Form 941cPR Rev October Planilla Para La Correcion De Informatcion Facilitada Anteriormente En Cuplimiento Con La Ley D

What is the Form 941cPR Rev October Planilla Para La Correcion De Informatcion Facilitada Anteriormente En Cuplimiento Con La Ley D

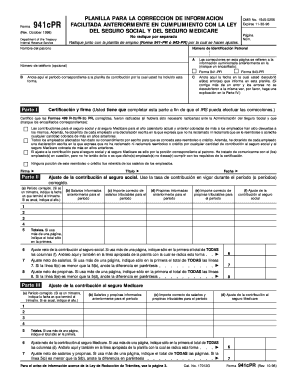

The Form 941cPR Rev October is a crucial document used by employers in Puerto Rico to correct previously submitted information regarding payroll taxes. This form is specifically designed to ensure compliance with federal tax regulations and to rectify any discrepancies in the information provided in earlier submissions. It is essential for employers to maintain accurate records and to report any changes to the IRS in a timely manner to avoid penalties.

How to use the Form 941cPR Rev October Planilla Para La Correcion De Informatcion Facilitada Anteriormente En Cuplimiento Con La Ley D

Using the Form 941cPR Rev October involves several key steps. First, employers must gather all relevant information regarding the original submission that needs correction. This includes identifying the specific areas where errors occurred, such as incorrect employee information or payroll amounts. Once the necessary information is collected, employers can fill out the form, ensuring that all corrections are clearly indicated. After completing the form, it should be submitted to the IRS as directed, either electronically or by mail, depending on the employer's preference.

Steps to complete the Form 941cPR Rev October Planilla Para La Correcion De Informatcion Facilitada Anteriormente En Cuplimiento Con La Ley D

Completing the Form 941cPR Rev October requires careful attention to detail. Here are the steps to follow:

- Review the original Form 941cPR for accuracy.

- Identify the specific errors that need correction.

- Obtain the latest version of the Form 941cPR Rev October.

- Fill out the form, clearly indicating the corrections in the appropriate sections.

- Double-check all entries for accuracy and completeness.

- Submit the corrected form to the IRS by the specified deadline.

Legal use of the Form 941cPR Rev October Planilla Para La Correcion De Informatcion Facilitada Anteriormente En Cuplimiento Con La Ley D

The legal use of the Form 941cPR Rev October is governed by IRS regulations. This form must be used to correct any inaccuracies in previously filed payroll tax information. Employers are legally obligated to ensure that all submitted information is correct and up to date. Failure to use this form appropriately can result in penalties or audits by the IRS. It is important for employers to understand the legal implications of their submissions and to utilize the form correctly to maintain compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Form 941cPR Rev October are critical for compliance. Employers must submit the corrected form within a specific timeframe to avoid penalties. Generally, corrections should be made as soon as discrepancies are identified. It is advisable to consult the IRS guidelines for the exact deadlines related to the form, as these can vary depending on the nature of the correction and the employer's filing schedule.

Form Submission Methods (Online / Mail / In-Person)

The Form 941cPR Rev October can be submitted through various methods, providing flexibility for employers. Options include:

- Online submission through the IRS e-file system.

- Mailing the completed form to the designated IRS address.

- In-person submission at local IRS offices, if applicable.

Employers should choose the method that best suits their needs while ensuring timely submission to avoid any compliance issues.

Quick guide on how to complete form 941cpr rev october 1998 planilla para la correcion de informatcion facilitada anteriormente en cuplimiento con la ley del

Complete Form 941cPR Rev October Planilla Para La Correcion De Informatcion Facilitada Anteriormente En Cuplimiento Con La Ley D effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow offers you all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form 941cPR Rev October Planilla Para La Correcion De Informatcion Facilitada Anteriormente En Cuplimiento Con La Ley D on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and electronically sign Form 941cPR Rev October Planilla Para La Correcion De Informatcion Facilitada Anteriormente En Cuplimiento Con La Ley D with ease

- Find Form 941cPR Rev October Planilla Para La Correcion De Informatcion Facilitada Anteriormente En Cuplimiento Con La Ley D and click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form 941cPR Rev October Planilla Para La Correcion De Informatcion Facilitada Anteriormente En Cuplimiento Con La Ley D and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 941cpr rev october 1998 planilla para la correcion de informatcion facilitada anteriormente en cuplimiento con la ley del

How to generate an electronic signature for your Form 941cpr Rev October 1998 Planilla Para La Correcion De Informatcion Facilitada Anteriormente En Cuplimiento Con La Ley Del online

How to generate an electronic signature for your Form 941cpr Rev October 1998 Planilla Para La Correcion De Informatcion Facilitada Anteriormente En Cuplimiento Con La Ley Del in Google Chrome

How to generate an electronic signature for putting it on the Form 941cpr Rev October 1998 Planilla Para La Correcion De Informatcion Facilitada Anteriormente En Cuplimiento Con La Ley Del in Gmail

How to create an electronic signature for the Form 941cpr Rev October 1998 Planilla Para La Correcion De Informatcion Facilitada Anteriormente En Cuplimiento Con La Ley Del from your smartphone

How to make an eSignature for the Form 941cpr Rev October 1998 Planilla Para La Correcion De Informatcion Facilitada Anteriormente En Cuplimiento Con La Ley Del on iOS devices

How to make an eSignature for the Form 941cpr Rev October 1998 Planilla Para La Correcion De Informatcion Facilitada Anteriormente En Cuplimiento Con La Ley Del on Android OS

People also ask

-

What is the Form 941cPR Rev October Planilla Para La Correcion De Informatcion Facilitada Anteriormente En Cuplimiento Con La Ley D.?

The Form 941cPR Rev October Planilla Para La Correcion De Informatcion Facilitada Anteriormente En Cuplimiento Con La Ley D. is designed for businesses to correct previously reported information regarding payroll taxes. This form is critical to ensure compliance with tax laws while providing accurate reports to the IRS.

-

How does airSlate SignNow simplify the submission of the Form 941cPR Rev October?

airSlate SignNow offers an easy-to-use platform for sending and eSigning the Form 941cPR Rev October Planilla Para La Correcion De Informatcion Facilitada Anteriormente En Cuplimiento Con La Ley D. With its intuitive interface, users can streamline the signing process and ensure speedy submission to tax authorities.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow provides various pricing plans designed to meet diverse business needs. Each plan includes features necessary for handling important documents, like the Form 941cPR Rev October Planilla Para La Correcion De Informatcion Facilitada Anteriormente En Cuplimiento Con La Ley D., making it a cost-effective choice for any organization.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow comes equipped with powerful features such as unlimited eSignatures, document templates, and robust tracking capabilities. These features simplify the management of the Form 941cPR Rev October Planilla Para La Correcion De Informatcion Facilitada Anteriormente En Cuplimiento Con La Ley D., ensuring a smooth workflow.

-

Can I integrate airSlate SignNow with other software tools?

Yes, airSlate SignNow offers seamless integrations with various business tools like Google Drive, Salesforce, and others. This allows users to manage the Form 941cPR Rev October Planilla Para La Correcion De Informatcion Facilitada Anteriormente En Cuplimiento Con La Ley D. alongside their existing workflows.

-

How can airSlate SignNow help ensure compliance when handling forms?

airSlate SignNow is designed to enhance compliance by providing secure, legally-binding eSignatures and a thorough approval process. This is especially important for forms like the Form 941cPR Rev October Planilla Para La Correcion De Informatcion Facilitada Anteriormente En Cuplimiento Con La Ley D., where accuracy and legality are crucial.

-

Is there customer support available for using airSlate SignNow?

Absolutely! airSlate SignNow offers comprehensive customer support through various channels, including chat, email, and phone. Their team is equipped to assist users with questions related to the Form 941cPR Rev October Planilla Para La Correcion De Informatcion Facilitada Anteriormente En Cuplimiento Con La Ley D. and any other aspect of the service.

Get more for Form 941cPR Rev October Planilla Para La Correcion De Informatcion Facilitada Anteriormente En Cuplimiento Con La Ley D

Find out other Form 941cPR Rev October Planilla Para La Correcion De Informatcion Facilitada Anteriormente En Cuplimiento Con La Ley D

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast