Nebraska Income Tax Withholding Certificate for Form

What is the Nebraska Income Tax Withholding Certificate For

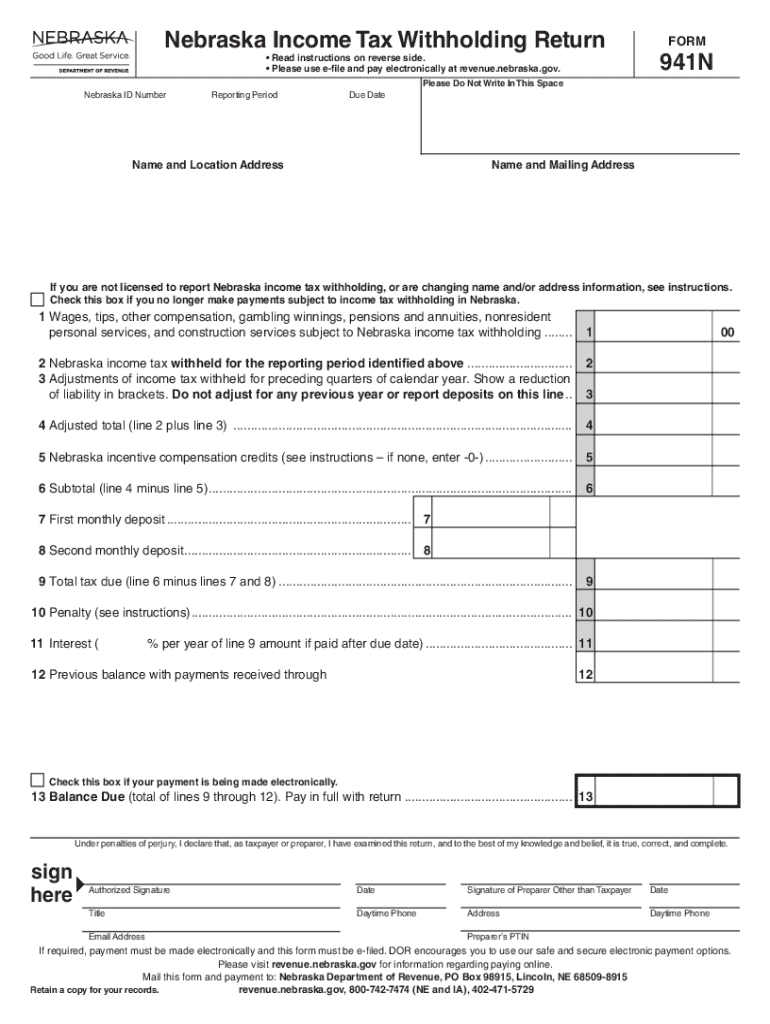

The Nebraska Income Tax Withholding Certificate, often referred to as the Nebraska Form W-4N, is a crucial document for both employers and employees in the state. It is used to determine the amount of state income tax to withhold from an employee's paycheck. This form helps ensure that the correct amount of tax is deducted, allowing employees to meet their tax obligations while avoiding underpayment or overpayment throughout the year.

Employers are required to have this certificate on file for each employee to comply with state tax regulations. The information provided on the form directly affects the employee's take-home pay and contributes to the overall revenue collected by the state of Nebraska.

How to use the Nebraska Income Tax Withholding Certificate For

To use the Nebraska Income Tax Withholding Certificate effectively, employees must complete the form accurately and submit it to their employer. The form requires personal information such as name, address, Social Security number, and the number of allowances claimed. Employees can adjust their withholding by increasing or decreasing the number of allowances based on their financial situation.

Once the form is submitted, employers will use the information to calculate the appropriate state income tax withholding from each paycheck. It is important for employees to review their withholding periodically, especially after major life events such as marriage, divorce, or the birth of a child, as these changes can impact tax liability.

Steps to complete the Nebraska Income Tax Withholding Certificate For

Completing the Nebraska Income Tax Withholding Certificate involves several straightforward steps:

- Obtain the form from your employer or the Nebraska Department of Revenue website.

- Fill out your personal information, including your name, address, and Social Security number.

- Determine the number of allowances you wish to claim based on your tax situation.

- If applicable, indicate any additional withholding amounts you want to be deducted from your pay.

- Sign and date the form before submitting it to your employer.

Following these steps ensures that your withholding is calculated correctly, aligning with your financial needs and tax obligations.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Nebraska Income Tax Withholding Certificate is essential for both employers and employees. Generally, employees should submit their completed W-4N form to their employer as soon as they start a new job or experience a significant life change that affects their tax situation.

Employers are responsible for updating their payroll systems to reflect any changes in withholding based on the submitted forms. It is advisable for employees to review their withholding status at least once a year or before the start of a new tax year to ensure compliance and accuracy.

Penalties for Non-Compliance

Failure to comply with Nebraska's income tax withholding requirements can lead to significant penalties for both employers and employees. Employers who do not withhold the correct amount of state income tax may face fines and interest on unpaid taxes. Additionally, employees who underpay their taxes due to incorrect withholding may incur penalties when filing their annual tax returns.

To avoid these penalties, it is crucial for both parties to ensure that the Nebraska Income Tax Withholding Certificate is completed accurately and submitted in a timely manner. Regular reviews of withholding amounts can also help mitigate risks associated with non-compliance.

Eligibility Criteria

Eligibility to file the Nebraska Income Tax Withholding Certificate is generally open to all employees working in Nebraska. This includes full-time, part-time, and temporary workers. However, certain exemptions may apply, such as for employees who are not subject to Nebraska income tax or those who are exempt from withholding due to their specific tax situation.

It is important for employees to assess their eligibility based on their individual circumstances and consult with a tax professional if necessary. Understanding eligibility criteria can help ensure compliance and optimize tax withholding.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nebraska income tax withholding certificate for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to Nebraska revenue?

airSlate SignNow is a powerful eSignature solution that helps businesses streamline their document signing processes. By utilizing airSlate SignNow, companies in Nebraska can enhance their operational efficiency, ultimately impacting their revenue positively. This tool simplifies the signing process, making it easier for businesses to close deals faster and increase their overall Nebraska revenue.

-

How can airSlate SignNow help improve my Nebraska revenue?

By adopting airSlate SignNow, businesses can reduce the time spent on document management and signing, which directly contributes to increased productivity. This efficiency allows companies to focus on core activities that drive Nebraska revenue. Additionally, the ability to send and sign documents quickly can lead to faster deal closures, further boosting revenue.

-

What are the pricing options for airSlate SignNow in Nebraska?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses in Nebraska. These plans are designed to be cost-effective, ensuring that companies can choose an option that aligns with their budget while maximizing their potential Nebraska revenue. You can find detailed pricing information on our website.

-

What features does airSlate SignNow offer that can benefit Nebraska businesses?

airSlate SignNow includes a variety of features such as customizable templates, real-time tracking, and secure cloud storage. These features are designed to enhance the document signing experience for businesses in Nebraska, ultimately leading to improved efficiency and increased Nebraska revenue. The platform's user-friendly interface also ensures a smooth experience for all users.

-

Can airSlate SignNow integrate with other tools commonly used in Nebraska?

Yes, airSlate SignNow offers seamless integrations with various business applications that are popular among Nebraska companies. This includes CRM systems, project management tools, and more, allowing businesses to streamline their workflows. By integrating these tools, companies can enhance their operational efficiency and drive Nebraska revenue.

-

Is airSlate SignNow secure for handling sensitive documents in Nebraska?

Absolutely, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive documents in Nebraska. The platform employs advanced encryption and adheres to industry standards to protect your data. This commitment to security helps businesses maintain trust with their clients, which is essential for sustaining Nebraska revenue.

-

What are the benefits of using airSlate SignNow for small businesses in Nebraska?

Small businesses in Nebraska can greatly benefit from using airSlate SignNow due to its affordability and ease of use. The platform allows these businesses to manage their document signing processes efficiently, which can lead to increased productivity and higher Nebraska revenue. Additionally, the ability to send documents quickly helps small businesses compete effectively in the market.

Get more for Nebraska Income Tax Withholding Certificate For

- Salary verification form for potential lease virginia

- Landlord agreement to allow tenant alterations to premises virginia form

- Notice of default on residential lease virginia form

- Landlord tenant lease co signer agreement virginia form

- Application for sublease virginia form

- Inventory and condition of leased premises for pre lease and post lease virginia form

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out virginia form

- Property manager agreement virginia form

Find out other Nebraska Income Tax Withholding Certificate For

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy