Form RP 425 GC Application for Extension of 2025 Enhanced STAR Deadline Revised 1024 2024-2026

Understanding the RP 425 GC Application for Enhanced STAR Deadline

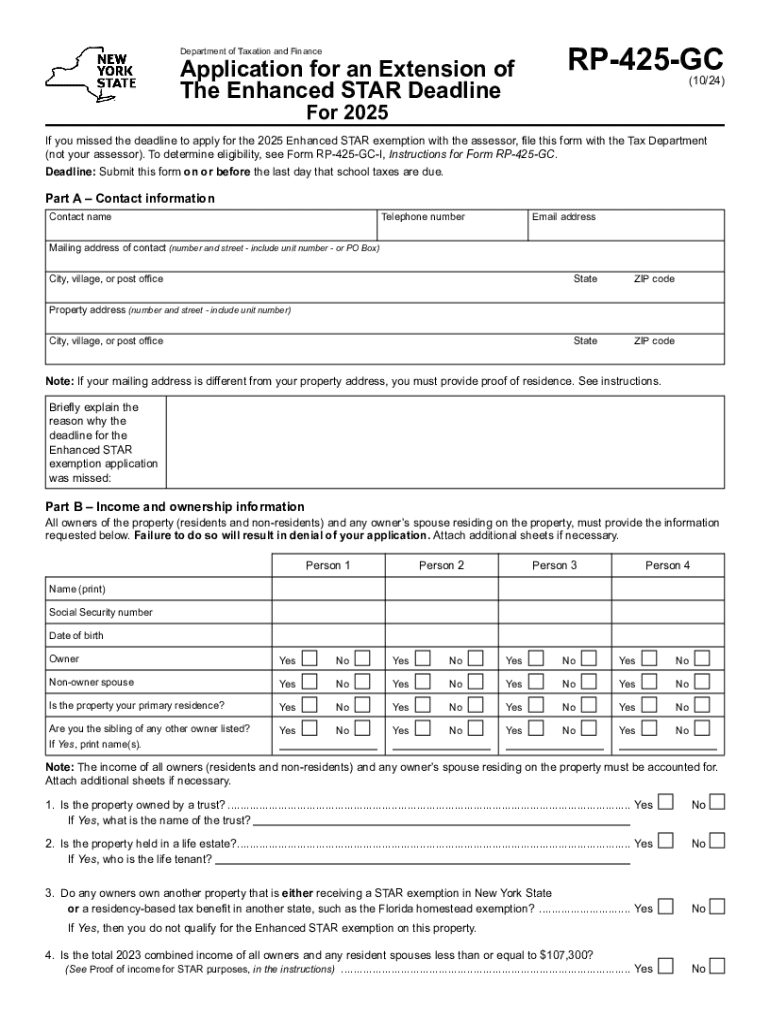

The RP 425 GC application is specifically designed for individuals seeking an extension for the Enhanced School Tax Relief (STAR) program in New York. This application allows eligible homeowners to request an extension of the deadline to file for the Enhanced STAR exemption, which can significantly reduce property taxes. The form is essential for those who may have missed the initial filing deadline and wish to benefit from the tax relief program.

Steps to Complete the RP 425 GC Application

Completing the RP 425 GC application involves several key steps to ensure accuracy and compliance. First, gather all necessary personal information, including your name, address, and property details. Next, fill out the application form, ensuring that you provide accurate information regarding your eligibility for the Enhanced STAR program. It is crucial to review the completed application for any errors before submission. Finally, submit the application to the appropriate local tax authority by the specified deadline to ensure consideration for the extension.

Eligibility Criteria for the RP 425 GC Application

To qualify for the Enhanced STAR program and subsequently the RP 425 GC application, applicants must meet specific eligibility criteria. Generally, applicants must be homeowners residing in New York State, and their income must fall below a certain threshold set by the state. Additionally, the property must be the primary residence of the applicant, and the homeowner must be at least sixty-five years old or have a disability. It is important to check the most current income limits and other eligibility requirements as they may change annually.

Filing Deadlines for the RP 425 GC Application

Filing deadlines for the RP 425 GC application are critical for ensuring that homeowners receive the tax relief benefits. Typically, the application must be submitted by the designated deadline set by the New York State Department of Taxation and Finance. For the 2025 tax year, the deadline for filing the RP 425 GC application is often aligned with the regular Enhanced STAR application deadlines. Homeowners should stay informed about any changes to these deadlines to avoid missing out on potential tax savings.

How to Obtain the RP 425 GC Application

The RP 425 GC application can be obtained through various channels. Homeowners can download the form directly from the New York State Department of Taxation and Finance website. Additionally, local tax offices may provide physical copies of the application for those who prefer to fill it out by hand. It is advisable to ensure that you are using the most current version of the form to avoid any issues during the submission process.

Form Submission Methods for the RP 425 GC Application

Submitting the RP 425 GC application can be done through multiple methods to accommodate different preferences. Homeowners can choose to submit the form electronically, if available, or send it via mail to their local tax authority. For those who prefer in-person submissions, visiting the local tax office is also an option. Each submission method has its own guidelines, so it is important to follow the instructions carefully to ensure that the application is processed efficiently.

Create this form in 5 minutes or less

Find and fill out the correct form rp 425 gc application for extension of 2025 enhanced star deadline revised 1024

Create this form in 5 minutes!

How to create an eSignature for the form rp 425 gc application for extension of 2025 enhanced star deadline revised 1024

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the rp 425gc enhanced and how does it work?

The rp 425gc enhanced is a powerful tool designed to streamline document signing and management. It allows users to send, sign, and store documents securely, ensuring a seamless workflow. With its user-friendly interface, businesses can easily integrate this solution into their existing processes.

-

What are the key features of the rp 425gc enhanced?

The rp 425gc enhanced offers a range of features including customizable templates, real-time tracking, and advanced security options. These features help businesses manage their documents more efficiently while ensuring compliance with legal standards. Additionally, the solution supports multiple file formats for added convenience.

-

How much does the rp 425gc enhanced cost?

Pricing for the rp 425gc enhanced varies based on the plan selected, with options designed to fit different business needs. airSlate SignNow provides competitive pricing that reflects the value of its features and capabilities. For detailed pricing information, it's best to visit the airSlate SignNow website or contact their sales team.

-

What are the benefits of using the rp 425gc enhanced for my business?

Using the rp 425gc enhanced can signNowly improve your business's efficiency by reducing the time spent on document management. It enhances collaboration among team members and clients, allowing for quicker turnaround times. Moreover, the solution helps in minimizing errors and ensuring that all documents are securely stored.

-

Can the rp 425gc enhanced integrate with other software?

Yes, the rp 425gc enhanced is designed to integrate seamlessly with various software applications, including CRM and project management tools. This integration capability allows businesses to streamline their workflows and enhance productivity. Users can easily connect their existing systems to maximize the benefits of the rp 425gc enhanced.

-

Is the rp 425gc enhanced secure for sensitive documents?

Absolutely, the rp 425gc enhanced prioritizes security with features such as encryption and secure access controls. This ensures that sensitive documents are protected from unauthorized access. Businesses can confidently use the rp 425gc enhanced knowing that their data is safe and compliant with industry standards.

-

How can I get started with the rp 425gc enhanced?

Getting started with the rp 425gc enhanced is simple. You can sign up for a free trial on the airSlate SignNow website to explore its features. Once you're ready, you can choose a subscription plan that fits your business needs and start enjoying the benefits of efficient document management.

Get more for Form RP 425 GC Application For Extension Of 2025 Enhanced STAR Deadline Revised 1024

- Due on or before february 1 2022 tax year state of rhode form

- Estate tax 706memaine revenue servicesestate income tax return when is it dueinstructions for form 706 092020internal revenue

- 2017 new mexico net operating loss carryforward schedule for corporate income tax form

- Wwwuslegalformscomform library535801 20212021 live freshwater bait fish license application cagov

- Www1mainegov revenue sitesform maine w 4me employees withholding allowance certi cate

- Michigan treasury onlinetax form search treas securestatemiustreasury treasury state of michigantax form search treas

- Fmcsa form op 1 federal motor carrier safety administration

- Fillable michigan department of treasury 518 rev 02 18 kallasleo michigan business tax registration online ampamp form

Find out other Form RP 425 GC Application For Extension Of 2025 Enhanced STAR Deadline Revised 1024

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile