Tax Utah Gov Forms Current Tc Tc 938PDF

Understanding the TC 938 Utah Form

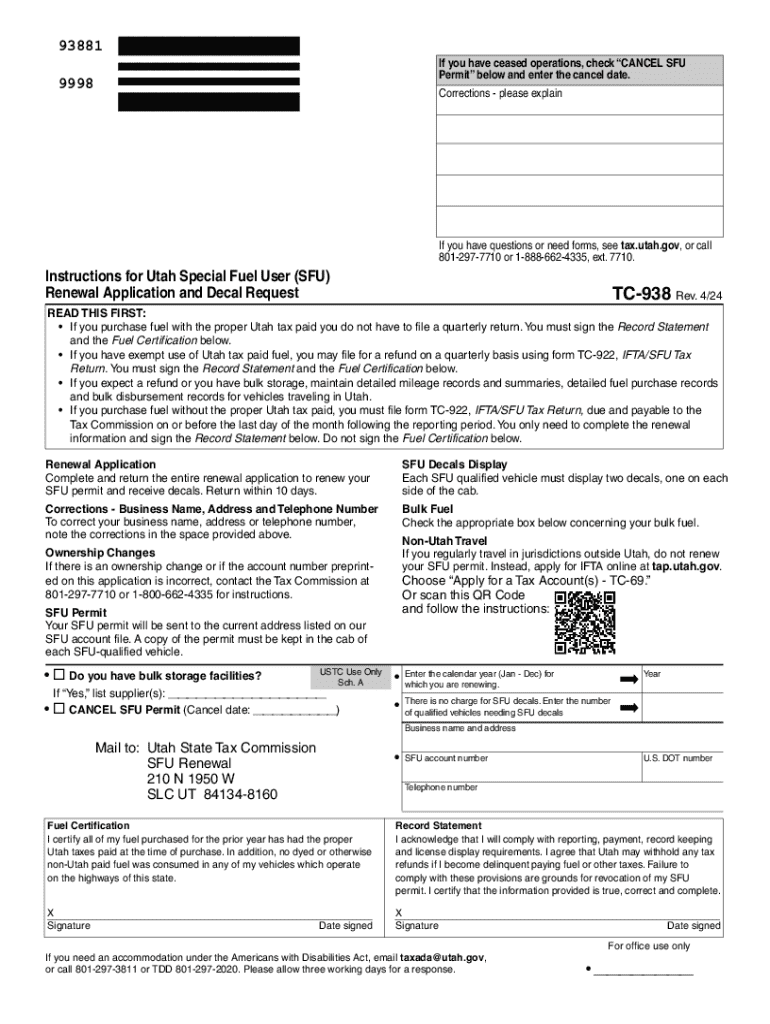

The TC 938 form, known as the Utah Special Fuel User Permit Application, is essential for businesses and individuals who utilize special fuels in Utah. This form allows users to apply for a special fuel user permit, which is necessary for the legal use of certain fuels in vehicles, machinery, or equipment. Understanding the purpose and requirements of this form is critical for compliance with state regulations.

Steps to Complete the TC 938 Utah Form

Filling out the TC 938 form involves several key steps:

- Gather necessary information, including your business details, fuel usage, and vehicle information.

- Complete all sections of the form accurately, ensuring that all required fields are filled.

- Review the completed form for any errors or omissions before submission.

- Submit the form through the appropriate channels as outlined by the Utah State Tax Commission.

Required Documents for the TC 938 Utah Form

When applying for the special fuel user permit using the TC 938 form, you will need to provide specific documentation to support your application. Commonly required documents include:

- Proof of identity or business registration.

- Documentation of fuel usage, such as invoices or receipts.

- Vehicle registration details for all vehicles using special fuels.

Legal Use of the TC 938 Utah Form

The TC 938 form is legally mandated for individuals and businesses that use special fuels in Utah. Submitting this form ensures compliance with state laws regarding fuel usage and permits. Failure to obtain the necessary permit can result in fines or penalties, making it crucial to understand the legal implications of the form.

Form Submission Methods

The TC 938 form can be submitted through various methods to accommodate different preferences:

- Online submission via the Utah State Tax Commission's website.

- Mailing the completed form to the designated address provided on the form.

- In-person submission at local tax offices for immediate processing.

Eligibility Criteria for the TC 938 Utah Form

To be eligible for a special fuel user permit through the TC 938 form, applicants must meet specific criteria, including:

- Demonstrating a legitimate need for special fuels in their operations.

- Providing accurate information regarding their fuel usage and vehicle registration.

- Complying with all state regulations related to fuel usage and permits.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax utah gov forms current tc tc 938pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the TC 938 Utah form?

The TC 938 Utah form is a document used for various tax-related purposes in the state of Utah. It is essential for businesses and individuals to understand its requirements to ensure compliance with state regulations. airSlate SignNow simplifies the process of filling out and eSigning the TC 938 Utah form, making it easier for users to manage their tax documentation.

-

How can airSlate SignNow help with the TC 938 Utah form?

airSlate SignNow provides an intuitive platform for completing and eSigning the TC 938 Utah form. Users can easily upload the form, fill it out, and send it for signatures, all within a secure environment. This streamlines the process and reduces the time spent on paperwork.

-

Is there a cost associated with using airSlate SignNow for the TC 938 Utah form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and provides access to features that enhance the management of documents like the TC 938 Utah form. Users can choose a plan that best fits their requirements and budget.

-

What features does airSlate SignNow offer for the TC 938 Utah form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking for the TC 938 Utah form. These features ensure that users can efficiently manage their documents while maintaining compliance and security. Additionally, the platform is user-friendly, making it accessible for everyone.

-

Can I integrate airSlate SignNow with other applications for the TC 938 Utah form?

Absolutely! airSlate SignNow offers integrations with various applications, allowing users to streamline their workflow when handling the TC 938 Utah form. This means you can connect it with your CRM, cloud storage, and other tools to enhance productivity and efficiency.

-

What are the benefits of using airSlate SignNow for the TC 938 Utah form?

Using airSlate SignNow for the TC 938 Utah form provides numerous benefits, including time savings, improved accuracy, and enhanced security. The platform allows for quick eSigning and document management, which can signNowly reduce the turnaround time for important tax documents. Additionally, it ensures that your data is protected throughout the process.

-

Is airSlate SignNow secure for handling the TC 938 Utah form?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling the TC 938 Utah form. The platform uses advanced encryption and security protocols to protect your documents and personal information. Users can confidently manage their sensitive tax documents without worrying about data bsignNowes.

Get more for Tax utah gov Forms Current Tc Tc 938PDF

- Electrical contract for contractor new jersey form

- Sheetrock drywall contract for contractor new jersey form

- Flooring contract for contractor new jersey form

- Agreement or contract for deed for sale and purchase of real estate aka land or executory contract new jersey form

- Notice of intent to enforce forfeiture provisions of contact for deed new jersey form

- Final notice of forfeiture and request to vacate property under contract for deed new jersey form

- Buyers request for accounting from seller under contract for deed new jersey form

- Buyers notice of intent to vacate and surrender property to seller under contract for deed new jersey form

Find out other Tax utah gov Forms Current Tc Tc 938PDF

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy