City Worker Nonresident Tax Form NYC 1127

What is the City Worker Nonresident Tax Form NYC 1127

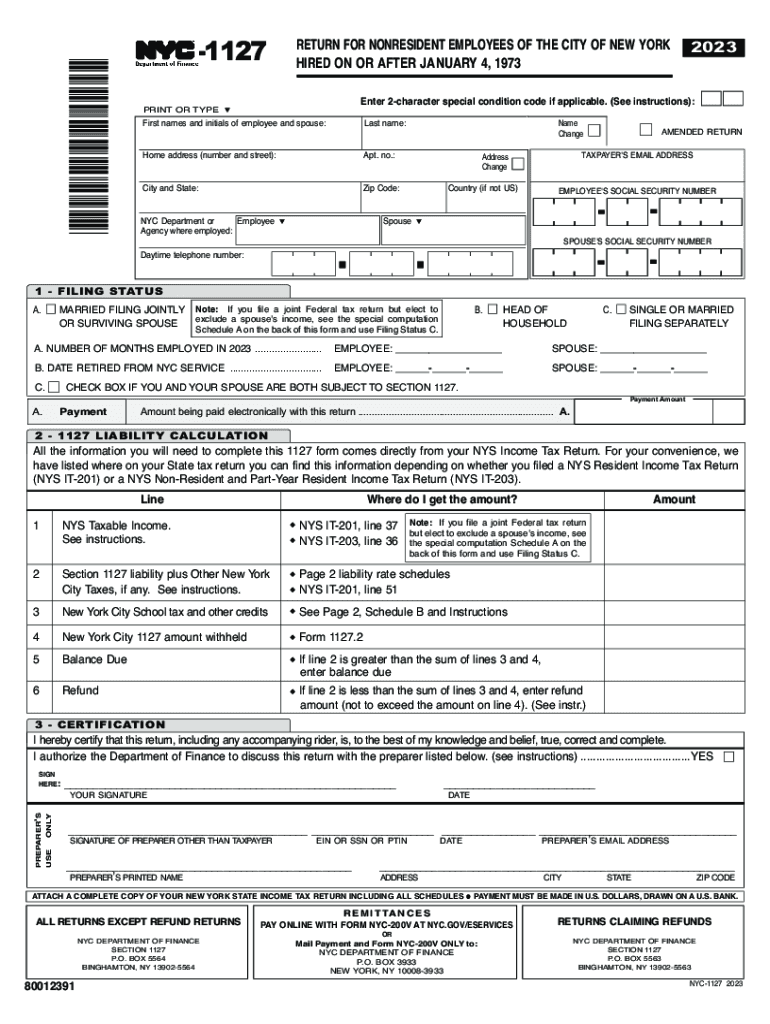

The City Worker Nonresident Tax Form NYC 1127 is a tax document used by nonresident individuals who work in New York City. This form is specifically designed for those who earn income from employment within the city but do not reside there. By filing this form, nonresidents can report their earnings and determine their tax liabilities to the city. The NYC 1127 is essential for ensuring compliance with local tax regulations and avoiding potential penalties.

How to use the City Worker Nonresident Tax Form NYC 1127

To use the City Worker Nonresident Tax Form NYC 1127, individuals must first gather their income information and any relevant tax documents. The form requires details about the taxpayer's employment, including wages earned and any applicable deductions. After completing the form, it should be submitted to the appropriate city tax authority. It is crucial to ensure that all information is accurate to avoid delays or issues with processing.

Steps to complete the City Worker Nonresident Tax Form NYC 1127

Completing the NYC 1127 involves several key steps:

- Gather necessary documents, including W-2 forms and pay stubs.

- Fill out personal information, including name, address, and Social Security number.

- Report total wages earned from employment in New York City.

- Calculate any applicable deductions or credits.

- Review the completed form for accuracy.

- Submit the form either electronically or via mail to the designated tax office.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the NYC 1127. Typically, the form must be submitted by the tax deadline, which is usually April fifteenth for most taxpayers. However, specific deadlines may vary based on individual circumstances or changes in tax law. Keeping track of these dates helps ensure timely submissions and compliance with tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The NYC 1127 can be submitted through various methods. Taxpayers have the option to file online, which is often the fastest method, or they can choose to mail the completed form to the appropriate tax authority. In-person submissions may also be possible at designated tax offices. Each method has its own processing times and requirements, so individuals should select the one that best suits their needs.

Eligibility Criteria

To be eligible to file the NYC 1127, individuals must be nonresidents who have earned income from employment in New York City. This includes workers who live outside the city but commute to work within its limits. Additionally, individuals must have a valid Social Security number or Individual Taxpayer Identification Number. Meeting these criteria is essential for proper filing and compliance with city tax laws.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city worker nonresident tax form nyc 1127

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nyc 1127 pdf and how can airSlate SignNow help?

The nyc 1127 pdf is a specific form used in New York City for various official purposes. airSlate SignNow simplifies the process of filling out and eSigning the nyc 1127 pdf, ensuring that you can complete your documentation quickly and efficiently.

-

How much does it cost to use airSlate SignNow for the nyc 1127 pdf?

airSlate SignNow offers competitive pricing plans that cater to different business needs. You can access features for managing the nyc 1127 pdf at a cost-effective rate, making it an affordable solution for businesses of all sizes.

-

What features does airSlate SignNow provide for the nyc 1127 pdf?

With airSlate SignNow, you can easily create, edit, and eSign the nyc 1127 pdf. The platform also offers templates, collaboration tools, and secure storage, enhancing your document management experience.

-

Can I integrate airSlate SignNow with other applications for the nyc 1127 pdf?

Yes, airSlate SignNow supports integrations with various applications, allowing you to streamline your workflow when handling the nyc 1127 pdf. This ensures that you can connect your existing tools and enhance productivity.

-

Is airSlate SignNow secure for handling the nyc 1127 pdf?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your nyc 1127 pdf and other documents are protected. The platform uses advanced encryption and secure access protocols to safeguard your information.

-

How can airSlate SignNow improve my workflow with the nyc 1127 pdf?

By using airSlate SignNow, you can automate the process of sending and signing the nyc 1127 pdf, reducing the time spent on manual tasks. This leads to increased efficiency and allows you to focus on more important aspects of your business.

-

What are the benefits of using airSlate SignNow for the nyc 1127 pdf?

The benefits of using airSlate SignNow for the nyc 1127 pdf include time savings, enhanced collaboration, and improved accuracy. The platform's user-friendly interface makes it easy for anyone to manage their documents effectively.

Get more for City Worker Nonresident Tax Form NYC 1127

Find out other City Worker Nonresident Tax Form NYC 1127

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document