114 7 UBT PAID CREDIT *61112391* Form

Understanding the 1147 UBT Paid Credit

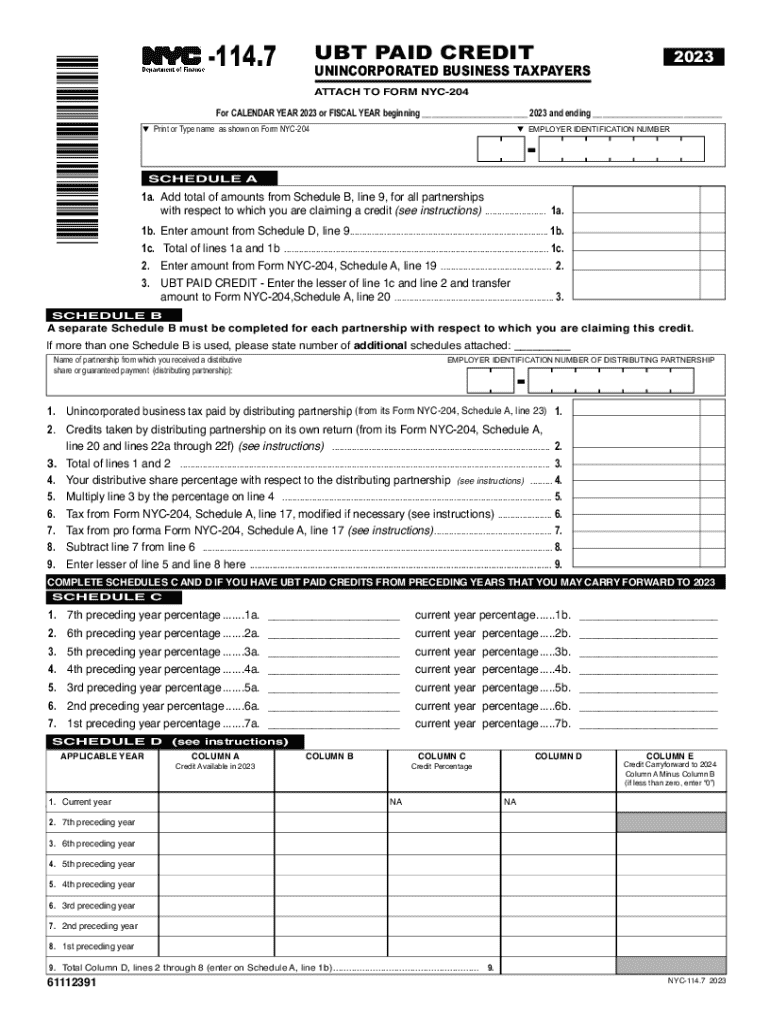

The 1147 UBT Paid Credit is a tax credit available for unincorporated businesses operating in New York City. This credit is designed to alleviate some of the financial burdens associated with the Unincorporated Business Tax (UBT). Eligible businesses can claim this credit on their tax returns, which can lead to significant savings. It is essential for business owners to understand the specific eligibility criteria and how this credit applies to their financial situation.

How to Obtain the 1147 UBT Paid Credit

To obtain the 1147 UBT Paid Credit, businesses must first ensure they meet the eligibility requirements set by the New York City Department of Finance. This includes being an unincorporated business and having paid the UBT in the relevant tax year. Once eligibility is confirmed, businesses should complete the necessary forms, including the NYC-1147, and submit them along with their tax returns. It is advisable to keep thorough records of all payments made towards the UBT to support the credit claim.

Steps to Complete the 1147 UBT Paid Credit Application

Completing the application for the 1147 UBT Paid Credit involves several key steps:

- Review eligibility criteria to confirm that your business qualifies for the credit.

- Gather all necessary documentation, including proof of UBT payments and business identification.

- Fill out the NYC-1147 form accurately, ensuring all information is complete and correct.

- Submit the form along with your tax return, either online or via mail, following the submission guidelines provided by the NYC Department of Finance.

Required Documents for the 1147 UBT Paid Credit

When applying for the 1147 UBT Paid Credit, businesses need to prepare several important documents:

- Proof of payment for the Unincorporated Business Tax.

- Completed NYC-1147 form.

- Business identification documents, such as a business license or registration.

- Any additional documentation that may support the claim for the credit.

Legal Use of the 1147 UBT Paid Credit

The legal use of the 1147 UBT Paid Credit is governed by New York City tax regulations. Businesses must ensure they are compliant with all local tax laws when claiming this credit. Misuse or fraudulent claims can lead to penalties, including fines and interest on unpaid taxes. It is crucial for business owners to understand their obligations and the proper procedures for claiming the credit to avoid any legal issues.

Filing Deadlines for the 1147 UBT Paid Credit

Filing deadlines for the 1147 UBT Paid Credit align with the general tax filing deadlines set by the IRS and the New York City Department of Finance. Typically, businesses must file their tax returns by April fifteenth for the previous tax year. However, it is important to check for any specific dates or extensions that may apply to the UBT to ensure timely submission of the credit claim.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 114 7 ubt paid credit 61112391

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is NYC UBT and how does it relate to airSlate SignNow?

NYC UBT stands for New York City Unincorporated Business Tax. airSlate SignNow helps businesses in NYC manage their document signing processes efficiently, ensuring compliance with local regulations, including UBT. By using airSlate SignNow, businesses can streamline their operations while staying compliant with NYC UBT requirements.

-

How much does airSlate SignNow cost for NYC UBT businesses?

airSlate SignNow offers flexible pricing plans tailored for businesses, including those subject to NYC UBT. Our pricing is competitive and designed to provide value, ensuring that you can manage your document signing needs without breaking the bank. Contact us for a customized quote that fits your NYC UBT business requirements.

-

What features does airSlate SignNow offer for NYC UBT compliance?

airSlate SignNow includes features such as secure eSigning, document templates, and audit trails that are essential for NYC UBT compliance. These features help businesses maintain accurate records and ensure that all documents are signed in accordance with local laws. With airSlate SignNow, you can confidently manage your compliance needs.

-

Can airSlate SignNow integrate with other tools for NYC UBT businesses?

Yes, airSlate SignNow offers seamless integrations with various business tools that NYC UBT businesses commonly use. Whether you need to connect with CRM systems, cloud storage, or accounting software, our platform can easily integrate to enhance your workflow. This ensures that your document management aligns with your overall business operations.

-

What are the benefits of using airSlate SignNow for NYC UBT businesses?

Using airSlate SignNow provides numerous benefits for NYC UBT businesses, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to send and eSign documents quickly, saving time and resources. Additionally, you can ensure that your documents are legally binding and compliant with NYC UBT regulations.

-

Is airSlate SignNow secure for handling sensitive documents related to NYC UBT?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive documents, including those related to NYC UBT. Our platform is designed to keep your data safe while ensuring that your eSigning processes are smooth and reliable. You can trust airSlate SignNow with your important business documents.

-

How can I get started with airSlate SignNow for my NYC UBT business?

Getting started with airSlate SignNow is easy for NYC UBT businesses. Simply visit our website to sign up for a free trial, where you can explore our features and see how they can benefit your operations. Our user-friendly interface makes it simple to start sending and eSigning documents right away.

Get more for 114 7 UBT PAID CREDIT *61112391*

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy wisconsin form

- Warranty deed for parents to child with reservation of life estate wisconsin form

- Wisconsin conversion form

- Warranty deed for separate or joint property to joint tenancy wisconsin form

- Warranty deed for separate property of one spouse to both as joint tenants wisconsin form

- Fiduciary deed for use by executors trustees trustors administrators and other fiduciaries wisconsin form

- Wisconsin limited partnership form

- Wisconsin husband wife form

Find out other 114 7 UBT PAID CREDIT *61112391*

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online