Do I Qualify for the Minnesota Long Term Care Insurance Form

Understanding Minnesota Long Term Care Insurance Eligibility

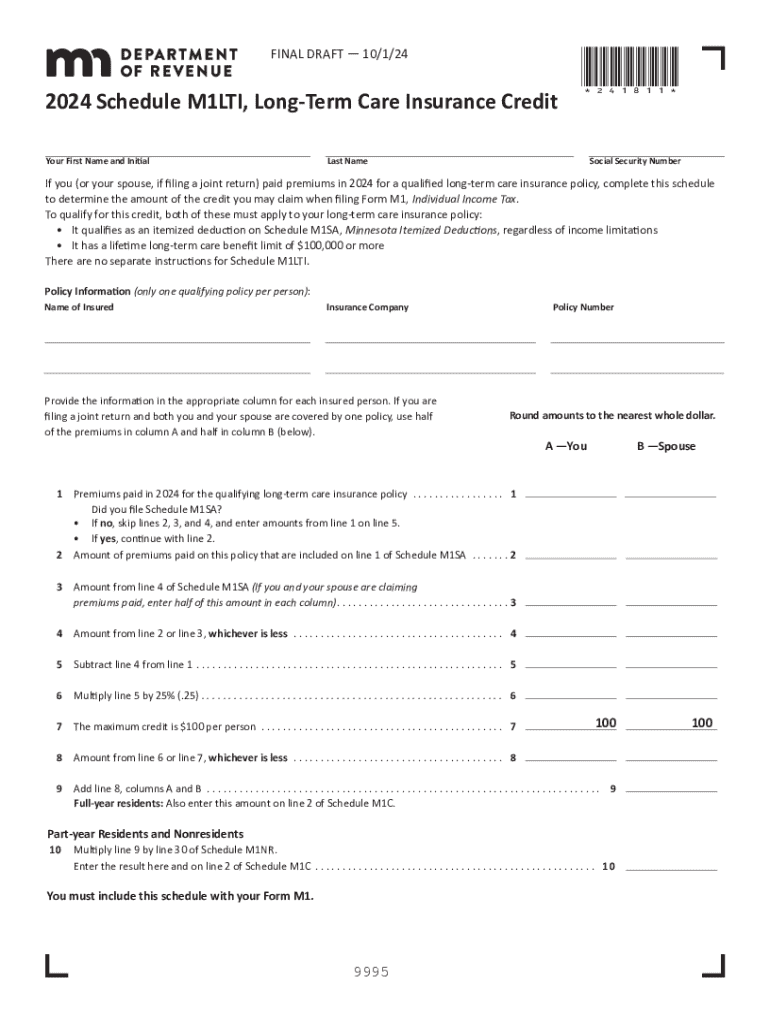

The Minnesota Long Term Care Insurance program is designed to help individuals cover the costs associated with long-term care services. To qualify, applicants typically need to meet specific eligibility criteria, including age, health status, and financial considerations. Generally, individuals must be at least 18 years old and may need to undergo a medical assessment to evaluate their health condition. Additionally, financial eligibility often involves a review of income and assets to ensure that applicants do not exceed certain limits.

Steps to Complete the Minnesota Long Term Care Insurance Application

Completing the application for Minnesota Long Term Care Insurance involves several key steps. First, gather necessary documents, such as identification, proof of income, and any medical records that may be required. Next, fill out the application form accurately, ensuring all information is complete and truthful. After submitting the application, applicants may need to participate in an interview or provide additional documentation as requested. It is essential to keep copies of all submitted materials for personal records.

Required Documents for Application

When applying for the Minnesota Long Term Care Insurance, several documents are typically required. These may include:

- Proof of identity, such as a driver's license or state ID

- Financial documents, including tax returns and bank statements

- Medical records or assessments from healthcare providers

- Any previous long-term care insurance policies, if applicable

Having these documents ready can streamline the application process and help avoid delays.

State-Specific Rules for Long Term Care Insurance

Each state has its own regulations regarding long-term care insurance. In Minnesota, specific rules may dictate the types of coverage available, premium rates, and benefit limits. It is important for applicants to familiarize themselves with these state-specific guidelines to ensure compliance and understand their rights and responsibilities under the program. This knowledge can also aid in selecting the most suitable policy for individual needs.

Application Process and Approval Time

The application process for Minnesota Long Term Care Insurance can vary in duration depending on several factors. After submitting the application, the review process typically takes anywhere from a few weeks to several months. Factors influencing the timeline include the completeness of the application, the need for additional documentation, and the volume of applications being processed. Applicants are encouraged to follow up periodically to check on the status of their application.

Key Elements of the Long Term Care Insurance Program

Understanding the key elements of the Minnesota Long Term Care Insurance program is crucial for potential applicants. This includes knowing the types of services covered, such as in-home care, assisted living, and nursing home care. Additionally, applicants should be aware of the benefit period, which outlines how long the insurance will cover services, and any waiting periods that may apply before benefits begin. Familiarity with these elements can help individuals make informed decisions about their long-term care needs.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the do i qualify for the minnesota long term care insurance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What factors determine if I qualify for the Minnesota Long Term Care Insurance?

To determine if you qualify for the Minnesota Long Term Care Insurance, several factors are considered, including your age, health status, and financial situation. It's essential to review the eligibility criteria set by the state and insurance providers. Consulting with a licensed insurance agent can also provide clarity on your specific circumstances.

-

How much does the Minnesota Long Term Care Insurance cost?

The cost of Minnesota Long Term Care Insurance varies based on factors such as your age, health, and the level of coverage you choose. Typically, premiums can range from a few hundred to several thousand dollars annually. It's advisable to get quotes from multiple providers to find a plan that fits your budget while meeting your needs.

-

What benefits does the Minnesota Long Term Care Insurance offer?

Minnesota Long Term Care Insurance offers a range of benefits, including coverage for nursing home care, assisted living, and in-home care services. These policies are designed to help you manage the costs associated with long-term care, ensuring you receive the support you need as you age. Understanding the specific benefits of your policy is crucial to maximizing your coverage.

-

Are there any waiting periods for the Minnesota Long Term Care Insurance?

Yes, many Minnesota Long Term Care Insurance policies include a waiting period, also known as an elimination period, before benefits kick in. This period can range from 30 to 180 days, depending on the policy you choose. It's important to review the terms of your policy to understand how this may affect your coverage.

-

Can I customize my Minnesota Long Term Care Insurance policy?

Yes, many providers allow you to customize your Minnesota Long Term Care Insurance policy to better suit your needs. You can often choose the amount of coverage, the duration of benefits, and additional riders for specific services. Customization ensures that your policy aligns with your personal care preferences and financial situation.

-

How do I apply for the Minnesota Long Term Care Insurance?

To apply for the Minnesota Long Term Care Insurance, you typically need to fill out an application form and provide information about your health and financial status. After submitting your application, the insurance company will review your information and may require a medical exam. It's advisable to work with an insurance agent to navigate the application process smoothly.

-

What happens if I move out of Minnesota after purchasing Long Term Care Insurance?

If you move out of Minnesota after purchasing Long Term Care Insurance, your policy may still provide coverage, but it's essential to check with your insurance provider. Some policies may have specific terms regarding out-of-state care. Contacting your insurer will help clarify how your move affects your coverage and benefits.

Get more for Do I Qualify For The Minnesota Long Term Care Insurance

Find out other Do I Qualify For The Minnesota Long Term Care Insurance

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe