Minnesota Form IG260 Nonadmitted Insurance Premium

What is the Minnesota Form IG260 Nonadmitted Insurance Premium

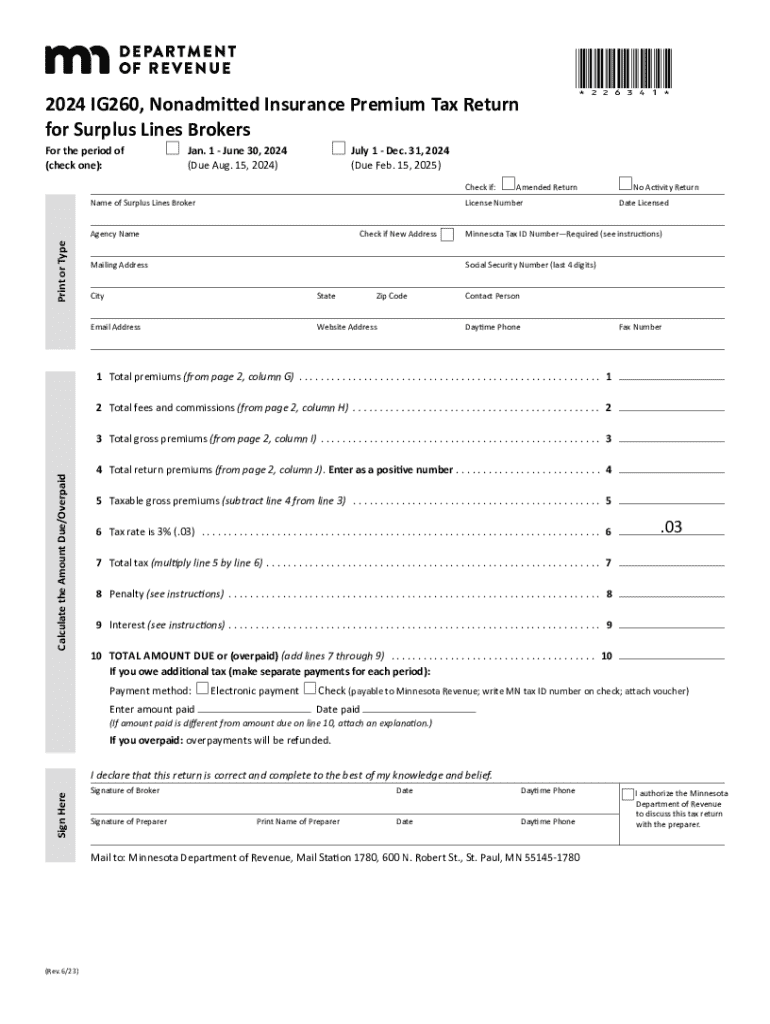

The Minnesota Form IG260 is a crucial document for nonadmitted insurance premium reporting in the state. Nonadmitted insurance refers to coverage provided by insurers not licensed in Minnesota. This form is specifically designed for brokers to report and remit the appropriate taxes on these premiums. Understanding the purpose and requirements of the IG260 form is essential for compliance with state regulations and for ensuring that all necessary taxes are accurately reported.

How to use the Minnesota Form IG260 Nonadmitted Insurance Premium

Using the Minnesota Form IG260 involves several key steps. First, brokers must gather all relevant information regarding the nonadmitted insurance premiums they have collected. This includes details about the insured parties, the types of coverage provided, and the total premium amounts. Once this information is compiled, brokers can accurately fill out the form, ensuring that all fields are completed as required. After completing the form, brokers must submit it to the Minnesota Department of Revenue along with any applicable tax payments.

Steps to complete the Minnesota Form IG260 Nonadmitted Insurance Premium

Completing the Minnesota Form IG260 requires careful attention to detail. Follow these steps for accurate completion:

- Gather all necessary information regarding nonadmitted insurance premiums.

- Fill in the broker's details, including name, address, and license number.

- Detail the insured parties and the types of coverage provided.

- Calculate the total premium amount and any taxes owed.

- Review the form for accuracy before submission.

Once completed, the form can be submitted either online or via mail, depending on the preferred submission method.

State-specific rules for the Minnesota Form IG260 Nonadmitted Insurance Premium

Each state has its own regulations regarding nonadmitted insurance and the associated reporting requirements. In Minnesota, brokers must adhere to specific rules when completing the IG260 form. This includes understanding the tax rates applicable to nonadmitted premiums and ensuring that all information reported is accurate and complete. Familiarity with these state-specific rules is vital for compliance and to avoid potential penalties.

Filing Deadlines / Important Dates

Timely filing of the Minnesota Form IG260 is essential to avoid penalties. Brokers should be aware of the specific deadlines for submitting the form and remitting any taxes owed. Generally, the form must be filed on a quarterly basis, with specific due dates outlined by the Minnesota Department of Revenue. Keeping track of these important dates helps ensure compliance and avoids unnecessary fees.

Penalties for Non-Compliance

Failure to comply with the requirements of the Minnesota Form IG260 can result in significant penalties. These may include fines for late submissions, interest on unpaid taxes, and potential legal actions for continued non-compliance. It is crucial for brokers to understand the implications of not filing the form correctly and on time, as this can have serious financial consequences for their business.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the minnesota form ig260 nonadmitted insurance premium

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Minnesota nonadmitted lines brokers?

Minnesota nonadmitted lines brokers are licensed professionals who facilitate the placement of insurance coverage that is not available through admitted carriers. They help businesses find specialized insurance solutions that meet their unique needs, ensuring compliance with state regulations.

-

How can airSlate SignNow benefit Minnesota nonadmitted lines brokers?

airSlate SignNow provides Minnesota nonadmitted lines brokers with a streamlined platform to send and eSign documents efficiently. This enhances their workflow, allowing them to focus on securing the best coverage for their clients while ensuring all documentation is handled securely and promptly.

-

What features does airSlate SignNow offer for Minnesota nonadmitted lines brokers?

airSlate SignNow offers features such as customizable templates, real-time tracking, and secure cloud storage. These tools are designed to simplify the document management process for Minnesota nonadmitted lines brokers, making it easier to handle multiple clients and policies.

-

Is airSlate SignNow cost-effective for Minnesota nonadmitted lines brokers?

Yes, airSlate SignNow is a cost-effective solution for Minnesota nonadmitted lines brokers. With flexible pricing plans, brokers can choose a package that fits their budget while still accessing powerful features that enhance their operational efficiency.

-

Can airSlate SignNow integrate with other tools used by Minnesota nonadmitted lines brokers?

Absolutely! airSlate SignNow integrates seamlessly with various CRM and document management systems commonly used by Minnesota nonadmitted lines brokers. This integration helps brokers maintain a cohesive workflow and ensures that all client interactions are documented effectively.

-

What are the benefits of using airSlate SignNow for document signing?

Using airSlate SignNow for document signing offers numerous benefits, including faster turnaround times and enhanced security. Minnesota nonadmitted lines brokers can ensure that their clients' documents are signed quickly and securely, which is crucial in the fast-paced insurance industry.

-

How does airSlate SignNow ensure the security of documents for Minnesota nonadmitted lines brokers?

airSlate SignNow employs advanced encryption and security protocols to protect documents. Minnesota nonadmitted lines brokers can trust that their sensitive information is safeguarded, allowing them to focus on providing excellent service to their clients.

Get more for Minnesota Form IG260 Nonadmitted Insurance Premium

Find out other Minnesota Form IG260 Nonadmitted Insurance Premium

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy