I integrate airSlate SignNow with other software for managing form 05 305?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing your ability to manage form 05 305. Whether you use CRM systems, cloud storage, or project management tools, our integrations ensure that your document workflow remains efficient and connected. This flexibility allows you to customize your processes according to your business needs.

-

What features does airSlate SignNow offer for handling form 05 305?

airSlate SignNow provides a range of features specifically designed for handling form 05 305, including customizable templates, electronic signatures, and real-time tracking. These features help you manage your documents more effectively and ensure that all necessary steps are completed promptly. Additionally, our user-friendly interface makes it easy for anyone to navigate the process.

-

Is airSlate SignNow secure for signing form 05 305?

Absolutely! Security is a top priority at airSlate SignNow. Our platform uses advanced encryption and complies with industry standards to protect your data while signing form 05 305. You can trust that your sensitive information is safe and secure throughout the entire signing process.

-

How does airSlate SignNow improve the efficiency of processing form 05 305?

By using airSlate SignNow, you can signNowly improve the efficiency of processing form 05 305. Our platform automates many steps in the document workflow, reducing the time spent on manual tasks. This allows your team to focus on more critical activities, ultimately enhancing productivity and turnaround times.

-

Can I track the status of my form 05 305 with airSlate SignNow?

Yes, airSlate SignNow offers real-time tracking for your form 05 305. You can easily monitor who has viewed, signed, or completed the document at any time. This feature provides transparency and helps you manage deadlines effectively, ensuring that your processes stay on track.

Get more for Form 05 359, Request For Certificate Of Account Status Form 05 359, Request For Certificate Of Account Status

- Jury instruction false statement regarding federal workers compensation benefits form

- Instruction with force form

- Instruction interference with form

- Jury instruction interference with commerce by robbery hobbs act racketeering robbery form

- Jury instruction illegal gambling business bookmaking form

- 60 day notice of proposed information collection family

- Benefits investigation form id symtuza hcp

- Daily cleaning guide pepsi bargun pepsi equipment service form

Find out other Form 05 359, Request For Certificate Of Account Status Form 05 359, Request For Certificate Of Account Status

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation