M1LS, Tax on Lump Sum Distribution M1LS, Tax on Lump Sum Distribution Form

Understanding the M1LS, Tax On Lump Sum Distribution

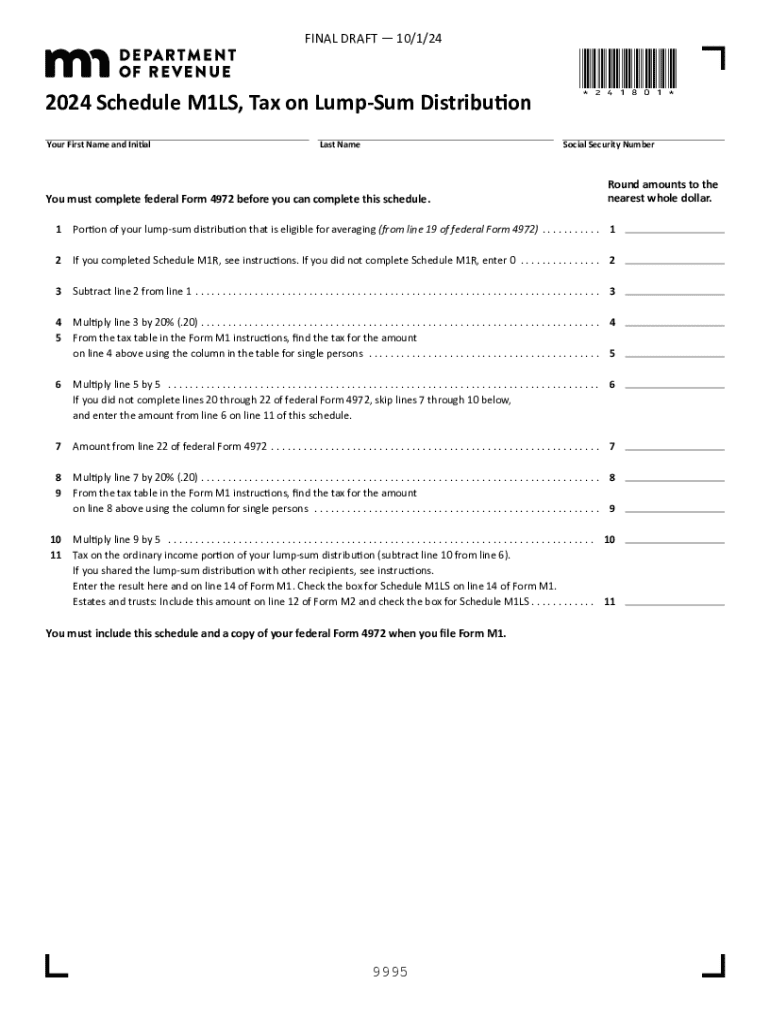

The M1LS, Tax On Lump Sum Distribution, is a specific tax form used in the United States to report taxes on lump sum distributions from retirement plans or pensions. This form is essential for individuals who receive a one-time payment from their retirement accounts, as it helps determine the tax implications of such distributions. The M1LS form ensures that taxpayers accurately report their income and comply with IRS regulations regarding retirement distributions.

How to Complete the M1LS, Tax On Lump Sum Distribution

Completing the M1LS form involves several steps. First, gather all necessary documentation related to your lump sum distribution, including your retirement plan statements and any previous tax returns. Next, fill out the form by providing your personal information, including your Social Security number and address. Indicate the amount received from the lump sum distribution and any taxes withheld. Finally, review the form for accuracy before submission to ensure compliance with IRS guidelines.

Key Elements of the M1LS, Tax On Lump Sum Distribution

Several key elements must be included when filling out the M1LS form. These include:

- Your personal identification information, such as name and Social Security number.

- The total amount of the lump sum distribution received.

- The amount of federal income tax withheld from the distribution.

- Any applicable state tax information, if required.

Ensuring that all these elements are accurately reported is crucial for proper tax filing and compliance.

Filing Deadlines for the M1LS, Tax On Lump Sum Distribution

Filing deadlines for the M1LS form typically align with the general tax filing deadlines set by the IRS. Generally, individual taxpayers must file their tax returns by April 15 of each year. If you are filing the M1LS form as part of your annual tax return, ensure it is submitted by this date to avoid penalties. In certain circumstances, extensions may be available, but it is essential to check IRS guidelines for specific rules regarding extensions.

IRS Guidelines for the M1LS, Tax On Lump Sum Distribution

The IRS provides specific guidelines regarding the use of the M1LS form. It is important to review these guidelines to understand the tax implications of lump sum distributions. The IRS outlines how to report these distributions, including any potential penalties for early withdrawal or failure to report accurately. Familiarizing yourself with these guidelines can help ensure compliance and avoid unnecessary tax liabilities.

Examples of Using the M1LS, Tax On Lump Sum Distribution

Examples of scenarios where the M1LS form is applicable include:

- A retiree receiving a one-time payout from a pension plan.

- An individual cashing out a 401(k) plan after changing jobs.

- Someone who inherits a retirement account and chooses to take a lump sum distribution.

In each of these cases, accurately reporting the distribution on the M1LS form is essential for proper tax treatment.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the m1ls tax on lump sum distribution m1ls tax on lump sum distribution

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is M1LS, Tax On Lump Sum Distribution?

M1LS, Tax On Lump Sum Distribution refers to the tax implications associated with receiving a lump sum distribution from a retirement account. Understanding this tax can help you make informed financial decisions regarding your retirement funds.

-

How does airSlate SignNow help with M1LS, Tax On Lump Sum Distribution?

airSlate SignNow provides a streamlined platform for managing documents related to M1LS, Tax On Lump Sum Distribution. By using our eSigning features, you can easily sign and send tax-related documents securely and efficiently.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Whether you are a small business or a large enterprise, our pricing is designed to provide value while helping you manage M1LS, Tax On Lump Sum Distribution documents effectively.

-

Can I integrate airSlate SignNow with other software for M1LS, Tax On Lump Sum Distribution?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow for M1LS, Tax On Lump Sum Distribution. This allows you to manage your documents alongside your existing tools for a more efficient process.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which are essential for managing M1LS, Tax On Lump Sum Distribution documents. These features ensure that your tax documents are handled efficiently and securely.

-

Is airSlate SignNow user-friendly for those unfamiliar with tax documents?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate and manage M1LS, Tax On Lump Sum Distribution documents. Our intuitive interface ensures that even those unfamiliar with tax documents can use the platform effectively.

-

What benefits does airSlate SignNow provide for businesses dealing with M1LS, Tax On Lump Sum Distribution?

Using airSlate SignNow can signNowly reduce the time and effort required to manage M1LS, Tax On Lump Sum Distribution documents. Our platform enhances collaboration, ensures compliance, and provides a secure environment for all your tax-related paperwork.

Get more for M1LS, Tax On Lump Sum Distribution M1LS, Tax On Lump Sum Distribution

- Ut corporation 497427416 form

- Notice of completion utah state construction registry form

- Utah husband wife 497427419 form

- Warranty deed from husband and wife to corporation utah form

- Utah divorce contested 497427421 form

- Subcontractors request for notice of preliminary notice received individual form

- Utah husband wife 497427424 form

- Warranty deed from husband and wife to llc utah form

Find out other M1LS, Tax On Lump Sum Distribution M1LS, Tax On Lump Sum Distribution

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online