20322010006 Missouri Department of Revenue MO Gov Form

Understanding Form 2827 for Missouri Tax

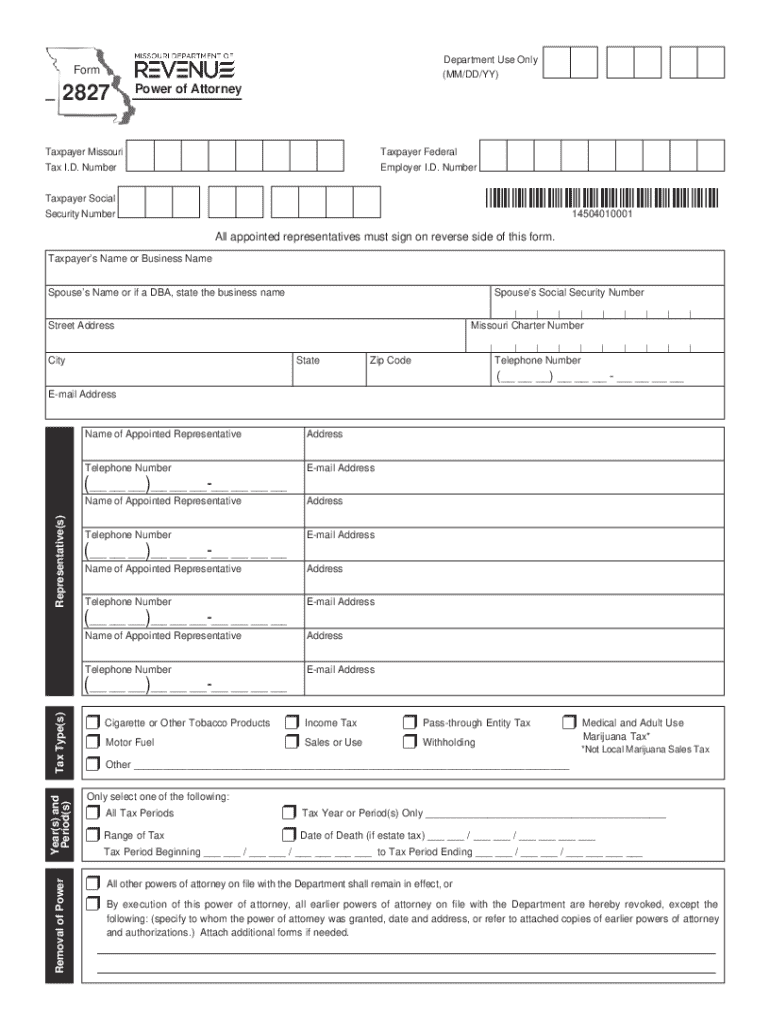

The Form 2827 is a crucial document used by taxpayers in Missouri to grant power of attorney to a designated individual. This form allows the appointed person to act on behalf of the taxpayer in various tax matters with the Missouri Department of Revenue. It is essential for individuals who wish to have someone manage their tax responsibilities, ensuring that all communications and filings are handled efficiently.

Steps to Complete Form 2827

Filling out Form 2827 requires careful attention to detail. Here are the primary steps involved:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Identify the individual you are granting power of attorney by providing their name and contact details.

- Specify the type of tax matters they will handle, such as income tax or sales tax.

- Sign and date the form to validate your request.

- Submit the completed form to the Missouri Department of Revenue via mail or in person.

Required Documents for Submission

When submitting Form 2827, it is important to include any necessary supporting documents. This may include:

- A copy of your government-issued identification.

- Any previous tax returns related to the matters being addressed.

- Additional forms or documents that may be relevant to your specific tax situation.

Legal Use of Form 2827

Form 2827 is legally binding, granting the designated individual the authority to represent you in tax matters. This includes the ability to receive confidential information from the Missouri Department of Revenue. It is essential to choose a trustworthy individual, as they will have access to sensitive financial information.

Filing Deadlines and Important Dates

Timely submission of Form 2827 is crucial to avoid any penalties. Generally, the form should be submitted before any tax filings or communications with the Missouri Department of Revenue. Be aware of specific deadlines related to your tax situation, as these can vary based on the type of tax and the fiscal year.

Form Submission Methods

Form 2827 can be submitted to the Missouri Department of Revenue in several ways:

- By mail: Send the completed form to the appropriate address provided by the Department.

- In person: Visit a local Department of Revenue office to submit the form directly.

- Online: Check if electronic submission is available for your situation.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 20322010006 missouri department of revenue mo gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 2827 tax and why is it important?

The form 2827 tax is a crucial document used for reporting specific tax information to the IRS. It helps ensure compliance with tax regulations and can affect your overall tax liability. Understanding its importance can help businesses avoid penalties and streamline their tax processes.

-

How can airSlate SignNow assist with the form 2827 tax?

airSlate SignNow provides an efficient platform for electronically signing and sending the form 2827 tax. Our solution simplifies the process, making it easy to gather necessary signatures and ensure timely submission. This helps businesses stay organized and compliant with tax requirements.

-

What are the pricing options for using airSlate SignNow for form 2827 tax?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans include features that facilitate the management of documents like the form 2827 tax, ensuring you get the best value for your investment. You can choose a plan that fits your budget and requirements.

-

Are there any features specifically designed for handling form 2827 tax?

Yes, airSlate SignNow includes features that streamline the handling of the form 2827 tax, such as customizable templates and automated workflows. These tools help reduce errors and save time, making the tax filing process more efficient. Our platform is designed to enhance your document management experience.

-

Can I integrate airSlate SignNow with other software for managing form 2827 tax?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, allowing for seamless management of the form 2827 tax. This connectivity ensures that your data flows smoothly between platforms, enhancing your overall productivity and accuracy in tax reporting.

-

What benefits does airSlate SignNow provide for businesses dealing with form 2827 tax?

Using airSlate SignNow for the form 2827 tax offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows for quick access to documents and easy collaboration, which can signNowly improve your tax filing process. Additionally, eSigning ensures that your documents are legally binding and secure.

-

Is airSlate SignNow user-friendly for filing form 2827 tax?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to navigate the platform when filing the form 2827 tax. Our intuitive interface allows users to quickly learn how to send and sign documents without extensive training. This accessibility helps businesses focus on their core operations rather than getting bogged down by complicated software.

Get more for 20322010006 Missouri Department Of Revenue MO gov

- J k police spo form pdf

- Seahawks schedule 2022 printable form

- Truworths account application online form

- Life orientation grade 11 assessment 2022 form

- Library membership form word format

- Stonebridge country club leadership scholarship award form

- State of hawaii department of education mckinley community school for form

- Dmvl590 08 08 form

Find out other 20322010006 Missouri Department Of Revenue MO gov

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template

- Sign North Carolina Profit and Loss Statement Computer

- Sign Florida Non-Compete Agreement Fast

- How Can I Sign Hawaii Non-Compete Agreement

- Sign Oklahoma General Partnership Agreement Online

- Sign Tennessee Non-Compete Agreement Computer

- Sign Tennessee Non-Compete Agreement Mobile

- Sign Utah Non-Compete Agreement Secure

- Sign Texas General Partnership Agreement Easy

- Sign Alabama LLC Operating Agreement Online

- Sign Colorado LLC Operating Agreement Myself

- Sign Colorado LLC Operating Agreement Easy

- Can I Sign Colorado LLC Operating Agreement

- Sign Kentucky LLC Operating Agreement Later

- Sign Louisiana LLC Operating Agreement Computer

- How Do I Sign Massachusetts LLC Operating Agreement