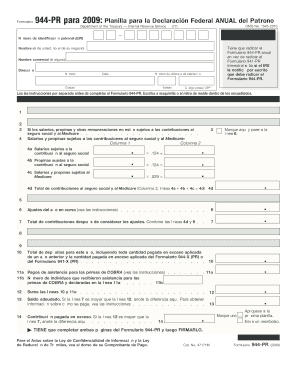

Formulario 944 PR Para Planilla Para La Declaraci N Federal ANUAL Del Patrono Department of the Treasury Internal Reven

What is the Formulario 944 PR?

The Formulario 944 PR is a tax form used by employers in Puerto Rico to report annual Federal income taxes withheld from employees' wages. It is specifically designed for small businesses that have a low volume of payroll activity. This form simplifies the reporting process by allowing eligible employers to file annually instead of quarterly, which can reduce administrative burdens.

How to Use the Formulario 944 PR

To use the Formulario 944 PR, employers must first determine their eligibility based on the annual payroll tax liability. Once confirmed, they can download the form from the IRS website or obtain it through authorized channels. The form requires detailed information about the employer, employee wages, and the amount of federal income tax withheld. After completing the form, employers should submit it to the IRS along with any required payments.

Steps to Complete the Formulario 944 PR

Completing the Formulario 944 PR involves several key steps:

- Gather necessary documentation, including employee wage records and tax withholding details.

- Fill out the employer information section, including the employer's name, address, and Employer Identification Number (EIN).

- Report the total wages paid and the federal income tax withheld during the year.

- Review the completed form for accuracy and ensure all required fields are filled.

- Submit the form by the specified deadline, either electronically or by mail.

Legal Use of the Formulario 944 PR

The Formulario 944 PR is legally binding when completed and submitted according to IRS regulations. Employers must ensure that the information provided is accurate to avoid penalties. Compliance with the filing requirements is essential, as failure to submit the form or inaccuracies can lead to fines or legal repercussions.

Filing Deadlines and Important Dates

It is crucial for employers to be aware of the filing deadlines for the Formulario 944 PR. Generally, the form must be submitted by January 31 of the following year for the previous tax year. Employers should also keep track of any changes to deadlines announced by the IRS to ensure timely compliance.

Penalties for Non-Compliance

Employers who fail to file the Formulario 944 PR on time or provide inaccurate information may face significant penalties. These can include fines based on the amount of tax owed and additional charges for late submissions. It is important to maintain accurate records and submit the form promptly to avoid these consequences.

Quick guide on how to complete formulario 944

Complete formulario 944 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage formulario 944 on any platform using the airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to modify and eSign formulario 944 without breaking a sweat

- Locate formulario 944 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you would like to submit your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign formulario 944 and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to formulario 944

Create this form in 5 minutes!

How to create an eSignature for the formulario 944

How to create an eSignature for your Formulario 944 Pr Para 2009 Planilla Para La Declaraci N Federal Anual Del Patrono Department Of The Treasury Internal Revenue in the online mode

How to make an eSignature for your Formulario 944 Pr Para 2009 Planilla Para La Declaraci N Federal Anual Del Patrono Department Of The Treasury Internal Revenue in Chrome

How to generate an eSignature for signing the Formulario 944 Pr Para 2009 Planilla Para La Declaraci N Federal Anual Del Patrono Department Of The Treasury Internal Revenue in Gmail

How to make an electronic signature for the Formulario 944 Pr Para 2009 Planilla Para La Declaraci N Federal Anual Del Patrono Department Of The Treasury Internal Revenue from your smartphone

How to create an electronic signature for the Formulario 944 Pr Para 2009 Planilla Para La Declaraci N Federal Anual Del Patrono Department Of The Treasury Internal Revenue on iOS devices

How to generate an eSignature for the Formulario 944 Pr Para 2009 Planilla Para La Declaraci N Federal Anual Del Patrono Department Of The Treasury Internal Revenue on Android devices

People also ask formulario 944

-

What is the formulario 944 and how is it used with airSlate SignNow?

The formulario 944 is a tax form used in the United States for business income reporting. With airSlate SignNow, businesses can easily fill out, send, and eSign the formulario 944, ensuring compliance and accuracy in their submissions.

-

How can airSlate SignNow help manage the formulario 944 efficiently?

AirSlate SignNow simplifies the management of the formulario 944 by allowing users to create templates, which can be reused and sent quickly. This saves time and reduces errors, making the process of handling tax documents more efficient.

-

What are the pricing plans for using formulario 944 with airSlate SignNow?

AirSlate SignNow offers various pricing plans to fit different business needs, including options for those who frequently use the formulario 944. Each plan provides access to unique features, streamlining the eSigning process and enhancing productivity.

-

Can I integrate airSlate SignNow with other tools for managing formulario 944?

Yes, airSlate SignNow offers integrations with popular business applications, enabling seamless management of the formulario 944. This allows users to connect their workflow, maximizing efficiency and reducing the need for manual data entry.

-

What are the benefits of using airSlate SignNow for the formulario 944?

Using airSlate SignNow for the formulario 944 offers numerous benefits, including enhanced security and compliance. The platform provides tracking options, ensuring that your submitted forms are documented and accessible at all times.

-

Is airSlate SignNow user-friendly for completing the formulario 944?

Absolutely! AirSlate SignNow is designed to be user-friendly, making it easy for anyone to complete the formulario 944 without technical expertise. Its intuitive interface streamlines the eSigning process for businesses of all sizes.

-

Does airSlate SignNow provide customer support for formulario 944 inquiries?

Yes, airSlate SignNow offers comprehensive customer support for any questions regarding the formulario 944. Users can access resources and live support to ensure they are fully utilizing the platform for their document management needs.

Get more for formulario 944

- Institutional support and reference form

- 1 5 the attached form consists of 6 pages

- New program proposal form sponsoring institutions mo gov dhe mo

- New program proposal form sponsoring institutions state dhe mo

- Form np new program proposal form sponsoring dhe mo

- Reset form virginia state corporation commission

- Application for attending another university of policy umn form

- Institutional verification form 1164387

Find out other formulario 944

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online