Tax Tables & Tax Rate Schedules Tax Tables & Tax Rate Schedules Form

Understanding the Tax Tables & Tax Rate Schedules

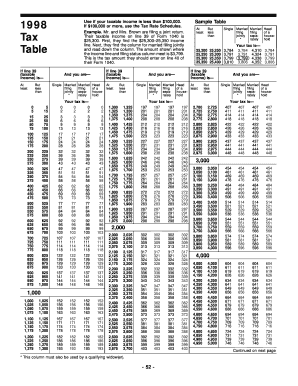

The Tax Tables & Tax Rate Schedules provide essential information for individuals and businesses to determine their tax obligations. These tables outline the income ranges and corresponding tax rates applicable for a given tax year. They are crucial for accurate tax calculations, ensuring taxpayers understand how much they owe based on their income level. The tables typically include various categories, such as single filers, married couples filing jointly, and heads of household, each with distinct tax brackets.

How to Use the Tax Tables & Tax Rate Schedules

To effectively use the Tax Tables & Tax Rate Schedules, individuals should first identify their filing status, which influences the applicable tax brackets. Once the correct table is located, taxpayers can find their taxable income within the ranges provided. By locating their income level, they can determine the corresponding tax rate. This process helps in calculating the total tax liability, allowing for better financial planning and preparation for tax submissions.

Steps to Complete the Tax Tables & Tax Rate Schedules

Completing the Tax Tables & Tax Rate Schedules involves several key steps:

- Identify your filing status (e.g., single, married filing jointly).

- Locate the appropriate tax table for your filing status.

- Determine your taxable income after deductions and exemptions.

- Find your income range in the tax table to ascertain your tax rate.

- Calculate your tax liability by applying the tax rate to your taxable income.

Legal Use of the Tax Tables & Tax Rate Schedules

The Tax Tables & Tax Rate Schedules are legally recognized documents used to determine tax obligations under U.S. law. Accurate use of these tables is essential for compliance with federal tax regulations. Taxpayers must ensure they are using the correct version for the applicable tax year, as tax rates and brackets can change annually. Utilizing outdated tables may result in incorrect calculations and potential penalties.

IRS Guidelines for Tax Tables & Tax Rate Schedules

The Internal Revenue Service (IRS) provides specific guidelines on how to use the Tax Tables & Tax Rate Schedules. These guidelines include instructions on determining taxable income, understanding deductions, and filing requirements. The IRS also emphasizes the importance of using the most current tables to ensure accurate tax reporting. Taxpayers are encouraged to refer to the IRS website or official publications for the latest updates and detailed instructions.

Filing Deadlines and Important Dates

Filing deadlines for taxes are critical to avoid penalties. Typically, individual tax returns are due on April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of deadlines for estimated tax payments, which are due quarterly. Keeping track of these dates helps ensure timely submissions and compliance with tax laws.

Quick guide on how to complete 1998 tax tables amp tax rate schedules 1998 tax tables amp tax rate schedules

Effortlessly prepare [SKS] on any device

Digital document management has become increasingly preferred by businesses and individuals alike. It serves as an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without any hold-ups. Manage [SKS] on any device with the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

Edit and eSign [SKS] with ease

- Obtain [SKS] and then click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you want to send your form—via email, text (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign [SKS] to ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Tax Tables & Tax Rate Schedules Tax Tables & Tax Rate Schedules

Create this form in 5 minutes!

How to create an eSignature for the 1998 tax tables amp tax rate schedules 1998 tax tables amp tax rate schedules

How to create an eSignature for your 1998 Tax Tables Amp Tax Rate Schedules 1998 Tax Tables Amp Tax Rate Schedules in the online mode

How to create an eSignature for the 1998 Tax Tables Amp Tax Rate Schedules 1998 Tax Tables Amp Tax Rate Schedules in Google Chrome

How to make an electronic signature for putting it on the 1998 Tax Tables Amp Tax Rate Schedules 1998 Tax Tables Amp Tax Rate Schedules in Gmail

How to make an electronic signature for the 1998 Tax Tables Amp Tax Rate Schedules 1998 Tax Tables Amp Tax Rate Schedules from your mobile device

How to make an eSignature for the 1998 Tax Tables Amp Tax Rate Schedules 1998 Tax Tables Amp Tax Rate Schedules on iOS devices

How to make an electronic signature for the 1998 Tax Tables Amp Tax Rate Schedules 1998 Tax Tables Amp Tax Rate Schedules on Android OS

People also ask

-

What are Tax Tables & Tax Rate Schedules?

Tax Tables & Tax Rate Schedules refer to the organized listings used to determine the tax obligations of individuals and businesses based on income levels. These tables help streamline the tax calculation process, ensuring compliance and accuracy when filing tax returns.

-

How do I access Tax Tables & Tax Rate Schedules in airSlate SignNow?

To access Tax Tables & Tax Rate Schedules in airSlate SignNow, simply log into your account and navigate to the resources section. We provide easy access to essential documents and tools that integrate seamlessly with your eSigning workflow.

-

Are the Tax Tables & Tax Rate Schedules updated regularly?

Yes, at airSlate SignNow, we prioritize accuracy and compliance, which is why our Tax Tables & Tax Rate Schedules are updated regularly. Our team ensures you have the latest information to make informed decisions for your business.

-

What features does airSlate SignNow offer for handling Tax Tables & Tax Rate Schedules?

airSlate SignNow provides features like secure eSigning, document tracking, and templates specifically designed for Tax Tables & Tax Rate Schedules. These tools help simplify the process of managing tax-related documents effectively.

-

Is there a cost associated with accessing Tax Tables & Tax Rate Schedules in airSlate SignNow?

Access to Tax Tables & Tax Rate Schedules comes as part of our affordable pricing plans designed to fit various business needs. With airSlate SignNow, you receive cost-effective solutions without compromising on essential features.

-

Can I integrate airSlate SignNow with other accounting software for handling Tax Tables & Tax Rate Schedules?

Absolutely! airSlate SignNow offers various integrations with popular accounting software, making it easy to incorporate Tax Tables & Tax Rate Schedules into your existing financial processes. This integration streamlines your workflow and enhances productivity.

-

What benefits can I expect from using airSlate SignNow for Tax Tables & Tax Rate Schedules?

Using airSlate SignNow for Tax Tables & Tax Rate Schedules provides signNow benefits such as improved efficiency, enhanced security, and the ability to manage documents from anywhere. This flexibility allows you to focus more on core business activities while ensuring compliance.

Get more for Tax Tables & Tax Rate Schedules Tax Tables & Tax Rate Schedules

- Personal care services deeming form

- Preemployment agreements form

- Authorization for recoupment caretaker supplement cts f 22565 form

- Uniform commercial code article 3 table of contents

- The political economy of up front fees form

- City of ann arbor consolidated strategy and plan fy one year action plan july 1 through june 30 city council approval may 7 sf form

- Pub 100 06 medicare financial management form

- Get 150 las vegas coupons ampampamp save moneyamerican casino guide form

Find out other Tax Tables & Tax Rate Schedules Tax Tables & Tax Rate Schedules

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself