Highway Use Tax Exemption Certification Form

What is the Highway Use Tax Exemption Certification

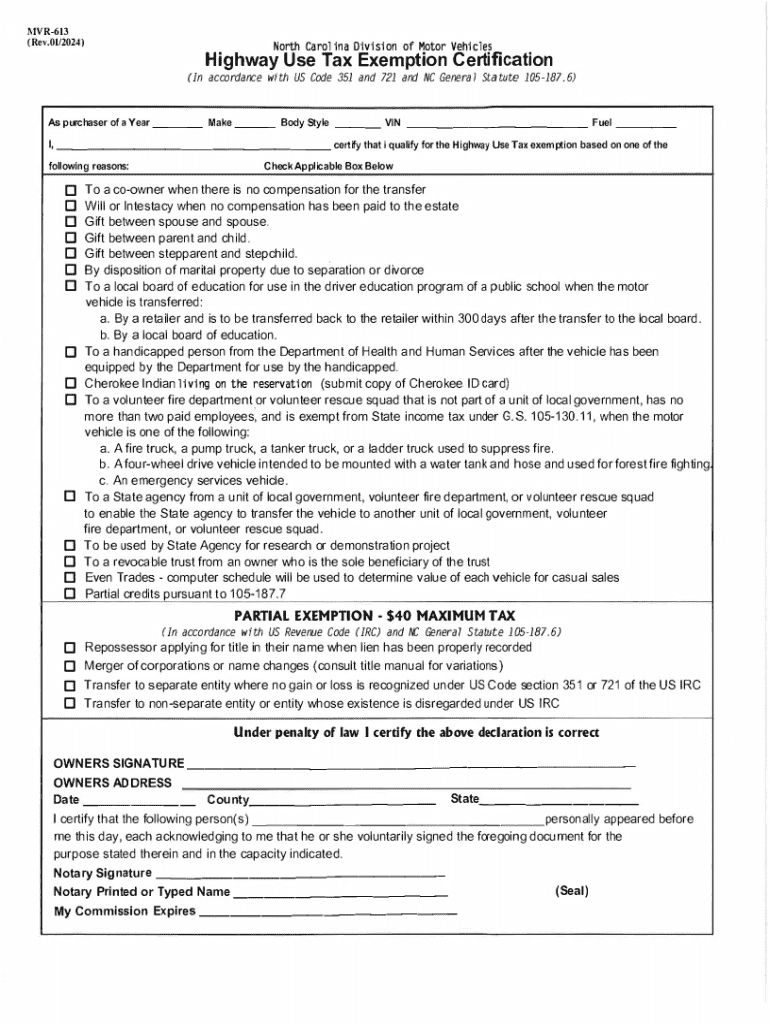

The Highway Use Tax Exemption Certification is a crucial document for businesses operating commercial vehicles on public highways in the United States. This certification allows eligible entities to claim an exemption from certain highway use taxes imposed by federal and state governments. The primary purpose of this certification is to reduce the tax burden on businesses that utilize vehicles primarily for exempt purposes, such as transporting goods for charitable organizations or government agencies.

How to obtain the Highway Use Tax Exemption Certification

To obtain the Highway Use Tax Exemption Certification, businesses must first determine their eligibility based on the specific criteria set forth by their state and federal regulations. Typically, this involves completing an application form that outlines the business's operations and the types of vehicles used. After gathering the necessary information, businesses should submit the application to the appropriate state tax authority or agency responsible for issuing the certification. It is essential to check for any state-specific requirements that may apply.

Steps to complete the Highway Use Tax Exemption Certification

Completing the Highway Use Tax Exemption Certification involves several key steps:

- Gather necessary documentation, including vehicle registration details and proof of business operations.

- Fill out the certification form accurately, ensuring all information is current and complete.

- Submit the form to the relevant tax authority, either online or by mail, depending on state guidelines.

- Retain a copy of the submitted certification for your records, along with any correspondence from the tax authority.

Legal use of the Highway Use Tax Exemption Certification

The legal use of the Highway Use Tax Exemption Certification is strictly defined by both federal and state laws. Businesses must ensure that their use of the certification aligns with the stated exempt purposes. Misuse or fraudulent claims can lead to severe penalties, including fines and the potential revocation of the certification. It is crucial for businesses to maintain accurate records and documentation to support their claims and comply with all regulatory requirements.

Eligibility Criteria

Eligibility for the Highway Use Tax Exemption Certification varies by state but generally includes criteria such as:

- Type of business entity (e.g., non-profit organizations, government agencies).

- Specific use of vehicles (e.g., transporting goods for exempt purposes).

- Compliance with state and federal tax regulations.

Businesses should review their state's guidelines to ensure they meet all eligibility requirements before applying for the certification.

Required Documents

When applying for the Highway Use Tax Exemption Certification, businesses typically need to provide several key documents, including:

- Proof of business registration and tax identification number.

- Vehicle registration documents for the vehicles covered under the exemption.

- Any additional documentation that demonstrates the exempt use of the vehicles.

Having these documents ready can streamline the application process and help ensure compliance with all requirements.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the highway use tax exemption certification

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Highway Use Tax Exemption Certification?

The Highway Use Tax Exemption Certification is a document that allows eligible businesses to claim exemptions from certain highway use taxes. This certification is essential for companies that operate vehicles on public highways and seek to reduce their tax liabilities. Understanding this certification can help businesses save money and ensure compliance with tax regulations.

-

How can airSlate SignNow help with the Highway Use Tax Exemption Certification process?

airSlate SignNow streamlines the process of obtaining and managing your Highway Use Tax Exemption Certification. Our platform allows you to easily create, send, and eSign necessary documents, ensuring that you can complete the certification process efficiently. With our user-friendly interface, you can focus on your business while we handle the paperwork.

-

What are the benefits of using airSlate SignNow for Highway Use Tax Exemption Certification?

Using airSlate SignNow for your Highway Use Tax Exemption Certification offers numerous benefits, including time savings and increased accuracy. Our solution minimizes the risk of errors in documentation and speeds up the approval process. Additionally, you can track the status of your certification in real-time, providing peace of mind.

-

Is there a cost associated with obtaining the Highway Use Tax Exemption Certification through airSlate SignNow?

While the Highway Use Tax Exemption Certification itself may have associated fees depending on your jurisdiction, airSlate SignNow offers a cost-effective solution for managing the documentation process. Our pricing plans are designed to fit various business needs, ensuring that you can access our services without breaking the bank. Contact us for detailed pricing information.

-

Can I integrate airSlate SignNow with other software for managing Highway Use Tax Exemption Certification?

Yes, airSlate SignNow offers seamless integrations with various software applications to enhance your workflow for Highway Use Tax Exemption Certification. Whether you use accounting software or fleet management tools, our platform can connect with them to streamline your processes. This integration capability helps you maintain organized records and improve efficiency.

-

What features does airSlate SignNow provide for managing Highway Use Tax Exemption Certification?

airSlate SignNow provides a range of features tailored for managing Highway Use Tax Exemption Certification, including customizable templates, secure eSigning, and document tracking. These features ensure that you can create and manage your certification documents with ease. Additionally, our platform offers compliance tools to help you stay up-to-date with tax regulations.

-

How secure is the information shared during the Highway Use Tax Exemption Certification process with airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your information during the Highway Use Tax Exemption Certification process. Our platform complies with industry standards to ensure that your sensitive data remains confidential and secure.

Get more for Highway Use Tax Exemption Certification

Find out other Highway Use Tax Exemption Certification

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple