Virginia Resident Form Individual Income Tax Return

What is the Virginia Resident Form Individual Income Tax Return

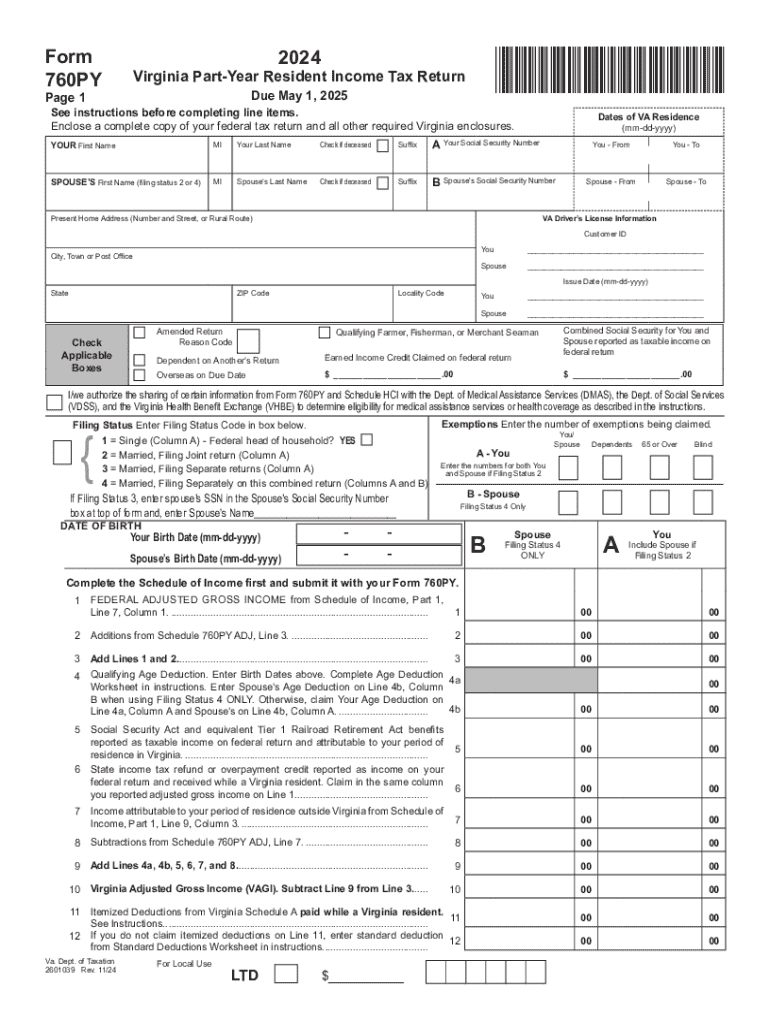

The Virginia Resident Form Individual Income Tax Return, commonly referred to as the VA 760PY, is a tax document used by individuals who are part-year residents of Virginia. This form allows taxpayers to report their income earned while residing in the state, ensuring compliance with Virginia tax laws. It is specifically designed for those who have moved into or out of Virginia during the tax year, capturing the income earned within the state during their period of residency.

Steps to complete the Virginia Resident Form Individual Income Tax Return

Completing the VA 760PY involves several key steps:

- Gather necessary documents: Collect all relevant income information, including W-2s, 1099s, and any other income statements.

- Determine residency status: Clearly define the periods of residency and non-residency within the tax year.

- Fill out the form: Input your personal information, income details, and deductions applicable to your residency period.

- Calculate tax liability: Use the provided tax tables or software to determine the amount of tax owed or refund due.

- Review for accuracy: Double-check all entries for completeness and correctness before submission.

- Submit the form: Choose your submission method, ensuring it aligns with Virginia's filing deadlines.

Key elements of the Virginia Resident Form Individual Income Tax Return

The VA 760PY includes several important sections that taxpayers must complete:

- Personal Information: This section requires your name, address, and Social Security number.

- Income Reporting: You must report all income earned during your residency in Virginia, including wages, interest, and dividends.

- Deductions and Credits: Identify any deductions or credits you may qualify for, which can reduce your taxable income.

- Tax Calculation: The form provides a space for calculating your total tax liability based on your reported income.

- Signature and Date: Ensure you sign and date the form to validate your submission.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the VA 760PY is crucial for compliance:

- The standard filing deadline is typically May 1 of the year following the tax year.

- If you are unable to meet this deadline, you may request an extension, but ensure you pay any estimated taxes owed to avoid penalties.

- Keep an eye on state announcements for any changes to deadlines or additional requirements.

Required Documents

To accurately complete the VA 760PY, you will need the following documents:

- W-2 Forms: For reporting wages earned while a resident of Virginia.

- 1099 Forms: For reporting any additional income such as freelance work or interest earnings.

- Proof of Residency: Documentation that verifies your residency status during the tax year.

- Previous Tax Returns: If applicable, to reference any carryover deductions or credits.

Form Submission Methods

The VA 760PY can be submitted through various methods, providing flexibility for taxpayers:

- Online Submission: Many taxpayers prefer to file electronically through approved software, which can simplify the process.

- Mail: You can print the completed form and send it to the appropriate Virginia Department of Taxation address.

- In-Person: For those who prefer face-to-face assistance, visiting a local tax office may be an option.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the virginia resident form individual income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the va 760py form and why is it important?

The va 760py form is a Virginia state tax return specifically designed for part-year residents. It is important because it allows individuals who have moved in or out of Virginia during the tax year to accurately report their income and claim any applicable deductions. Using the va 760py ensures compliance with state tax laws and helps avoid potential penalties.

-

How can airSlate SignNow help with the va 760py form?

airSlate SignNow simplifies the process of completing and submitting the va 760py form by providing an easy-to-use platform for eSigning and sending documents. With its intuitive interface, users can quickly fill out the form, sign it electronically, and send it directly to the appropriate tax authorities. This streamlines the filing process and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow for the va 760py?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting with a free trial. For users needing to manage the va 760py form and other documents, affordable monthly subscriptions are available that include features like unlimited eSignatures and document storage. This cost-effective solution ensures you can efficiently handle your tax documents without breaking the bank.

-

What features does airSlate SignNow provide for managing the va 760py?

airSlate SignNow provides a range of features tailored for managing the va 760py form, including customizable templates, secure eSigning, and real-time tracking of document status. Users can also integrate the platform with other applications to streamline their workflow. These features enhance productivity and ensure that your tax documents are handled efficiently.

-

Can I integrate airSlate SignNow with other software for the va 760py?

Yes, airSlate SignNow offers seamless integrations with various software applications, making it easy to manage the va 760py form alongside your existing tools. Whether you use CRM systems, cloud storage, or accounting software, airSlate SignNow can connect with them to enhance your document management process. This integration capability helps maintain a smooth workflow.

-

What are the benefits of using airSlate SignNow for the va 760py?

Using airSlate SignNow for the va 760py form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick eSigning and document sharing, which speeds up the filing process. Additionally, airSlate SignNow ensures that your sensitive information is protected with advanced security measures.

-

Is airSlate SignNow user-friendly for completing the va 760py?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete the va 760py form without technical expertise. The intuitive interface guides users through the process, ensuring that all necessary fields are filled out correctly. This user-friendly approach helps reduce frustration and errors during tax season.

Get more for Virginia Resident Form Individual Income Tax Return

- Conditional waiver and release of claim of lien upon final payment west virginia form

- 90 day notice to terminate year to year lease prior to end of term residential from landlord to tenant west virginia form

- West virginia notice 497431696 form

- Wv month form

- 90 day notice to terminate year to year lease prior to end of term residential from tenant to landlord west virginia form

- West virginia lease form

- 30 day notice to terminate month to month lease for residential from tenant to landlord west virginia form

- Assignment of deed of trust by individual mortgage holder west virginia form

Find out other Virginia Resident Form Individual Income Tax Return

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed