Iowa Withholding Quarterly Tax Return 2023-2026

What is the Iowa Withholding Quarterly Tax Return

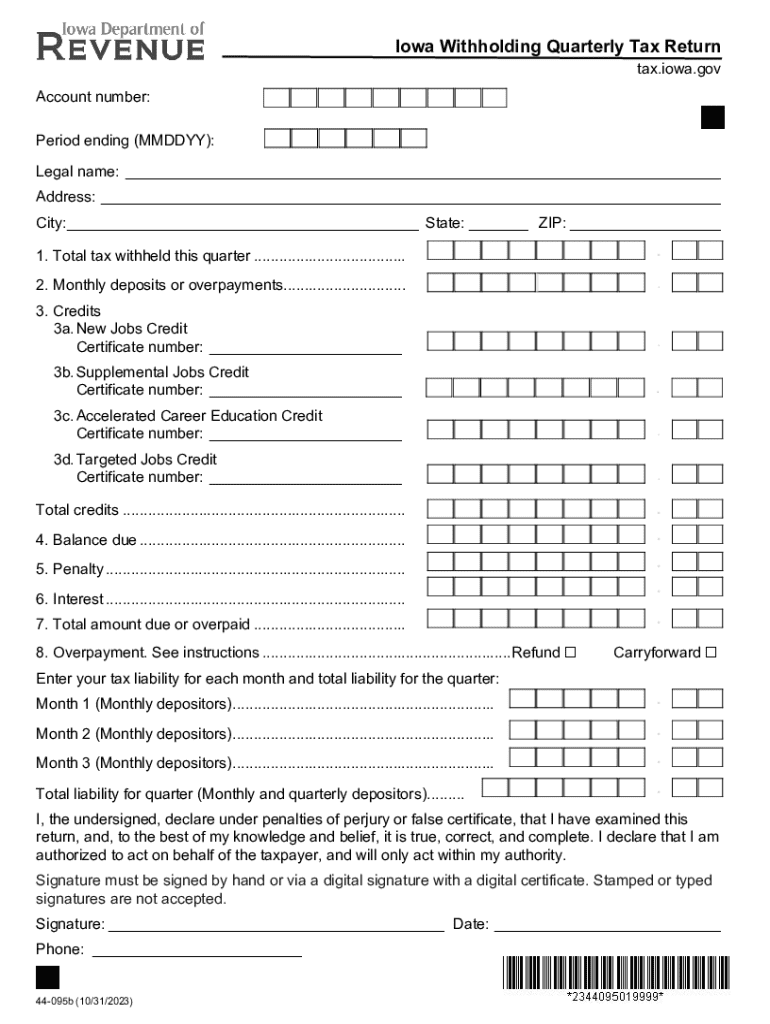

The Iowa Withholding Quarterly Tax Return is a form used by employers in Iowa to report and remit state income tax withheld from employee wages. This form is essential for ensuring compliance with Iowa tax laws and helps the state collect revenue from income taxes. Employers must file this return quarterly, detailing the amount of tax withheld during the reporting period. Understanding this form is crucial for maintaining accurate payroll records and fulfilling tax obligations.

How to use the Iowa Withholding Quarterly Tax Return

Employers utilize the Iowa Withholding Quarterly Tax Return to report the total amount of state income tax withheld from their employees' wages. To use the form effectively, employers should gather all necessary payroll records for the quarter, including gross wages and the amount withheld for state taxes. The completed form must be submitted to the Iowa Department of Revenue by the designated deadlines to avoid penalties.

Steps to complete the Iowa Withholding Quarterly Tax Return

Completing the Iowa Withholding Quarterly Tax Return involves several key steps:

- Gather payroll records for the quarter, including employee wages and withholding amounts.

- Fill out the form accurately, ensuring all required fields are completed, including employer information and total withholding amounts.

- Review the completed form for accuracy to prevent errors that could lead to penalties.

- Submit the form by the deadline, either electronically or by mail, as per the instructions provided by the Iowa Department of Revenue.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing the Iowa Withholding Quarterly Tax Return. The filing due dates are typically set for the last day of the month following the end of each quarter. For example, returns for the first quarter (January to March) are due by April 30. It is crucial for employers to be aware of these deadlines to avoid late fees and penalties.

Penalties for Non-Compliance

Failure to file the Iowa Withholding Quarterly Tax Return on time can result in significant penalties. The Iowa Department of Revenue may impose late fees based on the amount of tax owed. Additionally, employers may face interest charges on any unpaid tax amounts. Understanding these penalties highlights the importance of timely and accurate filing to maintain compliance with state tax laws.

Form Submission Methods

Employers can submit the Iowa Withholding Quarterly Tax Return through various methods, including:

- Online submission via the Iowa Department of Revenue's eFile system, which allows for quick processing.

- Mailing a paper form to the appropriate address provided by the Iowa Department of Revenue.

- In-person submission at designated state tax offices, which may be beneficial for employers with questions or needing assistance.

Create this form in 5 minutes or less

Find and fill out the correct iowa withholding quarterly tax return

Create this form in 5 minutes!

How to create an eSignature for the iowa withholding quarterly tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Iowa Withholding Quarterly Tax Return?

The Iowa Withholding Quarterly Tax Return is a tax form that employers in Iowa must file to report the state income tax withheld from employees' wages. This return is essential for ensuring compliance with Iowa tax laws and helps businesses manage their tax obligations effectively.

-

How can airSlate SignNow assist with the Iowa Withholding Quarterly Tax Return?

airSlate SignNow provides an easy-to-use platform for businesses to prepare, sign, and submit their Iowa Withholding Quarterly Tax Return electronically. This streamlines the process, reduces paperwork, and ensures that your tax documents are submitted on time.

-

What are the pricing options for using airSlate SignNow for tax returns?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for small businesses and larger enterprises. Each plan provides access to features that simplify the filing of the Iowa Withholding Quarterly Tax Return, ensuring you get the best value for your investment.

-

Are there any features specifically designed for tax compliance?

Yes, airSlate SignNow includes features that enhance tax compliance, such as automated reminders for filing deadlines and secure document storage. These features are particularly beneficial for managing the Iowa Withholding Quarterly Tax Return and ensuring that all necessary forms are completed accurately.

-

Can I integrate airSlate SignNow with my existing accounting software?

Absolutely! airSlate SignNow offers integrations with various accounting software solutions, making it easy to sync your financial data. This integration helps streamline the process of preparing your Iowa Withholding Quarterly Tax Return and ensures that all information is accurate and up-to-date.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management offers numerous benefits, including increased efficiency, reduced errors, and enhanced security. By utilizing our platform for your Iowa Withholding Quarterly Tax Return, you can focus more on your business while we handle the complexities of tax compliance.

-

Is airSlate SignNow user-friendly for those unfamiliar with tax forms?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible even for those unfamiliar with tax forms. Our intuitive interface guides users through the process of completing the Iowa Withholding Quarterly Tax Return, ensuring a smooth experience.

Get more for Iowa Withholding Quarterly Tax Return

- Order appointing guardian 497430071 form

- Ju 030400 order of dependency orod washington form

- Ju 030410 order of disposition on dependency ord washington form

- Washington guardianship 497430074 form

- Ju 030710 statement and certification of proposed guardian dclr washington form

- Ju 030720 statement of parent waiving presentation of order of guardianship wv washington form

- Ju 030730 hearing findings conclusions and order appointing guardian orapgd washington form

- Declaration petitioner form

Find out other Iowa Withholding Quarterly Tax Return

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter