BUSINESS LICENSE TAX APPLICATIONLPLLC Form

What is the BUSINESS LICENSE TAX APPLICATIONLPLLC

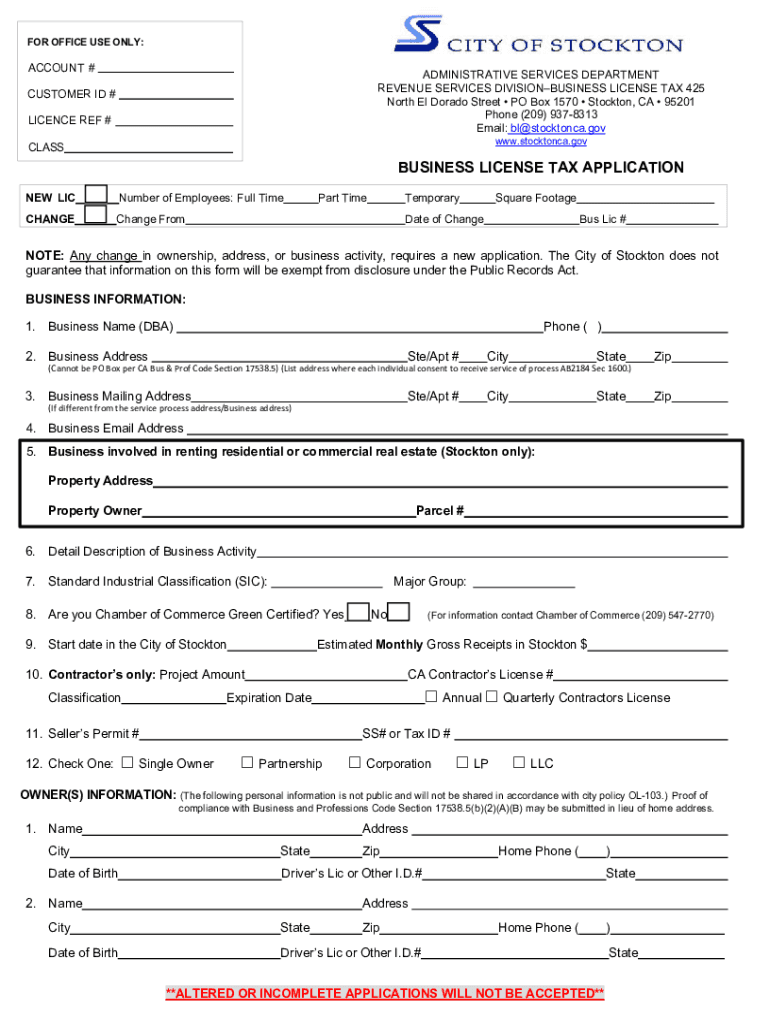

The BUSINESS LICENSE TAX APPLICATIONLPLLC is a specific form used by businesses, particularly Limited Liability Companies (LLCs), to apply for a business license tax. This application is essential for legally operating a business within a municipality or state in the United States. It outlines the business's details and ensures compliance with local tax regulations. The form typically requires information about the business structure, ownership, and the nature of the business activities.

How to obtain the BUSINESS LICENSE TAX APPLICATIONLPLLC

To obtain the BUSINESS LICENSE TAX APPLICATIONLPLLC, businesses can typically visit their local government or municipality's official website. Many jurisdictions provide downloadable forms that can be filled out digitally or printed for submission. In some cases, the application may also be available at local government offices. It is important to check the specific requirements and processes for your state or municipality, as they can vary significantly.

Steps to complete the BUSINESS LICENSE TAX APPLICATIONLPLLC

Completing the BUSINESS LICENSE TAX APPLICATIONLPLLC involves several key steps:

- Gather necessary information about your business, including its name, address, and ownership structure.

- Provide details about the nature of your business activities.

- Complete the application form accurately, ensuring all required fields are filled out.

- Review the form for any errors or omissions before submission.

- Submit the application according to your local jurisdiction's guidelines, which may include online submission, mailing, or in-person delivery.

Required Documents

When applying for the BUSINESS LICENSE TAX APPLICATIONLPLLC, certain documents may be required to support your application. Commonly requested documents include:

- Proof of business ownership, such as Articles of Organization for LLCs.

- Identification documents for the business owners or partners.

- Tax identification number (TIN) or Employer Identification Number (EIN).

- Any additional permits or licenses specific to your business type or industry.

Legal use of the BUSINESS LICENSE TAX APPLICATIONLPLLC

The BUSINESS LICENSE TAX APPLICATIONLPLLC serves a legal purpose by ensuring that businesses comply with local tax laws. Submitting this application is a crucial step in establishing a business legally within a jurisdiction. Failure to submit the application or to comply with local regulations can result in penalties, fines, or even the shutdown of the business.

Penalties for Non-Compliance

Non-compliance with the requirements associated with the BUSINESS LICENSE TAX APPLICATIONLPLLC can lead to significant penalties. These may include:

- Fines imposed by local authorities for operating without a valid business license.

- Back taxes owed if the business is found to be operating without proper licensing.

- Legal action, including potential closure of the business until compliance is achieved.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the business license tax applicationlpllc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the BUSINESS LICENSE TAX APPLICATIONLPLLC?

The BUSINESS LICENSE TAX APPLICATIONLPLLC is a streamlined solution designed to help businesses efficiently manage their licensing and tax applications. It simplifies the process of submitting necessary documents, ensuring compliance with local regulations. With airSlate SignNow, you can easily eSign and send your applications, saving time and reducing errors.

-

How does airSlate SignNow support the BUSINESS LICENSE TAX APPLICATIONLPLLC?

airSlate SignNow provides a user-friendly platform that enhances the BUSINESS LICENSE TAX APPLICATIONLPLLC process. Our solution allows you to create, edit, and eSign documents securely, ensuring that your applications are processed quickly. Additionally, our platform offers templates specifically designed for business license tax applications.

-

What are the pricing options for using the BUSINESS LICENSE TAX APPLICATIONLPLLC?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses utilizing the BUSINESS LICENSE TAX APPLICATIONLPLLC. Our plans are designed to be cost-effective, providing access to essential features without breaking the bank. You can choose from monthly or annual subscriptions based on your usage requirements.

-

What features are included in the BUSINESS LICENSE TAX APPLICATIONLPLLC?

The BUSINESS LICENSE TAX APPLICATIONLPLLC includes features such as document templates, eSignature capabilities, and real-time tracking of application status. These features ensure that your applications are completed accurately and submitted on time. Additionally, our platform allows for easy collaboration among team members.

-

How can the BUSINESS LICENSE TAX APPLICATIONLPLLC benefit my business?

Utilizing the BUSINESS LICENSE TAX APPLICATIONLPLLC can signNowly streamline your business operations. It reduces the time spent on paperwork and minimizes the risk of errors in your applications. By automating the process, you can focus more on your core business activities while ensuring compliance with licensing requirements.

-

Is the BUSINESS LICENSE TAX APPLICATIONLPLLC easy to integrate with other tools?

Yes, the BUSINESS LICENSE TAX APPLICATIONLPLLC is designed to integrate seamlessly with various business tools and applications. This allows you to enhance your workflow and maintain consistency across your operations. Whether you use CRM systems or accounting software, airSlate SignNow can help you connect your processes efficiently.

-

What support options are available for the BUSINESS LICENSE TAX APPLICATIONLPLLC?

airSlate SignNow offers comprehensive support for users of the BUSINESS LICENSE TAX APPLICATIONLPLLC. Our customer service team is available to assist you with any questions or issues you may encounter. We also provide extensive online resources, including tutorials and FAQs, to help you make the most of our platform.

Get more for BUSINESS LICENSE TAX APPLICATIONLPLLC

- Grade 5 exam papers download pdf form

- Herbalife associate application form pdf

- Hughesnet rebate form

- Malaysia visa application form 402159049

- National council for tibb form

- Swamy handbook 2022 pdf download form

- Retrenchment letter template south africa form

- Sw comprehensive warrantdoc le alcoda form

Find out other BUSINESS LICENSE TAX APPLICATIONLPLLC

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document