Application for Property Tax Abatement Exemption for Harris 2019

What is the Application For Property Tax Abatement Exemption For Harris

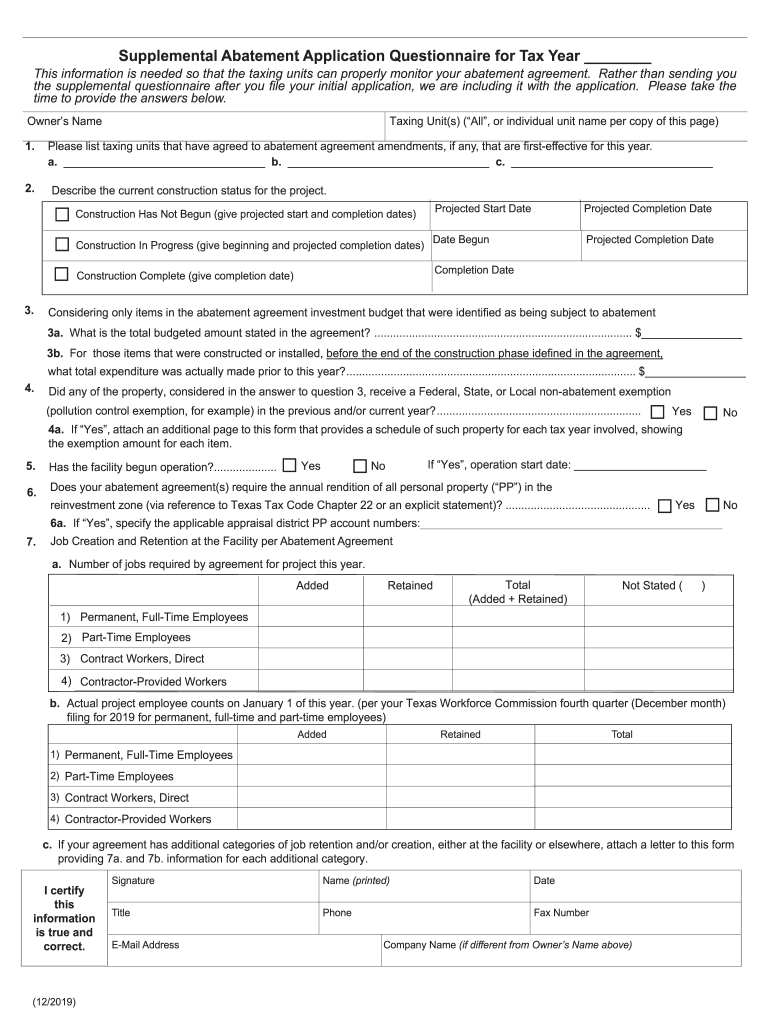

The Application For Property Tax Abatement Exemption For Harris is a formal request submitted by property owners seeking relief from property taxes. This exemption can significantly reduce the financial burden on homeowners and businesses by lowering the assessed value of their property for tax purposes. The application typically requires detailed information about the property, including its location, ownership, and the reason for the exemption request. Understanding the specifics of this application is crucial for ensuring compliance and maximizing potential benefits.

Steps to Complete the Application For Property Tax Abatement Exemption For Harris

Completing the Application For Property Tax Abatement Exemption For Harris involves several key steps:

- Gather necessary documentation, such as proof of ownership and any relevant financial statements.

- Fill out the application form accurately, ensuring all required fields are completed.

- Provide a clear explanation of the reasons for requesting the exemption, including any supporting evidence.

- Review the application for any errors or omissions before submission.

- Submit the application by the specified deadline, either online or via mail, depending on local regulations.

Eligibility Criteria

To qualify for the Application For Property Tax Abatement Exemption For Harris, applicants must meet specific criteria set by local authorities. Common eligibility requirements include:

- Ownership of the property in question.

- Compliance with local and state tax regulations.

- Demonstration of financial need or specific circumstances that warrant the exemption.

It is essential for applicants to review the specific eligibility criteria outlined by their local tax authority to ensure they meet all necessary requirements.

Required Documents

When submitting the Application For Property Tax Abatement Exemption For Harris, applicants must provide several supporting documents. These may include:

- Proof of property ownership, such as a deed or title.

- Financial statements or tax returns that demonstrate income levels.

- Any additional documentation that supports the request for exemption, such as letters from financial institutions or other relevant entities.

Having all required documents ready can streamline the application process and improve the chances of approval.

Form Submission Methods

The Application For Property Tax Abatement Exemption For Harris can typically be submitted through various methods, including:

- Online submission via the local tax authority's website, if available.

- Mailing the completed application to the designated office.

- In-person submission at local government offices during business hours.

Applicants should check with their local tax authority for specific submission guidelines and preferred methods.

Application Process & Approval Time

The application process for the Property Tax Abatement Exemption For Harris generally follows these stages:

- Submission of the completed application and supporting documents.

- Review by the local tax authority, which may take several weeks to months depending on the volume of applications.

- Notification of approval or denial, along with any reasons for denial, if applicable.

Understanding the timeline for approval can help applicants plan accordingly and manage their financial expectations.

Quick guide on how to complete application for property tax abatement exemption for harris

Complete Application For Property Tax Abatement Exemption For Harris effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents rapidly without delays. Manage Application For Property Tax Abatement Exemption For Harris on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Application For Property Tax Abatement Exemption For Harris with ease

- Obtain Application For Property Tax Abatement Exemption For Harris and click Get Form to commence.

- Use the tools available to fill out your document.

- Emphasize applicable sections of your documents or obscure confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes only a few seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your preferred device. Modify and electronically sign Application For Property Tax Abatement Exemption For Harris and ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct application for property tax abatement exemption for harris

Create this form in 5 minutes!

People also ask

-

What is the 'Application For Property Tax Abatement Exemption For Harris'?

The 'Application For Property Tax Abatement Exemption For Harris' is a formal request property owners submit to seek reductions in property taxes. By applying for this exemption, eligible homeowners can potentially reduce their tax liabilities, making their properties more affordable.

-

How can airSlate SignNow assist with the 'Application For Property Tax Abatement Exemption For Harris'?

AirSlate SignNow simplifies the process of submitting the 'Application For Property Tax Abatement Exemption For Harris' by providing an easy-to-use platform to eSign documents quickly. Our solution ensures that your application is completed accurately and submitted efficiently, eliminating paperwork hassles.

-

What features does airSlate SignNow offer for managing property tax exemption applications?

AirSlate SignNow comes equipped with features like customizable templates, secure eSigning, and document tracking, making it ideal for the 'Application For Property Tax Abatement Exemption For Harris.' These features allow users to streamline the submission process and monitor the status of their applications in real-time.

-

Is there a cost associated with using airSlate SignNow for the property tax abatement application?

Yes, there is a subscription fee for using airSlate SignNow, which provides various pricing plans tailored to different business needs. The investment in our platform is cost-effective when considering the savings you may achieve through approved property tax exemptions, such as the 'Application For Property Tax Abatement Exemption For Harris.'

-

How secure is the airSlate SignNow platform for handling sensitive documents?

Security is a top priority at airSlate SignNow. Our platform employs multiple layers of security, including data encryption and secure cloud storage, ensuring that all documents linked to the 'Application For Property Tax Abatement Exemption For Harris' are safeguarded against unauthorized access.

-

Can I integrate airSlate SignNow with other applications I use?

Absolutely! airSlate SignNow supports integrations with various applications, enabling users to connect their preferred tools seamlessly. This functionality enhances workflow efficiency when preparing and submitting the 'Application For Property Tax Abatement Exemption For Harris,' allowing for easier data transfers and document management.

-

What are the benefits of using airSlate SignNow for my property tax exemption needs?

Using airSlate SignNow for the 'Application For Property Tax Abatement Exemption For Harris' offers numerous benefits, including saving time on paperwork, improving document accuracy, and ensuring compliance with local regulations. By leveraging our solution, you can focus more on managing your property rather than the administrative burden.

Get more for Application For Property Tax Abatement Exemption For Harris

- To as vendor does hereby quitclaim give grant sell convey and deliver unto form

- Whose address is hereinafter referred to as vendors do hereby quitclaim form

- Whose address is hereinafter referred to as vendors do hereby grant form

- Accordance with the applicable laws of the state of louisiana form

- Everything you need to know about postnuptial agreements form

- Mineral deed form pdffiller

- Civil district court for the parish of form

- Private work kegler brown hill ampampamp ritter form

Find out other Application For Property Tax Abatement Exemption For Harris

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple