Six Steps to Approve a Tax Abatement Chapter 312 2023-2026

Understanding the Six Steps to Approve a Tax Abatement Chapter 312

The Six Steps to Approve a Tax Abatement Chapter 312 is a structured process designed to guide municipalities in the United States through the approval of tax abatements. This process is crucial for local governments looking to incentivize development and investment in their areas. Each step is aimed at ensuring compliance with legal requirements while providing transparency and fairness in the approval process. Understanding these steps is essential for both applicants seeking tax relief and officials responsible for granting these abatements.

Steps to Complete the Six Steps to Approve a Tax Abatement Chapter 312

Completing the Six Steps to Approve a Tax Abatement Chapter 312 involves a systematic approach:

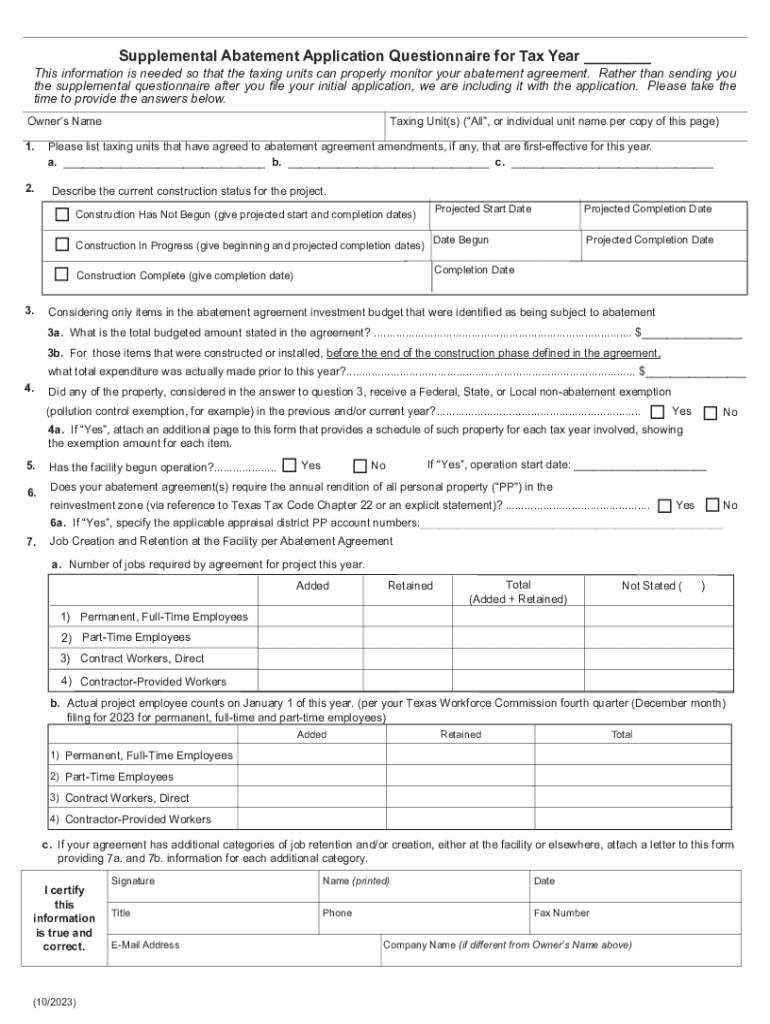

- Initial Application Submission: The applicant must submit a detailed application, including information about the project and the anticipated benefits to the community.

- Review by Local Authorities: The local governing body reviews the application for completeness and compliance with local regulations.

- Public Hearing: A public hearing is held to allow community members to voice their opinions regarding the proposed tax abatement.

- Decision Making: After considering public input, the governing body makes a decision on whether to approve or deny the application.

- Notification: The applicant is formally notified of the decision, and if approved, the terms of the abatement are outlined.

- Monitoring and Compliance: Once the abatement is granted, ongoing monitoring ensures that the applicant adheres to the agreed terms.

Key Elements of the Six Steps to Approve a Tax Abatement Chapter 312

Several key elements are vital to the success of the Six Steps to Approve a Tax Abatement Chapter 312:

- Eligibility Criteria: Applicants must meet specific criteria to qualify for a tax abatement, including project type and potential economic impact.

- Documentation Requirements: Complete and accurate documentation is necessary, detailing the project scope, financial projections, and anticipated benefits.

- Community Impact: The application must demonstrate how the project will positively impact the local community, such as job creation or infrastructure improvements.

- Compliance with Local Laws: Adherence to local laws and regulations is essential throughout the process to ensure legitimacy.

Legal Use of the Six Steps to Approve a Tax Abatement Chapter 312

The legal framework surrounding the Six Steps to Approve a Tax Abatement Chapter 312 is designed to protect both the municipality and the applicant. It ensures that the process is transparent and equitable. Local governments must follow these steps to avoid legal challenges and ensure that the tax abatement serves its intended purpose of stimulating economic growth while maintaining public trust.

Application Process and Approval Time

The application process for the Six Steps to Approve a Tax Abatement Chapter 312 can vary depending on the municipality. Typically, the entire process may take several weeks to months, depending on the complexity of the application and the scheduling of public hearings. It is important for applicants to be aware of any specific timelines set by local authorities to ensure timely submissions and responses.

Create this form in 5 minutes or less

Find and fill out the correct six steps to approve a tax abatement chapter 312

Create this form in 5 minutes!

How to create an eSignature for the six steps to approve a tax abatement chapter 312

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Six Steps To Approve A Tax Abatement Chapter 312?

The Six Steps To Approve A Tax Abatement Chapter 312 involve identifying eligible properties, submitting an application, conducting a public hearing, and obtaining approval from the governing body. Each step is crucial to ensure compliance with local regulations and maximize benefits for your business.

-

How can airSlate SignNow assist in the Six Steps To Approve A Tax Abatement Chapter 312?

airSlate SignNow streamlines the documentation process involved in the Six Steps To Approve A Tax Abatement Chapter 312. With our eSigning capabilities, you can easily send, sign, and manage all necessary documents, ensuring a smooth approval process.

-

What features does airSlate SignNow offer for tax abatement applications?

airSlate SignNow offers features such as customizable templates, secure eSigning, and real-time tracking, which are essential for completing the Six Steps To Approve A Tax Abatement Chapter 312 efficiently. These tools help you manage your applications effectively and keep all stakeholders informed.

-

Is there a cost associated with using airSlate SignNow for tax abatement processes?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Investing in our solution can signNowly simplify the Six Steps To Approve A Tax Abatement Chapter 312, ultimately saving you time and resources in the long run.

-

Can airSlate SignNow integrate with other software for tax abatement management?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow during the Six Steps To Approve A Tax Abatement Chapter 312. This integration allows for better data management and communication across platforms.

-

What are the benefits of using airSlate SignNow for tax abatement approvals?

Using airSlate SignNow for tax abatement approvals offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. These advantages are particularly valuable when navigating the Six Steps To Approve A Tax Abatement Chapter 312.

-

How does airSlate SignNow ensure the security of my tax abatement documents?

airSlate SignNow prioritizes document security by employing advanced encryption and secure storage solutions. This ensures that all documents related to the Six Steps To Approve A Tax Abatement Chapter 312 are protected against unauthorized access.

Get more for Six Steps To Approve A Tax Abatement Chapter 312

Find out other Six Steps To Approve A Tax Abatement Chapter 312

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document