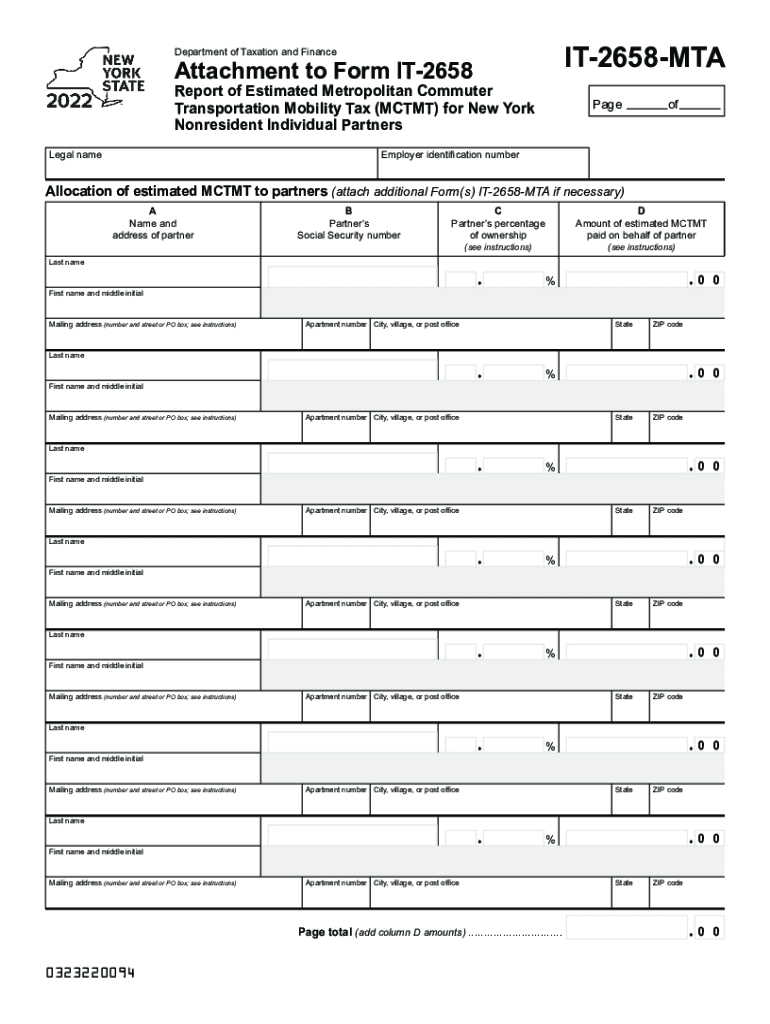

Attachment to Form it 2658, Report of Estimated 2022

What is the attachment to form IT 2658, Report of Estimated?

The attachment to form IT 2658 is a document used to report estimated income tax payments for individuals and businesses in the United States. This form is essential for taxpayers who expect to owe tax of a certain amount when filing their annual returns. It helps in calculating the estimated tax liability for the year and ensures that taxpayers meet their obligations to the state tax authority. The form includes sections for reporting income, deductions, and credits that affect the estimated tax calculation.

Steps to complete the attachment to form IT 2658, Report of Estimated

Completing the attachment to form IT 2658 involves several steps to ensure accuracy and compliance with tax regulations. Start by gathering all necessary financial documents, including income statements and previous tax returns. Then, follow these steps:

- Fill out the personal information section, including your name, address, and Social Security number.

- Report your expected income for the year, including wages, self-employment income, and any other sources.

- Calculate your deductions and credits, which will reduce your overall tax liability.

- Use the provided worksheets to determine your estimated tax payment based on your income and deductions.

- Review the completed form for accuracy before submission.

Legal use of the attachment to form IT 2658, Report of Estimated

The attachment to form IT 2658 is legally recognized for reporting estimated tax payments. To ensure its legal validity, it must be completed accurately and submitted on time. Compliance with IRS guidelines and state tax regulations is crucial. Utilizing electronic signature tools like airSlate SignNow can enhance the legal standing of your submission by providing a secure and compliant method for signing and submitting documents. This ensures that your attachment is considered valid by tax authorities.

Filing deadlines / Important dates

Filing deadlines for the attachment to form IT 2658 are critical for avoiding penalties. Typically, estimated tax payments are due quarterly, with specific deadlines throughout the year. It is important to mark these dates on your calendar:

- First quarter: April 15

- Second quarter: June 15

- Third quarter: September 15

- Fourth quarter: January 15 of the following year

Failure to submit payments by these deadlines may result in interest and penalties, so timely filing is essential.

Who issues the form

The attachment to form IT 2658 is issued by the state tax authority in the United States. Each state may have its own version of this form, tailored to its specific tax laws and regulations. It is important for taxpayers to ensure they are using the correct version for their state to avoid compliance issues. The form is typically available on the state tax authority's official website or through authorized tax preparation services.

Required documents

When completing the attachment to form IT 2658, certain documents are necessary to provide accurate information. These include:

- Previous year’s tax return for reference.

- Income statements such as W-2s or 1099s.

- Documentation for any deductions or credits you plan to claim.

- Records of any estimated tax payments made in the current year.

Having these documents ready will streamline the completion process and help ensure accuracy.

Quick guide on how to complete attachment to form it 2658 report of estimated

Effortlessly Prepare Attachment To Form IT 2658, Report Of Estimated on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to acquire the necessary form and safely store it online. airSlate SignNow provides you with all the tools you require to create, modify, and electronically sign your documents quickly and without delays. Handle Attachment To Form IT 2658, Report Of Estimated on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Simplest Way to Modify and Electronically Sign Attachment To Form IT 2658, Report Of Estimated Effortlessly

- Locate Attachment To Form IT 2658, Report Of Estimated and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or conceal sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Decide how you want to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you select. Modify and electronically sign Attachment To Form IT 2658, Report Of Estimated and ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct attachment to form it 2658 report of estimated

Create this form in 5 minutes!

How to create an eSignature for the attachment to form it 2658 report of estimated

The best way to generate an e-signature for your PDF file in the online mode

The best way to generate an e-signature for your PDF file in Chrome

How to make an e-signature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your smartphone

How to create an electronic signature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow related to the 2021 IT 2663 instructions?

airSlate SignNow offers robust features such as eSignature, document templates, and automated workflows which are essential for handling the 2021 IT 2663 instructions. These features streamline the signing process, making it easy to manage documents efficiently. Users can ensure compliance with the 2021 IT 2663 requirements through our tailored solutions.

-

Is airSlate SignNow cost-effective for managing the 2021 IT 2663 instructions?

Yes, airSlate SignNow provides a cost-effective solution for businesses looking to comply with the 2021 IT 2663 instructions. With flexible pricing plans, users can select options that fit their budget while still accessing the full suite of features. Investing in airSlate SignNow can lead to signNow savings in document management costs.

-

How does airSlate SignNow simplify the process of complying with the 2021 IT 2663 instructions?

airSlate SignNow simplifies compliance with the 2021 IT 2663 instructions by providing easy-to-use templates and automated workflows. These tools help users quickly prepare and manage documents necessary for compliance, reducing the risk of errors. The user-friendly interface ensures that all team members can efficiently navigate the requirements.

-

Can airSlate SignNow integrate with other tools to support the 2021 IT 2663 instructions?

Absolutely! airSlate SignNow integrates seamlessly with various tools such as Google Drive, Salesforce, and Microsoft Office, making it ideal for supporting the 2021 IT 2663 instructions. These integrations enhance collaboration and data sharing across teams. Users can centralize their document management efforts while adhering to compliance requirements.

-

What benefits does airSlate SignNow provide for businesses handling the 2021 IT 2663 instructions?

Businesses using airSlate SignNow for the 2021 IT 2663 instructions benefit from increased efficiency and reduced turnaround times for document signing. The electronic signature functionality ensures that documents are signed quickly and securely, accelerating workflows. Additionally, airSlate SignNow provides a complete audit trail for compliance verification.

-

How secure is airSlate SignNow for managing documents related to the 2021 IT 2663 instructions?

Security is a top priority at airSlate SignNow, especially for handling documents related to the 2021 IT 2663 instructions. Our platform employs industry-leading encryption protocols and complies with stringent data protection regulations. Users can feel confident that their sensitive documents are protected throughout the signing process.

-

What support options are available for users navigating the 2021 IT 2663 instructions with airSlate SignNow?

airSlate SignNow offers comprehensive support options for users managing the 2021 IT 2663 instructions, including live chat, email support, and extensive online resources. Our help center features guides and tutorials specifically focused on compliance processes. Users can access assistance whenever needed to ensure smooth document management.

Get more for Attachment To Form IT 2658, Report Of Estimated

Find out other Attachment To Form IT 2658, Report Of Estimated

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile