SCHEDULE K 1VT Shareholder, Partner, or Member Form

What is the Schedule K-1VT Shareholder, Partner, or Member?

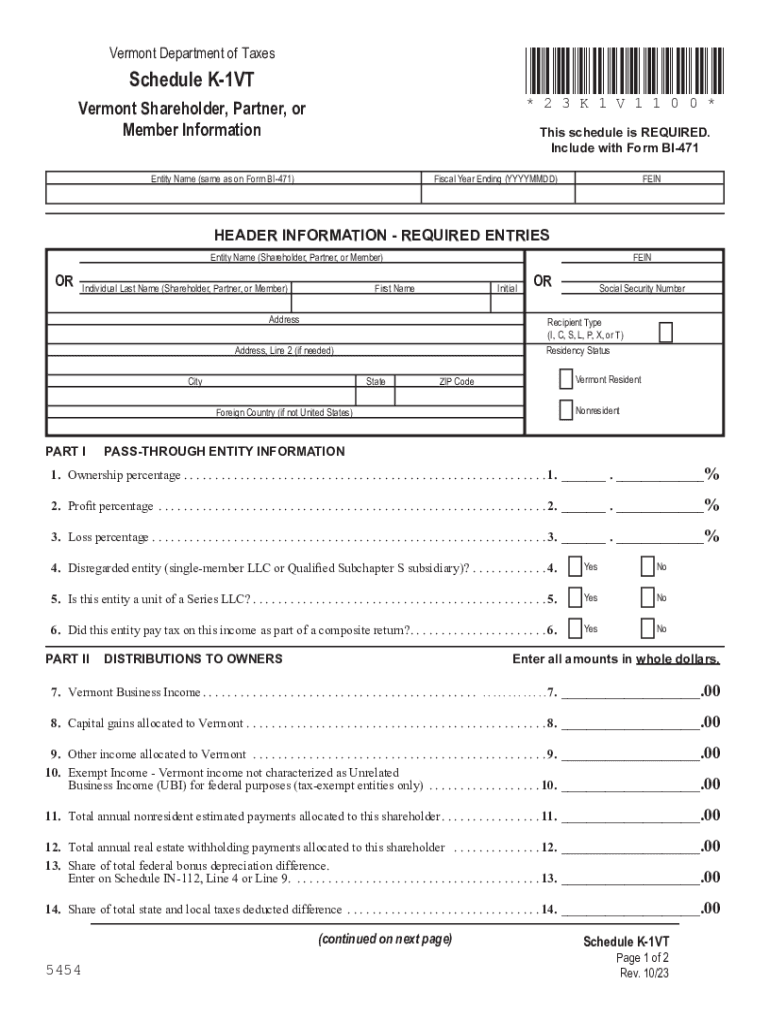

The Schedule K-1VT is a tax form used in Vermont for reporting income, deductions, and credits from partnerships, S corporations, and limited liability companies (LLCs). This form is essential for shareholders, partners, or members of these entities, as it provides detailed information necessary for personal income tax filings. The K-1VT form outlines each member's share of the entity's income, which is then reported on their individual tax returns.

How to Use the Schedule K-1VT Shareholder, Partner, or Member

To effectively use the Schedule K-1VT, recipients must first ensure they have received the form from their partnership or corporation. Once received, individuals should review the information provided, including income, deductions, and credits. This data must be accurately reported on the individual's Vermont personal income tax return. It is crucial to keep a copy of the K-1VT for personal records and future reference, as it may be required for audits or inquiries from the Vermont Department of Taxes.

Steps to Complete the Schedule K-1VT Shareholder, Partner, or Member

Completing the Schedule K-1VT involves several key steps:

- Obtain the form from your partnership or corporation.

- Review the information for accuracy, including your share of income and deductions.

- Transfer the relevant data from the K-1VT to your Vermont personal income tax return.

- Retain a copy of the completed form for your records.

It is advisable to consult a tax professional if there are any uncertainties regarding the completion of the form or its implications on your tax situation.

Legal Use of the Schedule K-1VT Shareholder, Partner, or Member

The Schedule K-1VT is legally required for reporting income from partnerships and S corporations in Vermont. Failure to provide accurate information on this form can lead to penalties from the Vermont Department of Taxes. It is essential for both the entity and the individual members to ensure compliance with state tax laws to avoid legal issues and fines.

Key Elements of the Schedule K-1VT Shareholder, Partner, or Member

Key elements of the Schedule K-1VT include:

- Entity Information: Name and identification number of the partnership or corporation.

- Member Information: Name, address, and identification number of the shareholder, partner, or member.

- Income and Deductions: Breakdown of each member's share of income, losses, and deductions.

- Credits: Any tax credits that can be claimed by the member.

Understanding these elements is crucial for accurate tax reporting and compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule K-1VT typically align with the due dates for Vermont personal income tax returns. Generally, the form must be filed by April 15 of each year. However, if an extension is filed, the deadline may be extended to October 15. It is important to check for any updates or changes to these dates annually, as they can vary based on state regulations.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule k 1vt shareholder partner or member

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a VT K1VT printable form?

The VT K1VT printable form is a tax document used in Vermont for reporting income and deductions. It is essential for individuals and businesses to accurately complete this form to ensure compliance with state tax regulations. Using airSlate SignNow, you can easily create, fill out, and eSign your VT K1VT printable forms online.

-

How can I access the VT K1VT printable form?

You can access the VT K1VT printable form through the airSlate SignNow platform. Simply log in, navigate to the forms section, and search for the VT K1VT printable form. This allows you to download, fill out, and eSign the document conveniently.

-

Is there a cost associated with using the VT K1VT printable form on airSlate SignNow?

airSlate SignNow offers various pricing plans that include access to the VT K1VT printable form. Depending on your needs, you can choose a plan that fits your budget while providing the necessary features for document management and eSigning. Check our pricing page for more details.

-

What features does airSlate SignNow offer for the VT K1VT printable form?

airSlate SignNow provides a range of features for the VT K1VT printable form, including customizable templates, secure eSigning, and document tracking. These features streamline the process of completing and submitting your tax forms, making it easier to manage your paperwork efficiently.

-

Can I integrate airSlate SignNow with other applications for the VT K1VT printable form?

Yes, airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when using the VT K1VT printable form. You can connect with popular tools like Google Drive, Dropbox, and CRM systems to enhance your document management process.

-

What are the benefits of using airSlate SignNow for the VT K1VT printable form?

Using airSlate SignNow for the VT K1VT printable form offers numerous benefits, including time savings, increased accuracy, and enhanced security. The platform simplifies the eSigning process, ensuring that your documents are completed quickly and securely, which is crucial during tax season.

-

Is it easy to eSign the VT K1VT printable form with airSlate SignNow?

Absolutely! airSlate SignNow makes it incredibly easy to eSign the VT K1VT printable form. With a user-friendly interface, you can sign documents electronically in just a few clicks, eliminating the need for printing and scanning.

Get more for SCHEDULE K 1VT Shareholder, Partner, Or Member

- New mexico form 497320387

- Warranty deed from trust to one individual new mexico form

- Petition for admission to practice new mexico form

- Financial affidavit pdf form

- New mexico deed 497320391 form

- Deed full reconveyance form

- Legal last will and testament form for single person with no children new mexico

- Legal last will and testament form for a single person with minor children new mexico

Find out other SCHEDULE K 1VT Shareholder, Partner, Or Member

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter