Texas Tax Power of Attorney Form 01 137 2024-2026

Understanding the Texas Tax Power Of Attorney Form 01 137

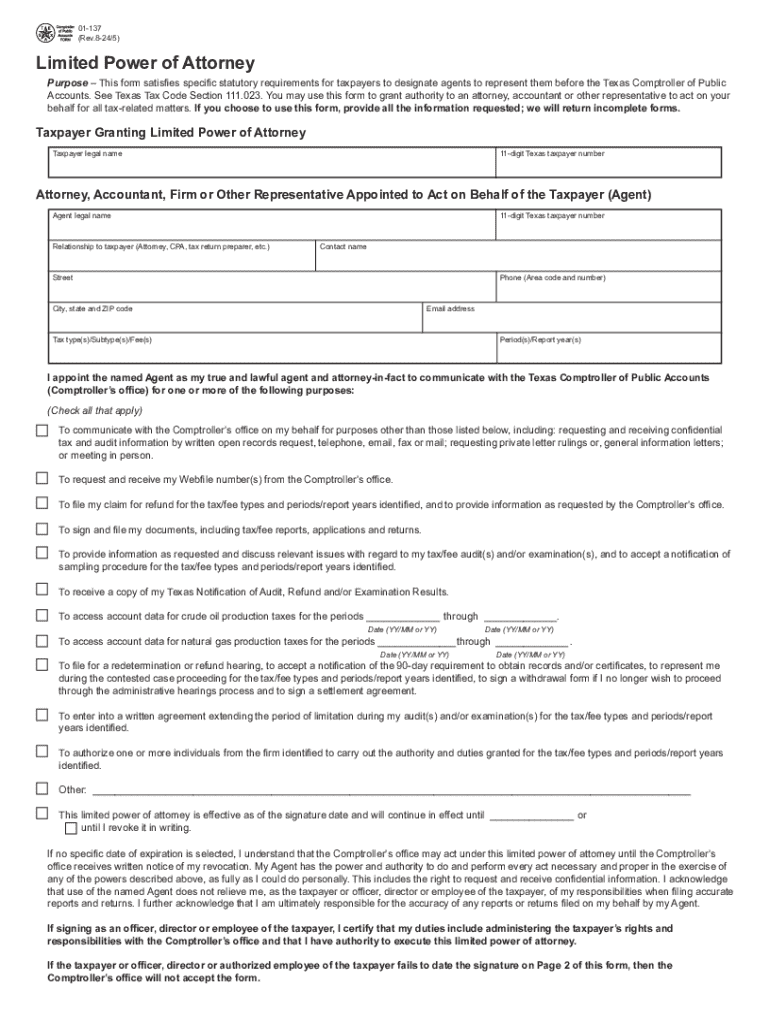

The Texas Tax Power of Attorney Form 01 137 is a legal document that allows a taxpayer to designate an individual or entity to act on their behalf in tax matters. This form is particularly useful for individuals who may need assistance with their tax filings or representation before the Texas Comptroller of Public Accounts. By completing this form, taxpayers can ensure that their appointed representative has the authority to handle various tax-related issues, including filing returns, making payments, and communicating with tax authorities.

Steps to Complete the Texas Tax Power Of Attorney Form 01 137

Completing the Texas Tax Power of Attorney Form 01 137 involves several key steps. First, the taxpayer must provide their personal information, including name, address, and taxpayer identification number. Next, the form requires details about the representative, including their name and contact information. It is crucial to specify the powers granted to the representative, which can range from general authority to specific tax matters. Finally, both the taxpayer and the representative must sign and date the form to validate it. Ensuring all sections are accurately filled out will help avoid delays in processing.

Legal Use of the Texas Tax Power Of Attorney Form 01 137

The legal use of the Texas Tax Power of Attorney Form 01 137 is governed by state tax laws. This form must be used in accordance with the Texas Tax Code and allows the designated representative to perform actions on behalf of the taxpayer. It is essential to understand that the powers granted through this form are limited to tax-related matters and do not extend to other legal issues. Taxpayers should also be aware that the authority granted can be revoked at any time by submitting a written notice to the Texas Comptroller.

Obtaining the Texas Tax Power Of Attorney Form 01 137

Taxpayers can obtain the Texas Tax Power of Attorney Form 01 137 from the Texas Comptroller's website or by contacting their office directly. The form is available in a downloadable format, making it easy to access and complete. It is advisable to ensure that the most current version of the form is used, as outdated forms may not be accepted by tax authorities. Additionally, taxpayers can seek assistance from tax professionals if they have questions about the form or the process of completing it.

Key Elements of the Texas Tax Power Of Attorney Form 01 137

Several key elements are essential to the Texas Tax Power of Attorney Form 01 137. These include the taxpayer's identification information, the representative's details, and the specific powers granted. The form must also include a clear statement of the purpose for which the authority is granted. Furthermore, signatures from both parties are required to finalize the document. Understanding these elements is vital for ensuring that the form serves its intended purpose effectively.

Filing Deadlines and Important Dates

Filing deadlines for the Texas Tax Power of Attorney Form 01 137 can vary based on the specific tax matters involved. Generally, it is advisable to submit the form well in advance of any tax deadlines to ensure that the designated representative is authorized to act on behalf of the taxpayer. Taxpayers should keep track of any upcoming tax obligations and ensure that the form is filed timely to avoid complications. Staying informed about important dates will help facilitate a smoother tax process.

Create this form in 5 minutes or less

Find and fill out the correct texas tax power of attorney form 01 137

Create this form in 5 minutes!

How to create an eSignature for the texas tax power of attorney form 01 137

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is texas 01 137 and how does it relate to airSlate SignNow?

Texas 01 137 refers to a specific document type or requirement that can be efficiently managed using airSlate SignNow. Our platform allows users to easily send, sign, and store these documents, ensuring compliance and efficiency in your business processes.

-

How much does airSlate SignNow cost for managing texas 01 137 documents?

The pricing for airSlate SignNow is competitive and designed to fit various business needs. For managing texas 01 137 documents, you can choose from different plans that offer features tailored to streamline your document workflows at an affordable rate.

-

What features does airSlate SignNow offer for texas 01 137 document management?

airSlate SignNow provides a range of features for texas 01 137 document management, including customizable templates, secure eSigning, and real-time tracking. These features help ensure that your documents are processed quickly and securely.

-

Can airSlate SignNow integrate with other software for texas 01 137?

Yes, airSlate SignNow offers seamless integrations with various software applications, making it easy to manage texas 01 137 documents alongside your existing tools. This integration capability enhances productivity and streamlines your workflow.

-

What are the benefits of using airSlate SignNow for texas 01 137?

Using airSlate SignNow for texas 01 137 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the signing process, allowing you to focus on your core business activities.

-

Is airSlate SignNow user-friendly for handling texas 01 137 documents?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to handle texas 01 137 documents. The intuitive interface ensures that users can quickly learn how to send and sign documents without extensive training.

-

How secure is airSlate SignNow when dealing with texas 01 137?

Security is a top priority at airSlate SignNow. When managing texas 01 137 documents, our platform employs advanced encryption and compliance measures to protect your sensitive information, ensuring that your documents are safe and secure.

Get more for Texas Tax Power Of Attorney Form 01 137

Find out other Texas Tax Power Of Attorney Form 01 137

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors