FINAL DRAFT 10124 *241551* Schedule M1M, Inc Form

Understanding the 2024 M1M Form

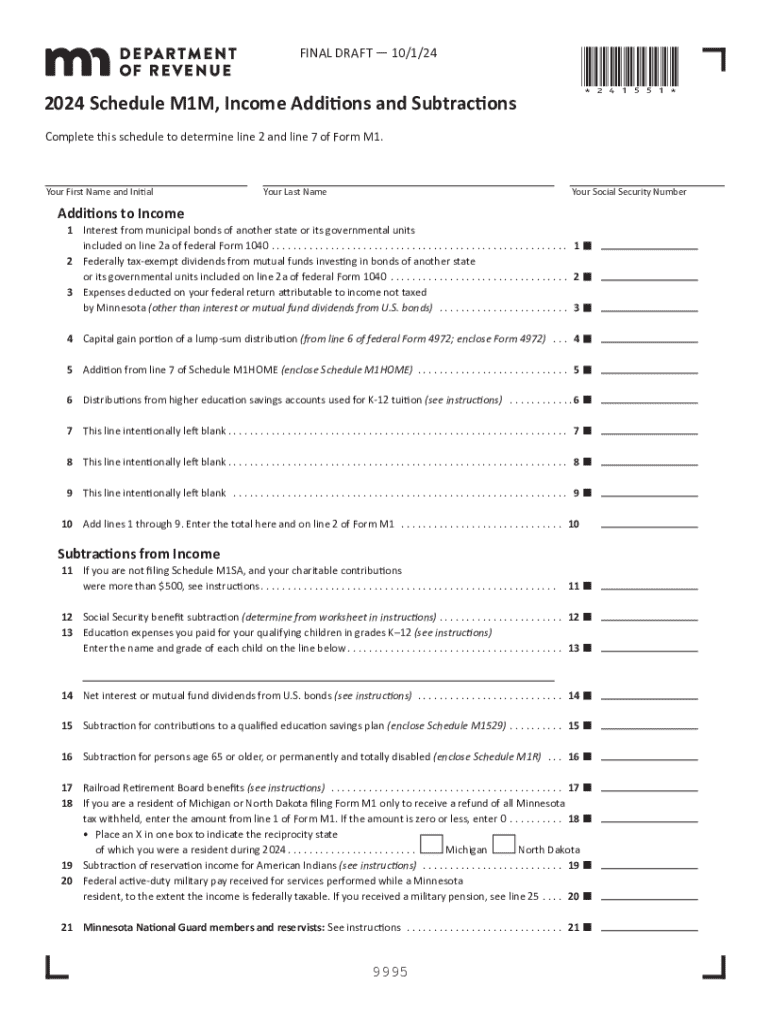

The 2024 M1M form, officially known as the Minnesota M1M, is a tax form used by individuals and businesses in Minnesota to report certain types of income adjustments. This form is particularly relevant for those who need to make modifications to their Minnesota income tax returns. It serves as an essential tool for ensuring accurate tax reporting and compliance with state regulations.

Steps to Complete the 2024 M1M Form

Filling out the 2024 M1M form involves several key steps. Begin by gathering all necessary documentation, including your federal tax return and any relevant Minnesota tax documents. Follow these steps:

- Enter your personal information, including your name, address, and Social Security number.

- Report your total income as shown on your federal return.

- Make any necessary adjustments to your income, such as adding or subtracting specific deductions.

- Calculate your adjusted gross income based on the modifications made.

- Complete the rest of the form by following the instructions provided for each section.

- Review your entries for accuracy before submitting the form.

Filing Deadlines for the 2024 M1M Form

It is crucial to be aware of the filing deadlines associated with the 2024 M1M form. Generally, the form must be submitted by the same deadline as your Minnesota income tax return. For most taxpayers, this means the due date is April 15, 2025. However, if you file for an extension, ensure you submit the M1M form by the extended deadline.

Required Documents for the 2024 M1M Form

To accurately complete the 2024 M1M form, you will need several documents on hand. These include:

- Your federal tax return (Form 1040 or 1040-SR).

- Any W-2 forms from employers.

- 1099 forms for other income sources.

- Documentation for any deductions or credits you plan to claim.

Having these documents ready will streamline the process and help ensure that your form is filled out correctly.

Digital Submission Methods for the 2024 M1M Form

The 2024 M1M form can be submitted through various methods, including digital options. Taxpayers have the flexibility to file online using approved e-filing software or by mailing a paper copy to the Minnesota Department of Revenue. Digital submission is often faster and allows for immediate confirmation of receipt, making it a preferred choice for many.

Penalties for Non-Compliance with the 2024 M1M Form

Failure to file the 2024 M1M form on time or inaccuracies in reporting can result in penalties. Minnesota may impose fines for late submissions or underpayment of taxes. It is essential to ensure that the form is completed accurately and submitted by the deadline to avoid any financial repercussions.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the final draft 10124 241551 schedule m1m inc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 m1m form and why is it important?

The 2024 m1m form is a crucial document for businesses that need to report specific financial information to the IRS. Understanding its requirements can help ensure compliance and avoid penalties. Using airSlate SignNow, you can easily eSign and send your 2024 m1m form securely.

-

How can airSlate SignNow help with the 2024 m1m form?

airSlate SignNow provides a user-friendly platform to create, send, and eSign your 2024 m1m form efficiently. With its intuitive interface, you can streamline the signing process, making it faster and more reliable. This ensures that your documents are handled with care and precision.

-

What are the pricing options for using airSlate SignNow for the 2024 m1m form?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including those specifically for managing the 2024 m1m form. You can choose from monthly or annual subscriptions, with options that scale as your business grows. This cost-effective solution ensures you get the best value for your document management needs.

-

Are there any features specifically designed for the 2024 m1m form?

Yes, airSlate SignNow includes features tailored for the 2024 m1m form, such as customizable templates and automated workflows. These features help you prepare and manage your documents efficiently, reducing the time spent on paperwork. Additionally, you can track the status of your forms in real-time.

-

Can I integrate airSlate SignNow with other software for the 2024 m1m form?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, making it easy to manage your 2024 m1m form alongside your existing tools. Whether you use CRM systems or accounting software, you can enhance your workflow and improve productivity.

-

What are the benefits of using airSlate SignNow for the 2024 m1m form?

Using airSlate SignNow for the 2024 m1m form provides numerous benefits, including enhanced security, ease of use, and faster turnaround times. The platform ensures that your documents are securely stored and easily accessible. This allows you to focus on your business while ensuring compliance with IRS requirements.

-

Is airSlate SignNow compliant with regulations for the 2024 m1m form?

Yes, airSlate SignNow is designed to comply with all relevant regulations for the 2024 m1m form, including eSignature laws. This compliance ensures that your electronically signed documents are legally binding and recognized by authorities. You can trust airSlate SignNow to keep your business compliant.

Get more for FINAL DRAFT 10124 *241551* Schedule M1M, Inc

- Waiver and release from liability for adult for fishing form

- Waiver and release from liability for minor child for fishing form

- Waiver and release from liability for adult for zoo form

- Waiver release liability form 497427119

- Waiver and release from liability for adult for go cart track form

- Waiver and release from liability for minor child for go cart track form

- Waiver and release from liability for adult for observatory or arboretum form

- Release minor child form 497427123

Find out other FINAL DRAFT 10124 *241551* Schedule M1M, Inc

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter