The Price of Fairness Form

Understanding Vermont Tax Form IN-113

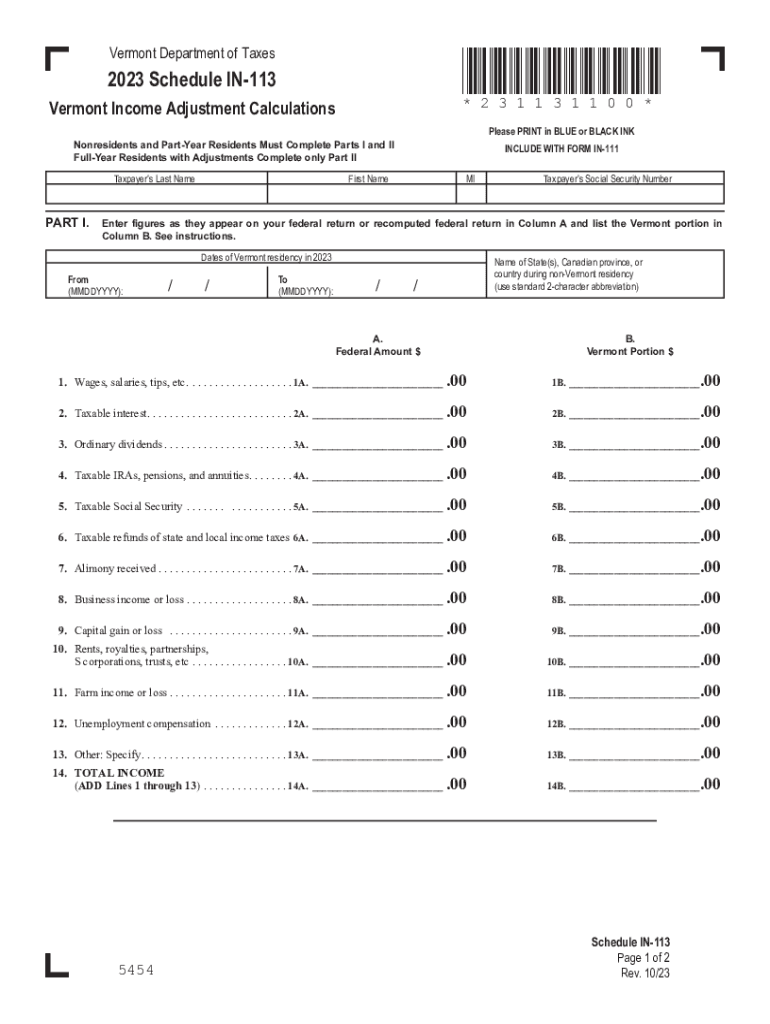

The Vermont tax form IN-113 is essential for individuals who are part-year residents of Vermont. This form is used to report income earned during the time you were a resident of the state. It is crucial for accurately calculating your state tax obligations and ensuring compliance with Vermont tax laws. The form requires detailed information about your income sources, deductions, and any adjustments that may apply to your specific situation.

Steps to Complete the IN-113 Form

Completing the IN-113 form involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your total income earned while a resident of Vermont.

- Complete the income calculations section, ensuring to include all relevant income sources.

- Apply any eligible deductions or adjustments as outlined in the form instructions.

- Review your calculations for accuracy before submission.

Required Documents for IN-113 Submission

To successfully file the IN-113 form, you need to prepare several documents:

- W-2 forms from your employers during the tax year.

- 1099 forms for any freelance or contract work.

- Records of any other income received while a resident.

- Documentation supporting any deductions or credits claimed.

Filing Deadlines for IN-113

It is important to be aware of the filing deadlines for the IN-113 form to avoid penalties. Typically, the form must be filed by April 15 of the year following the tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Ensure timely submission to maintain compliance with Vermont tax regulations.

Legal Use of the IN-113 Form

The IN-113 form is legally mandated for part-year residents of Vermont to report their income accurately. Failure to file this form can result in penalties, including fines or interest on unpaid taxes. It is essential to understand that using the form correctly is not only a legal requirement but also a means to ensure that you are paying the correct amount of state taxes based on your residency status.

Examples of Using the IN-113 Form

Consider a scenario where an individual moved to Vermont in June and earned income both before and after the move. The IN-113 form allows this individual to report only the income earned during their residency period. Another example includes someone who worked part-time while attending school in Vermont; they would use the IN-113 to report their income accurately for tax purposes. These examples illustrate how the form is tailored to accommodate various residency situations.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the the price of fairness

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is in113 and how does it relate to airSlate SignNow?

In113 is a key feature of airSlate SignNow that enhances document management and eSigning capabilities. It allows users to streamline their workflow by integrating eSignature solutions directly into their existing processes, making it easier to send and sign documents securely.

-

How much does airSlate SignNow cost for users interested in in113?

The pricing for airSlate SignNow varies based on the plan selected, but it remains a cost-effective solution for businesses looking to utilize in113. Users can choose from different tiers that cater to various needs, ensuring that they get the best value for their investment.

-

What features does in113 offer to enhance document signing?

In113 offers a range of features including customizable templates, real-time tracking, and secure cloud storage. These features are designed to simplify the signing process and improve overall efficiency, making airSlate SignNow a powerful tool for businesses.

-

Can I integrate in113 with other software applications?

Yes, airSlate SignNow supports integrations with various software applications, allowing users to incorporate in113 into their existing systems seamlessly. This flexibility helps businesses maintain their workflows while enhancing their document signing capabilities.

-

What are the benefits of using airSlate SignNow with in113?

Using airSlate SignNow with in113 provides numerous benefits, including increased efficiency, reduced turnaround times, and enhanced security for document transactions. Businesses can expect a smoother workflow and improved customer satisfaction as a result.

-

Is in113 suitable for small businesses?

Absolutely! In113 is designed to be user-friendly and cost-effective, making it an ideal solution for small businesses. With airSlate SignNow, small enterprises can access powerful eSigning features without breaking the bank.

-

How does airSlate SignNow ensure the security of documents signed with in113?

AirSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect documents signed with in113. This ensures that sensitive information remains confidential and secure throughout the signing process.

Get more for The Price Of Fairness

Find out other The Price Of Fairness

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast