Tax Table Form

What is the Tax Table

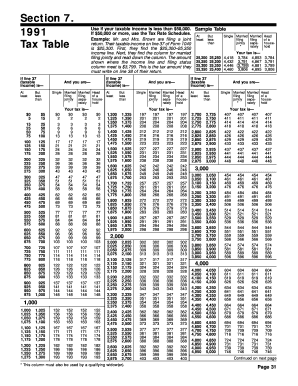

The Tax Table is a crucial document used by individuals and businesses in the United States to determine their tax liabilities based on their income levels. It provides a structured format that outlines the tax rates applicable to various income brackets. By referencing the Tax Table, taxpayers can accurately calculate the amount of tax owed to the federal government, ensuring compliance with tax regulations. This table is typically updated annually by the Internal Revenue Service (IRS) to reflect changes in tax laws and inflation adjustments.

How to use the Tax Table

Using the Tax Table involves a straightforward process. First, taxpayers should identify their filing status, such as single, married filing jointly, or head of household. Next, they need to locate their taxable income within the appropriate income range listed in the table. Once the correct income bracket is found, the corresponding tax amount can be determined. This amount represents the federal income tax owed before considering any deductions or credits. It is essential to ensure that the correct version of the Tax Table is used, as there may be variations based on the tax year.

Steps to complete the Tax Table

Completing the Tax Table requires careful attention to detail. Follow these steps for accurate completion:

- Gather all necessary financial documents, including W-2 forms and 1099s.

- Calculate your total taxable income by summing all sources of income.

- Determine your filing status to ensure you use the correct section of the Tax Table.

- Locate your income in the Tax Table and find the corresponding tax amount.

- Record the calculated tax amount on your tax return form.

Legal use of the Tax Table

The legal use of the Tax Table is governed by IRS regulations. Taxpayers must utilize the table to ensure accurate reporting of their income tax obligations. Failing to use the Tax Table correctly can result in underpayment or overpayment of taxes, which may lead to penalties or interest charges. It is essential to keep records of how the Tax Table was used in case of an audit by the IRS. The Tax Table serves as an official guideline, and adherence to its provisions is necessary for lawful tax compliance.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Tax Table. These guidelines include details on how to interpret the table, the importance of using the correct tax year version, and instructions on how to report tax liabilities accurately. Taxpayers are encouraged to review IRS publications and resources to stay informed about any changes in tax laws that may affect their use of the Tax Table. Understanding these guidelines helps ensure that individuals and businesses fulfill their tax obligations correctly.

Filing Deadlines / Important Dates

Filing deadlines for tax returns are critical for compliance. Typically, individual tax returns are due on April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of deadlines for estimated tax payments, which are generally due quarterly. Keeping track of these important dates is essential to avoid penalties and ensure timely filing of tax returns using the Tax Table.

Quick guide on how to complete 1991 tax table

Complete [SKS] seamlessly on any device

Managing documents online has gained immense traction among businesses and individuals. It offers a fantastic eco-friendly substitute to conventional printed and signed agreements, enabling you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without interruptions. Handle [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The most efficient way to modify and eSign [SKS] easily

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you want to share your form, via email, SMS, or a shareable link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Tax Table

Create this form in 5 minutes!

How to create an eSignature for the 1991 tax table

How to generate an eSignature for your 1991 Tax Table online

How to make an electronic signature for the 1991 Tax Table in Google Chrome

How to make an electronic signature for signing the 1991 Tax Table in Gmail

How to make an electronic signature for the 1991 Tax Table right from your mobile device

How to create an electronic signature for the 1991 Tax Table on iOS

How to make an eSignature for the 1991 Tax Table on Android OS

People also ask

-

What is a Tax Table in airSlate SignNow?

A Tax Table in airSlate SignNow allows users to easily manage and apply tax rates to documents requiring signatures. This feature simplifies the process of preparing tax-related documents, ensuring that all necessary information is accurately calculated and included prior to eSigning.

-

How does airSlate SignNow help with tax document management?

airSlate SignNow streamlines tax document management through customizable templates that include Tax Table fields. Users can create, send, and eSign tax-related documents quickly, ensuring compliance and reducing the chances of errors in tax calculations.

-

Is there a cost associated with using the Tax Table feature?

The Tax Table feature is included in various pricing plans of airSlate SignNow, making it a cost-effective solution for businesses. Different tiers offer distinct features, so you can choose a plan that best meets your needs while benefiting from the Tax Table capabilities.

-

Can I integrate third-party applications with the Tax Table feature?

Yes, airSlate SignNow offers integrations with various third-party applications, enhancing the utility of the Tax Table feature. These integrations allow users to import and export data efficiently, making tax management smoother and more effective.

-

What are the benefits of using a Tax Table in electronic documents?

Using a Tax Table in electronic documents provides numerous benefits, including accuracy and efficiency. It ensures that all tax rates are applied correctly, reducing manual calculations and allowing users to focus on other critical aspects of their business.

-

How reliable is the information generated by the Tax Table?

The information generated by the Tax Table in airSlate SignNow is highly reliable, as it is based on current tax rates that can be updated as needed. This helps businesses remain compliant with tax regulations while minimizing the risk of mistakes in document preparation.

-

Can I customize the Tax Table to fit specific tax needs?

Absolutely! airSlate SignNow allows users to customize the Tax Table to accommodate specific tax requirements. You can easily adjust tax rates and categories, ensuring your documents are tailored to reflect your unique business needs.

Get more for Tax Table

- Pain as the 5th vital sign fax referral form reason for compassionandsupport

- Plaintiffpetitioner ndtx case no v 5 circuit appeals court form

- Bill of costs u s court of appeals for the fifth circuit ca5 uscourts form

- Entity relationship modeling form

- Salary account signature authorization form

- Tulane university cost sharing authorization form

- Information sheet for retention review during academic affairs

- Application for inactive status form

Find out other Tax Table

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation