M15NP, Additional Charge for Underpayment of Estimated Tax Form

What is the M15NP, Additional Charge For Underpayment Of Estimated Tax

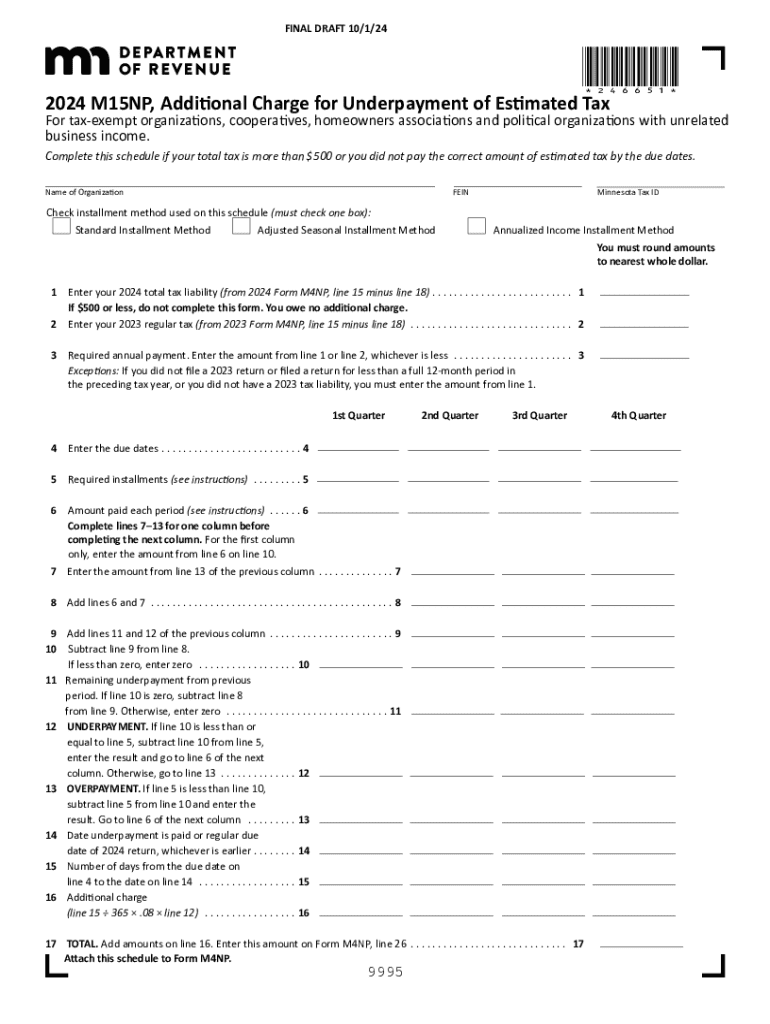

The M15NP form is a tax document used in the United States to assess an additional charge for individuals or entities that have underpaid their estimated tax obligations. This form is particularly relevant for taxpayers who may not have withheld enough tax throughout the year, leading to a potential penalty. The M15NP serves as a means for the tax authority to calculate the additional amount owed due to this underpayment, ensuring that taxpayers fulfill their tax responsibilities.

How to use the M15NP, Additional Charge For Underpayment Of Estimated Tax

Using the M15NP form involves several steps to accurately report underpayment of estimated taxes. First, taxpayers must gather their financial records, including income statements and previous tax filings. Next, the form requires the taxpayer to calculate the total estimated tax owed, compare it to the amount already paid, and determine the underpayment amount. Finally, the completed M15NP form should be submitted to the appropriate tax authority, either online or via mail, depending on the specific requirements.

Steps to complete the M15NP, Additional Charge For Underpayment Of Estimated Tax

Completing the M15NP form involves a clear process to ensure accuracy and compliance. Here are the essential steps:

- Gather all necessary financial documents, including income statements and prior tax returns.

- Calculate your total estimated tax liability for the year.

- Determine the amount you have already paid in estimated taxes.

- Subtract the total payments from your estimated tax liability to find the underpayment amount.

- Fill out the M15NP form with the calculated figures and any additional required information.

- Review the form for accuracy before submission.

- Submit the completed form to the tax authority by the specified deadline.

Key elements of the M15NP, Additional Charge For Underpayment Of Estimated Tax

The M15NP form contains several key elements that are crucial for proper completion. These include:

- Taxpayer Information: This section requires personal details such as name, address, and Social Security number.

- Estimated Tax Calculation: Taxpayers must provide their total estimated tax liability and the amount already paid.

- Underpayment Amount: The form must clearly indicate the calculated underpayment amount, which will determine the additional charge.

- Signature: The taxpayer must sign and date the form, certifying that the information provided is accurate.

Filing Deadlines / Important Dates

Filing deadlines for the M15NP form are crucial for avoiding penalties. Taxpayers should be aware of the following important dates:

- The M15NP form must typically be filed by the tax return due date, which is usually April 15 for individual taxpayers.

- If you are making estimated tax payments, ensure they are submitted quarterly to avoid underpayment penalties.

- Keep track of any changes in tax law that may affect filing deadlines or requirements for the current tax year.

Penalties for Non-Compliance

Failure to comply with the requirements outlined in the M15NP form can result in significant penalties. Taxpayers who underpay their estimated taxes may face:

- Interest Charges: Accumulated interest on the underpayment amount can increase the total owed.

- Additional Penalties: The tax authority may impose additional penalties for late payments or failure to file the M15NP form.

- Legal Consequences: Continued non-compliance can lead to more severe legal actions, including liens or levies against the taxpayer's assets.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the m15np additional charge for underpayment of estimated tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the M15NP, Additional Charge For Underpayment Of Estimated Tax?

The M15NP, Additional Charge For Underpayment Of Estimated Tax, refers to a penalty imposed by tax authorities when estimated tax payments are insufficient. Understanding this charge is crucial for businesses to avoid unexpected costs. airSlate SignNow can help streamline your document processes related to tax filings.

-

How can airSlate SignNow assist with M15NP, Additional Charge For Underpayment Of Estimated Tax?

airSlate SignNow provides tools to manage and eSign tax documents efficiently, reducing the risk of underpayment. By ensuring timely submissions and accurate documentation, businesses can mitigate the M15NP, Additional Charge For Underpayment Of Estimated Tax. Our platform simplifies the entire process, making compliance easier.

-

What features does airSlate SignNow offer to help with tax-related documents?

airSlate SignNow offers features like customizable templates, secure eSigning, and automated workflows that are essential for tax-related documents. These features help ensure that all necessary forms are completed accurately and submitted on time, reducing the likelihood of incurring the M15NP, Additional Charge For Underpayment Of Estimated Tax.

-

Is there a cost associated with using airSlate SignNow for tax documents?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Investing in our services can save you from potential penalties like the M15NP, Additional Charge For Underpayment Of Estimated Tax. Our cost-effective solutions ensure you get the best value for your document management.

-

Can I integrate airSlate SignNow with my existing accounting software?

Absolutely! airSlate SignNow integrates seamlessly with many popular accounting software solutions. This integration helps streamline your workflow and ensures that you stay compliant with tax regulations, minimizing the risk of the M15NP, Additional Charge For Underpayment Of Estimated Tax.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow enhances efficiency, reduces paperwork, and ensures compliance with tax regulations. By managing your documents effectively, you can avoid penalties such as the M15NP, Additional Charge For Underpayment Of Estimated Tax. Our platform empowers businesses to focus on growth while we handle the documentation.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your documents with advanced encryption and secure storage solutions. This ensures that sensitive information related to the M15NP, Additional Charge For Underpayment Of Estimated Tax is protected. You can trust our platform to keep your data safe while you manage your tax obligations.

Get more for M15NP, Additional Charge For Underpayment Of Estimated Tax

Find out other M15NP, Additional Charge For Underpayment Of Estimated Tax

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe