Iowa Form 44 095 2006

What is the Iowa Form 44 095

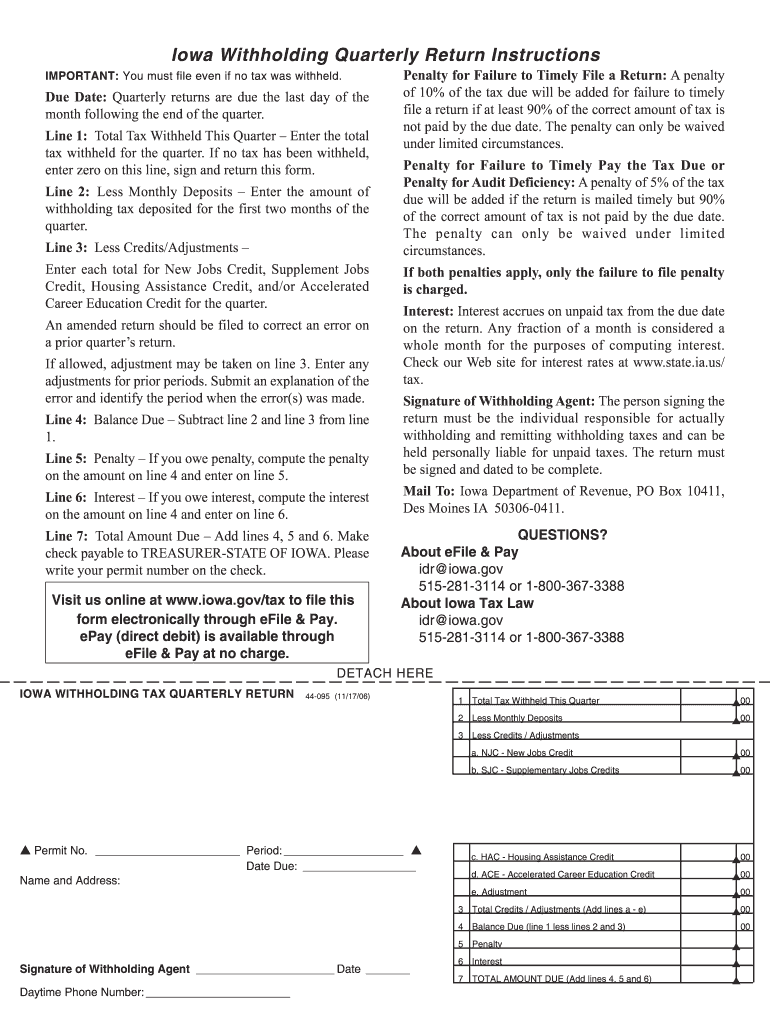

The Iowa Form 44 095 is a crucial document used for reporting and remitting state withholding tax for employers in Iowa. This form is essential for businesses that withhold income tax from employees' wages, ensuring compliance with state tax regulations. It serves as a quarterly withholding tax return, detailing the amount of tax withheld and the corresponding payments made to the state. Understanding the purpose and requirements of this form is vital for maintaining proper tax records and fulfilling legal obligations.

How to use the Iowa Form 44 095

Using the Iowa Form 44 095 involves several straightforward steps. Employers must accurately report the total amount of Iowa income tax withheld from employee wages during the quarter. The form requires specific details, including the employer's identification number, the total wages paid, and the total tax withheld. Once completed, the form must be submitted to the Iowa Department of Revenue, either electronically or via mail. Proper usage of this form helps ensure that employers meet their tax responsibilities and avoid potential penalties.

Steps to complete the Iowa Form 44 095

Completing the Iowa Form 44 095 requires careful attention to detail. Follow these steps for accurate completion:

- Gather necessary information, including the employer's identification number and total wages paid for the quarter.

- Calculate the total Iowa income tax withheld from employee wages during the reporting period.

- Fill out the form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the Iowa Department of Revenue by the specified deadline.

Legal use of the Iowa Form 44 095

The legal use of the Iowa Form 44 095 is governed by state tax laws. Employers must file this form to comply with Iowa's withholding tax regulations. Failure to submit the form on time or inaccuracies in reporting can lead to penalties. The form is considered a legal document, and its proper completion is essential for ensuring that the withheld taxes are accurately reported and remitted to the state. Employers should retain copies of submitted forms for their records, as they may be required for audits or other inquiries.

Filing Deadlines / Important Dates

Filing deadlines for the Iowa Form 44 095 are crucial for compliance. Employers must submit this form quarterly, with specific due dates that vary based on the quarter. Typically, the deadlines are as follows:

- First quarter (January - March): Due by April 30

- Second quarter (April - June): Due by July 31

- Third quarter (July - September): Due by October 31

- Fourth quarter (October - December): Due by January 31 of the following year

Employers should mark these dates on their calendars to avoid late submissions and potential penalties.

Form Submission Methods (Online / Mail / In-Person)

The Iowa Form 44 095 can be submitted through various methods, providing flexibility for employers. Options include:

- Online Submission: Employers can file electronically through the Iowa Department of Revenue's online portal, which is often the most efficient method.

- Mail Submission: Completed forms can be printed and mailed to the appropriate address provided by the Iowa Department of Revenue.

- In-Person Submission: Employers may also choose to deliver the form in person at designated state offices, although this is less common.

Choosing the right submission method can help ensure timely and accurate filing of the Iowa Form 44 095.

Quick guide on how to complete iowa withholding quarterly return form

Complete Iowa Form 44 095 effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Iowa Form 44 095 on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign Iowa Form 44 095 with ease

- Find Iowa Form 44 095 and click Get Form to initiate.

- Use the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes only seconds and carries the same legal validity as a standard handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Iowa Form 44 095 and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct iowa withholding quarterly return form

FAQs

-

How much would an accountant charge me for filling out a Quarterly Federal Tax Return (941) in Texas?

For full service payroll I charge $100 per month for up to 5 employees. That includes filing the federal and state quarterly returns and year end W2's.If you just need the 941 completed and you have all of your payroll records in order, then the fee would be $50 to prepare the form for you. Note that you also need to file a quarterly return with TWC if you have Texas employees.

-

When I fill out my tax information for a new employer, what do I put for max withholding, to get the biggest possible tax return?

It sounds like you wish to get a large tax return. In that case when filling out your W-4 form you should claim S-0 (that’s single with zero exemptions). This means that your employer will take out the maximum amount. For those people who insist upon the government having use of their money all year there is also an option to have additional funds taken out and held and then returned when your annual return is filed. For that matter you could allow the government to keep it all during the year and then when you file your return instead of taking a refund just tell them to keep it toward next years return. Seriously, I know the large tax return seems nice and for some people that is how they save for vacations and other things, but a tax return is not a gift from the USA. It is your money and receiving a large tax return means that you allowed someone else to have your money for a year without paying you interest for the privilege of keeping your money.

-

What is the official website to fill out the GST return form?

https://www.gst.gov.in/

-

I am doing an export but my turnover will be less than 1.5 crore. Will I have to fill out the GST return monthly or quarterly?

Taxpayers with an annual aggregate turnover up to Rs 1.5 crore in the previous financial year or anticipated in the current financial year can avail the option of filing GSTR1 quarterly.It is optional, user can file monthly or quarterly up to 1.5 Cr.Now govt has proposed new return format :RET-1RET-2 (sahaj), only for B2Cs supplyRET-3 (sugam)Small taxpayers having turnover up to Rs. 5 Cr. have the option to file one of 3 forms, namely – Quarterly return (RET-1), Sahaj (RET-2) or Sugam (RET-3).

-

Is it okay to submit a Form 67 after filling out my tax return?

As per the law, Form 67 is required for claiming Foreign Tax Credits by an assessee and it should be done along with the return of income.It is possible to file Form 67 before filing the return.The question is whether the Form can be filed after filing the return of income. While the requirement is procedural, a return may be termed as incomplete if the form is not filed along with the returns and an officer can deny foreign tax credits.However, for all intents and purposes if you file Form 67 before the completion of assessment or even with an application u/s 154 once the assessment is completed, it cannot be denied if the facts have been already disclosed in the return and teh form in itself is only completing a process.However, to avoid adventures with the department and unwanted litigation, it is always prudent to file the form with the return of income so that it is not missed out or forgotten.

-

I want to invest my IRS withholdings. How do I fill out a W-4 so my employer does not do federal withholding?

Legally you can’t. Those withholdings are not yours. They are payments towards your tax liability, made at the time that you earn the income. Pay as you go. It makes sense.So what you want to do is borrow money that isn’t really yours, interest free, invest it for a few months, and then pay it back the next year. Is that correct? While it’s not really permitted you can manage to get away with it. You can’t easily get away with stopping all withholding. That requires stating that you expect to pay zero taxes for the year, which you know is false. It looks suspicious and is easy for the feds to check. Instead, what you can do is reduce your withholding by claiming a large number of exemptions. That’s not nearly as suspicious. When you complete your return you’ll owe a lot of tax, which is clearly against the rules, but you’ll probably get away with it at least for a year or two and maybe longer depending on how lax the IRS is in enforcing the law on scamsters like yourself.I used to claim a large number of exemptions. It was legitimate since I actually had a lot of deductions at that time. But a couple of years I accidentally withheld too little money, more than a couple of thousand dollars. I paid the tax with my return and adjusted my withholding going forward and the IRS didn’t penalize me or question it afterwards. But if you’re talking about under withholding by a lot more than that and year after year then good luck. You might get caught, forced to pay a penalty and interest, and be flagged for special attention in the future.

-

I started teaching piano lessons this year, how do I pay quarterly taxes in California? What form should I fill out?

Go to https://www.irs.gov/pub/irs-pdf/... You will file a form 1040ES each quarter. The website will tell you the due dates for each quarterly payment. Get a similar form from your state tax board website if you pay state taxes.Note: If this is your first year filing, ever, then you can get away without sending in estimated payments because you owe the LESSER of what you owe this year or last year. Having been self-employed most of my life, I always filed quarterly estimated taxes, using the amount I had owed the year before, because I had to to avoid fines, and because I didn't want to get to April of the next year and not have the money. As for the amount you should pay to the IRS and your state, you might be able to figure this out using worksheets available on the IRS and state websites. If you chose to deal in cash and not report it, that's your business. Your students are not going to send you a 1099 at the end of the year. But if you teach at an institution which pays you more than a few thousand dollars a year, they WILL file a 1099 stating how much they paid you in miscellaneous income, with the IRS and state.

Create this form in 5 minutes!

How to create an eSignature for the iowa withholding quarterly return form

How to create an electronic signature for the Iowa Withholding Quarterly Return Form in the online mode

How to generate an eSignature for your Iowa Withholding Quarterly Return Form in Chrome

How to create an electronic signature for signing the Iowa Withholding Quarterly Return Form in Gmail

How to generate an electronic signature for the Iowa Withholding Quarterly Return Form from your mobile device

How to create an electronic signature for the Iowa Withholding Quarterly Return Form on iOS devices

How to make an electronic signature for the Iowa Withholding Quarterly Return Form on Android OS

People also ask

-

What is Iowa Form 44 095 and how can airSlate SignNow help with it?

Iowa Form 44 095 is a document used for tax purposes in the state of Iowa. With airSlate SignNow, you can easily fill out, sign, and manage Iowa Form 44 095 electronically, streamlining your tax preparation process. Our platform ensures compliance and security while saving you time.

-

Is airSlate SignNow affordable for businesses needing to manage Iowa Form 44 095?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Whether you need to manage Iowa Form 44 095 or other documents, our cost-effective solution ensures you can handle your paperwork without breaking the bank.

-

Can I integrate airSlate SignNow with other tools for managing Iowa Form 44 095?

Absolutely! airSlate SignNow seamlessly integrates with various applications like Google Drive, Dropbox, and CRM systems. This integration allows for easy access and management of Iowa Form 44 095 alongside your other documents, enhancing your workflow.

-

What features does airSlate SignNow offer for completing Iowa Form 44 095?

airSlate SignNow provides features such as customizable templates, electronic signatures, and secure cloud storage. These tools make it simple to complete Iowa Form 44 095 accurately and efficiently, reducing the risk of errors and ensuring timely submissions.

-

How does airSlate SignNow ensure the security of Iowa Form 44 095?

Security is a top priority for airSlate SignNow. We use bank-level encryption and secure access controls to protect your data, including Iowa Form 44 095. You can trust that your sensitive information is safe while using our platform.

-

Can I track the status of my Iowa Form 44 095 with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your Iowa Form 44 095 in real-time. You will receive notifications when your document is viewed, signed, or completed, providing you with peace of mind throughout the process.

-

What types of businesses can benefit from using airSlate SignNow for Iowa Form 44 095?

Businesses of all types can benefit from using airSlate SignNow for Iowa Form 44 095, including freelancers, small businesses, and large corporations. Our platform is designed to cater to various industries, helping streamline document management and improve efficiency.

Get more for Iowa Form 44 095

Find out other Iowa Form 44 095

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document