TC 69C Notice of Change for a Tax Account Cloudfront Net Form

What is the TC 69C Notice of Change for a Tax Account

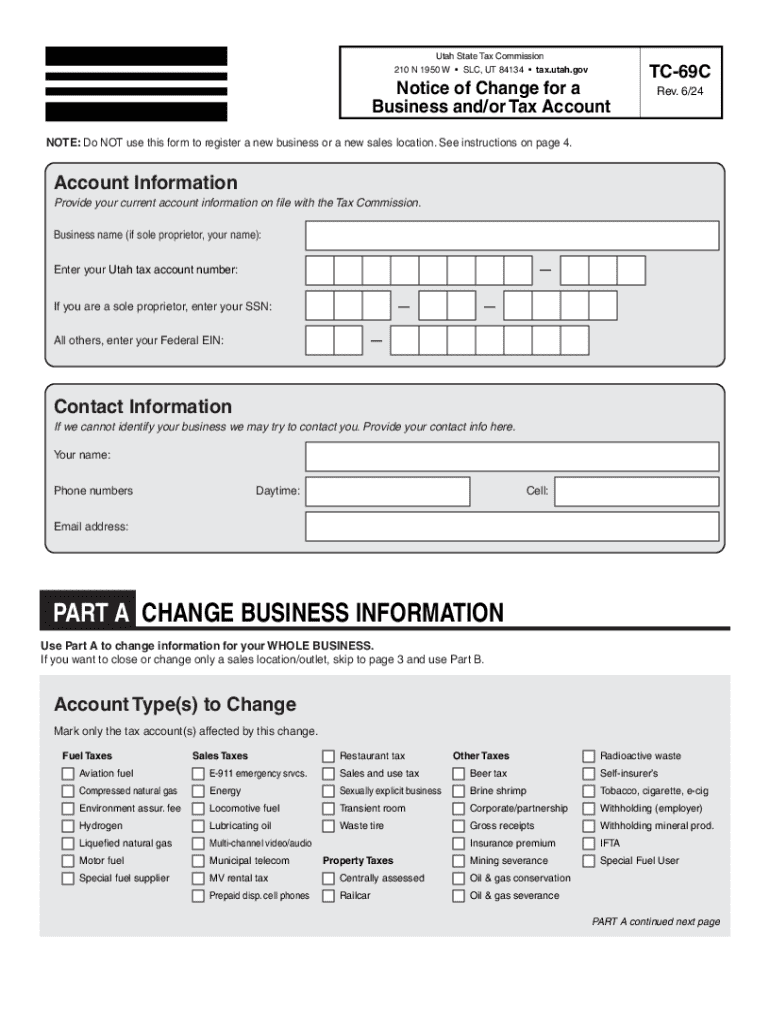

The TC 69C Notice of Change is an official document used by the Utah State Tax Commission to notify taxpayers of changes to their tax accounts. This form is essential for updating information related to a taxpayer's account, such as changes in address, name, or business structure. It ensures that the tax records are accurate and up to date, which is crucial for compliance with state tax laws.

Key Elements of the TC 69C Notice of Change

The TC 69C includes several important components that taxpayers should be aware of:

- Taxpayer Identification: This section requires the taxpayer's name, address, and identification number.

- Details of Change: Taxpayers must specify the nature of the change, whether it's a change of address, name, or other relevant information.

- Effective Date: The form requires the date when the change will take effect, which is critical for tax records.

- Signature: The taxpayer must sign the form to validate the changes being reported.

Steps to Complete the TC 69C Notice of Change

Filling out the TC 69C Notice of Change involves several straightforward steps:

- Gather necessary information, including your current tax account details.

- Complete the form by entering your identification information and specifying the changes.

- Review the form for accuracy to avoid any potential issues with your tax account.

- Sign and date the form to confirm the changes.

- Submit the completed form to the appropriate tax authority, either online or via mail.

How to Obtain the TC 69C Notice of Change

The TC 69C Notice of Change can be obtained directly from the Utah State Tax Commission website or through local tax offices. Many taxpayers prefer to download the form online for convenience. It is also advisable to check for any updates or changes to the form to ensure compliance with current regulations.

Filing Deadlines / Important Dates

Timely submission of the TC 69C is crucial. Taxpayers should be aware of specific deadlines related to their tax account changes. Generally, changes should be reported as soon as they occur to avoid any penalties or complications with tax filings. It is recommended to keep track of any relevant deadlines set by the Utah State Tax Commission.

Legal Use of the TC 69C Notice of Change

The TC 69C Notice of Change is a legally recognized document. Proper use of this form is vital for maintaining accurate tax records and ensuring compliance with Utah tax laws. Failure to report changes using this form may result in discrepancies in tax records, which could lead to penalties or legal issues. Taxpayers should ensure they understand the legal implications of the information reported on this form.

Handy tips for filling out TC 69C Notice Of Change For A Tax Account Cloudfront net online

Quick steps to complete and e-sign TC 69C Notice Of Change For A Tax Account Cloudfront net online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Get access to a HIPAA and GDPR compliant solution for maximum efficiency. Use signNow to e-sign and share TC 69C Notice Of Change For A Tax Account Cloudfront net for e-signing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tc 69c notice of change for a tax account cloudfront net

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the utah form tc69 and why is it important?

The utah form tc69 is a crucial document used for tax purposes in Utah. It helps individuals and businesses report their income accurately and ensures compliance with state regulations. Understanding how to fill out and submit the utah form tc69 can save you time and prevent potential penalties.

-

How can airSlate SignNow help with the utah form tc69?

airSlate SignNow simplifies the process of completing and eSigning the utah form tc69. Our platform allows you to fill out the form electronically, ensuring that all necessary fields are completed accurately. Additionally, you can securely send the form to others for their signatures, streamlining the entire process.

-

Is there a cost associated with using airSlate SignNow for the utah form tc69?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our plans are designed to be cost-effective, providing you with the tools necessary to manage documents like the utah form tc69 efficiently. You can choose a plan that fits your budget while still accessing essential features.

-

What features does airSlate SignNow offer for managing the utah form tc69?

airSlate SignNow provides a range of features to assist with the utah form tc69, including customizable templates, secure eSigning, and document tracking. These features ensure that you can manage your forms effectively and keep track of their status throughout the signing process. Our user-friendly interface makes it easy to navigate and utilize these tools.

-

Can I integrate airSlate SignNow with other applications for the utah form tc69?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when handling the utah form tc69. Whether you use CRM systems, cloud storage, or other document management tools, our platform can connect seamlessly to enhance your productivity.

-

What are the benefits of using airSlate SignNow for the utah form tc69?

Using airSlate SignNow for the utah form tc69 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete and send documents quickly, minimizing delays in your processes. Additionally, the secure eSigning feature ensures that your sensitive information is protected.

-

Is airSlate SignNow user-friendly for completing the utah form tc69?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete the utah form tc69. Our intuitive interface guides you through the process, ensuring that you can fill out and eSign documents without any technical difficulties. You can get started quickly, even if you're not tech-savvy.

Get more for TC 69C Notice Of Change For A Tax Account Cloudfront net

- Legal last will and testament form for divorced person not remarried with no children virginia

- Legal last will and testament form for divorced person not remarried with minor children virginia

- Legal last will and testament form for divorced person not remarried with adult and minor children virginia

- Mutual wills package with last wills and testaments for married couple with adult children virginia form

- Mutual wills package with last wills and testaments for married couple with no children virginia form

- Mutual wills package with last wills and testaments for married couple with minor children virginia form

- Legal last will and testament form for married person with adult children virginia

- Va married form

Find out other TC 69C Notice Of Change For A Tax Account Cloudfront net

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure