Form it 2658 MTA Attachment to Form it 2658 Report of Estimated Metropolitain Commuter Transportation Mobility Tax MCTMT for New 2024

Understanding the Form IT 2658 MTA Attachment

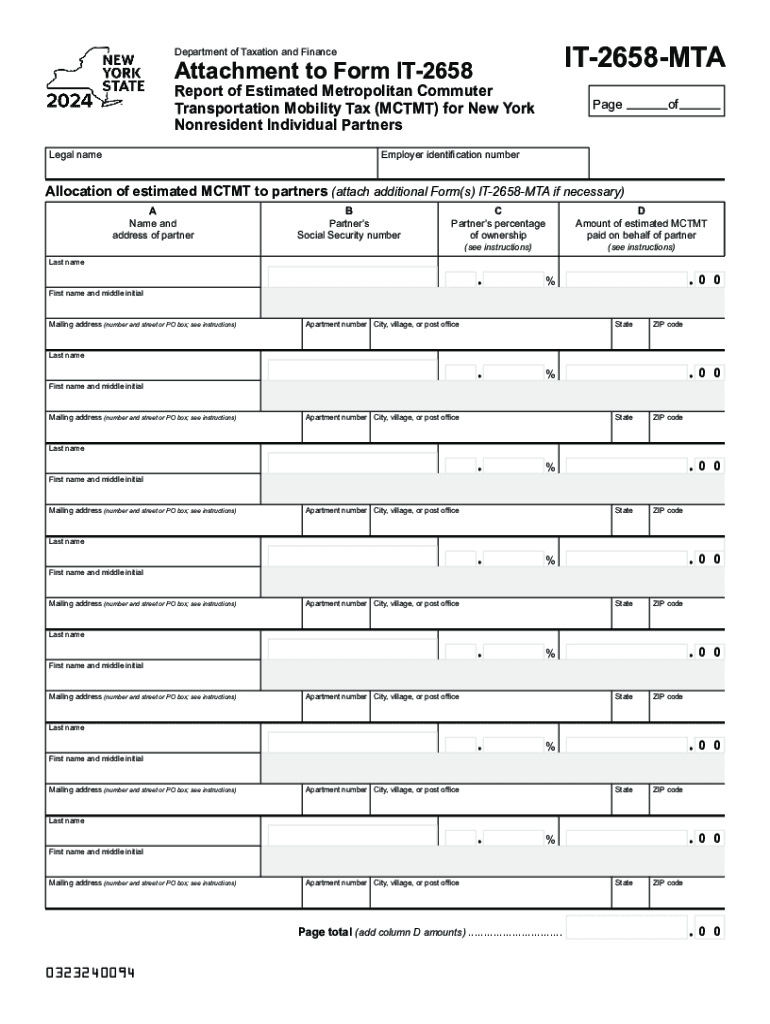

The Form IT 2658 MTA Attachment to Form IT 2658 is a critical document for nonresident individual partners in New York. This form is used to report the estimated Metropolitan Commuter Transportation Mobility Tax (MCTMT). The MCTMT is applicable to individuals who earn income from self-employment or partnership activities within the metropolitan commuter transportation district. Understanding this form is essential for compliance with New York tax regulations.

Steps to Complete the Form IT 2658 MTA Attachment

Completing the Form IT 2658 MTA Attachment involves several key steps:

- Gather necessary financial information, including income statements and partnership agreements.

- Calculate the estimated MCTMT based on your expected income for the year.

- Fill out the form accurately, ensuring all sections are completed, including personal information and income details.

- Review the form for accuracy and completeness before submission.

Each step is crucial to ensure that you meet your tax obligations and avoid potential penalties.

Legal Use of the Form IT 2658 MTA Attachment

The Form IT 2658 MTA Attachment serves a legal purpose in New York's tax framework. It is required for nonresident individual partners to report their estimated MCTMT liabilities. Failing to submit this form can result in penalties, including fines and interest on unpaid taxes. Therefore, it is important to understand the legal implications of this form and ensure timely and accurate filing.

Filing Deadlines for the Form IT 2658 MTA Attachment

Timely filing of the Form IT 2658 MTA Attachment is essential to avoid penalties. The deadline for submitting this form typically aligns with the tax year, which is usually April fifteenth. However, if you are unable to file by this date, it is advisable to check for any extensions or specific deadlines that may apply to your situation. Staying informed about these dates can help you manage your tax responsibilities effectively.

Key Elements of the Form IT 2658 MTA Attachment

The Form IT 2658 MTA Attachment includes several key elements that must be accurately completed:

- Personal Information: Name, address, and taxpayer identification number.

- Income Reporting: Detailed reporting of income earned from self-employment or partnerships.

- Estimated Tax Calculation: A section to calculate the estimated MCTMT based on your income.

- Signature: Required to validate the information provided on the form.

Understanding these elements ensures that you provide all necessary information for proper tax assessment.

Obtaining the Form IT 2658 MTA Attachment

The Form IT 2658 MTA Attachment can be obtained through the New York State Department of Taxation and Finance website or by contacting their offices directly. It is important to ensure that you are using the most current version of the form to comply with state regulations. Keeping a copy of the form for your records is also advisable once it has been completed and submitted.

Create this form in 5 minutes or less

Find and fill out the correct form it 2658 mta attachment to form it 2658 report of estimated metropolitain commuter transportation mobility tax mctmt for

Create this form in 5 minutes!

How to create an eSignature for the form it 2658 mta attachment to form it 2658 report of estimated metropolitain commuter transportation mobility tax mctmt for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form IT 2658 MTA Attachment To Form IT 2658 Report Of Estimated Metropolitan Commuter Transportation Mobility Tax MCTMT For New York Nonresident Individual Partners Year?

The Form IT 2658 MTA Attachment To Form IT 2658 Report Of Estimated Metropolitan Commuter Transportation Mobility Tax MCTMT For New York Nonresident Individual Partners Year is a tax form used by nonresident individual partners to report their estimated MCTMT. This form helps ensure compliance with New York tax regulations and accurately calculates the tax owed based on income earned in the metropolitan area.

-

How can airSlate SignNow assist with the Form IT 2658 MTA Attachment?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending the Form IT 2658 MTA Attachment To Form IT 2658 Report Of Estimated Metropolitan Commuter Transportation Mobility Tax MCTMT For New York Nonresident Individual Partners Year. Our solution streamlines the document management process, making it simple to complete and submit your tax forms securely.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including options for individuals and teams. By choosing our service, you can efficiently manage the Form IT 2658 MTA Attachment To Form IT 2658 Report Of Estimated Metropolitan Commuter Transportation Mobility Tax MCTMT For New York Nonresident Individual Partners Year without incurring high costs, ensuring a cost-effective solution for your document signing needs.

-

What features does airSlate SignNow offer for managing tax documents?

Our platform includes features such as customizable templates, secure eSignature capabilities, and real-time tracking of document status. These features enhance the process of completing the Form IT 2658 MTA Attachment To Form IT 2658 Report Of Estimated Metropolitan Commuter Transportation Mobility Tax MCTMT For New York Nonresident Individual Partners Year, ensuring that you can manage your tax documents efficiently and securely.

-

Is airSlate SignNow compliant with tax regulations?

Yes, airSlate SignNow is designed to comply with relevant tax regulations, including those pertaining to the Form IT 2658 MTA Attachment To Form IT 2658 Report Of Estimated Metropolitan Commuter Transportation Mobility Tax MCTMT For New York Nonresident Individual Partners Year. Our platform ensures that all electronic signatures and document submissions meet legal standards, providing peace of mind for users.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers integrations with various accounting and tax preparation software, allowing you to streamline your workflow. This means you can easily incorporate the Form IT 2658 MTA Attachment To Form IT 2658 Report Of Estimated Metropolitan Commuter Transportation Mobility Tax MCTMT For New York Nonresident Individual Partners Year into your existing processes without hassle.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for your tax forms, including the Form IT 2658 MTA Attachment To Form IT 2658 Report Of Estimated Metropolitan Commuter Transportation Mobility Tax MCTMT For New York Nonresident Individual Partners Year, offers numerous benefits. These include increased efficiency, reduced paperwork, and enhanced security for sensitive information, making tax season less stressful.

Get more for Form IT 2658 MTA Attachment To Form IT 2658 Report Of Estimated Metropolitain Commuter Transportation Mobility Tax MCTMT For New

- Wisconsin chapter 48 form

- Dispositional order form

- Petition protection of form

- Wisconsin parental consent form

- Affidavit of clergyperson to waive parental consent for abortion wisconsin form

- Wisconsin parental consent 497431074 form

- Order on waiver of parental consent for abortion wisconsin form

- Termination parental rights wisconsin form

Find out other Form IT 2658 MTA Attachment To Form IT 2658 Report Of Estimated Metropolitain Commuter Transportation Mobility Tax MCTMT For New

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History