Nebraska Exemption Application for Common or Contract Carrier's Form

Purpose of the Nebraska Exemption Application for Common or Contract Carriers

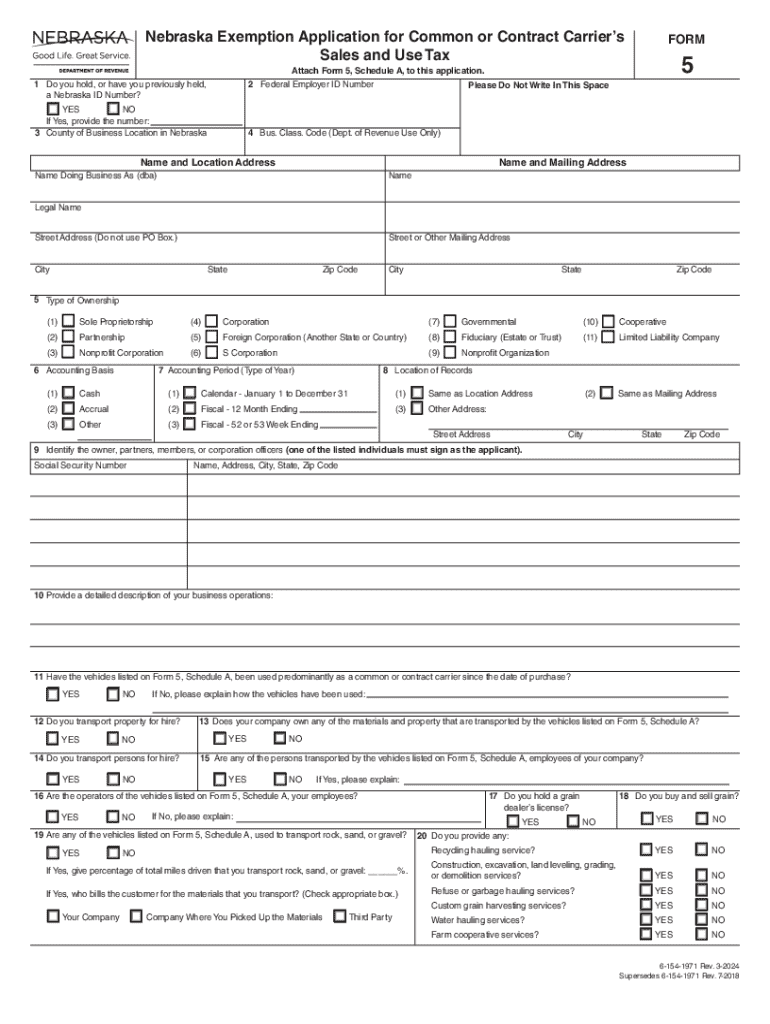

The Nebraska exemption application serves as a formal request for tax exemptions specifically designed for common or contract carriers operating within the state. This application allows eligible businesses to claim exemptions from certain taxes, including sales and use taxes, which can significantly reduce operational costs. By utilizing this exemption, carriers can allocate more resources towards their business operations, enhancing competitiveness in the market.

Steps to Complete the Nebraska Exemption Application for Common or Contract Carriers

Completing the Nebraska exemption application involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your business details, tax identification number, and specifics about the services provided. Next, fill out the application form carefully, ensuring that all sections are completed. It is important to double-check for any errors or omissions. Once completed, submit the application according to the specified guidelines, which may include online or mail submission options.

Eligibility Criteria for the Nebraska Exemption Application

To qualify for the Nebraska exemption application, businesses must meet specific eligibility criteria. Generally, only common or contract carriers that provide transportation services are eligible. Additionally, the services must be directly related to the transportation of goods or passengers. Businesses should also maintain proper documentation that supports their claim for exemption, ensuring compliance with state regulations.

Required Documents for the Nebraska Exemption Application

When applying for the Nebraska exemption, certain documents are required to support your application. These typically include:

- A completed Nebraska exemption application form.

- Proof of business registration, such as a business license.

- Tax identification number or employer identification number (EIN).

- Documentation demonstrating the nature of your transportation services.

Having these documents ready can streamline the application process and help avoid delays in approval.

Form Submission Methods for the Nebraska Exemption Application

The Nebraska exemption application can be submitted through various methods, providing flexibility for businesses. Options typically include:

- Online submission through the Nebraska Department of Revenue website.

- Mailing the completed form to the appropriate state office.

- In-person submission at designated state offices.

Each method has its own processing times and requirements, so it is advisable to choose the one that best fits your needs.

Legal Use of the Nebraska Exemption Application

The legal use of the Nebraska exemption application is governed by state tax laws and regulations. Businesses must ensure that they are using the form for its intended purpose and comply with all relevant legal requirements. Misuse of the exemption application can result in penalties, including fines or revocation of the exemption status. It is essential for businesses to stay informed about any changes in legislation that may affect their eligibility or the application process.

Application Process and Approval Time for the Nebraska Exemption Application

The application process for the Nebraska exemption can vary in duration based on several factors, including the volume of applications received by the state. Typically, businesses can expect a processing time of several weeks. It is advisable to submit the application well in advance of any deadlines to ensure timely approval. Once approved, businesses will receive confirmation of their exemption status, which should be kept on file for future reference.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nebraska exemption application for common or contract carriers

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nebraska exemption application process?

The Nebraska exemption application process involves submitting specific forms to the state to qualify for tax exemptions. airSlate SignNow simplifies this process by allowing you to eSign and send documents securely, ensuring that your Nebraska exemption application is completed efficiently.

-

How can airSlate SignNow help with my Nebraska exemption application?

airSlate SignNow provides a user-friendly platform to manage your Nebraska exemption application. With features like document templates and eSignature capabilities, you can streamline the application process and ensure all necessary documents are submitted correctly.

-

What are the costs associated with using airSlate SignNow for my Nebraska exemption application?

airSlate SignNow offers competitive pricing plans that cater to various business needs. By using our service for your Nebraska exemption application, you can save time and reduce costs associated with traditional document handling and signing methods.

-

Are there any integrations available for airSlate SignNow that can assist with the Nebraska exemption application?

Yes, airSlate SignNow integrates with various applications such as Google Drive, Dropbox, and CRM systems. These integrations can help you manage your documents more effectively while working on your Nebraska exemption application.

-

What features does airSlate SignNow offer for managing the Nebraska exemption application?

airSlate SignNow offers features like customizable templates, real-time tracking, and secure cloud storage. These tools are designed to enhance your experience while preparing and submitting your Nebraska exemption application.

-

Can I track the status of my Nebraska exemption application using airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for all documents, including your Nebraska exemption application. You will receive notifications when your application is viewed or signed, keeping you informed throughout the process.

-

Is airSlate SignNow secure for submitting my Nebraska exemption application?

Yes, airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. You can confidently submit your Nebraska exemption application knowing that your sensitive information is protected.

Get more for Nebraska Exemption Application For Common Or Contract Carrier's

- Letter from tenant to landlord for failure of landlord to return all prepaid and unearned rent and security recoverable by 497320661 form

- Nevada codes form

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497320663 form

- Letter from landlord to tenant for failure to keep premises as clean and safe as condition of premises permits remedy or lease 497320664 form

- Nevada landlord in form

- Nevada landlord tenant 497320666 form

- Landlord tenant use 497320667 form

- Letter from landlord to tenant as notice to tenant of tenants disturbance of neighbors peaceful enjoyment to remedy or lease 497320668 form

Find out other Nebraska Exemption Application For Common Or Contract Carrier's

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors