Form it 2104 Employee's Withholding Allowance Certificate Tax Year

What is the Form IT 2104 Employee's Withholding Allowance Certificate Tax Year

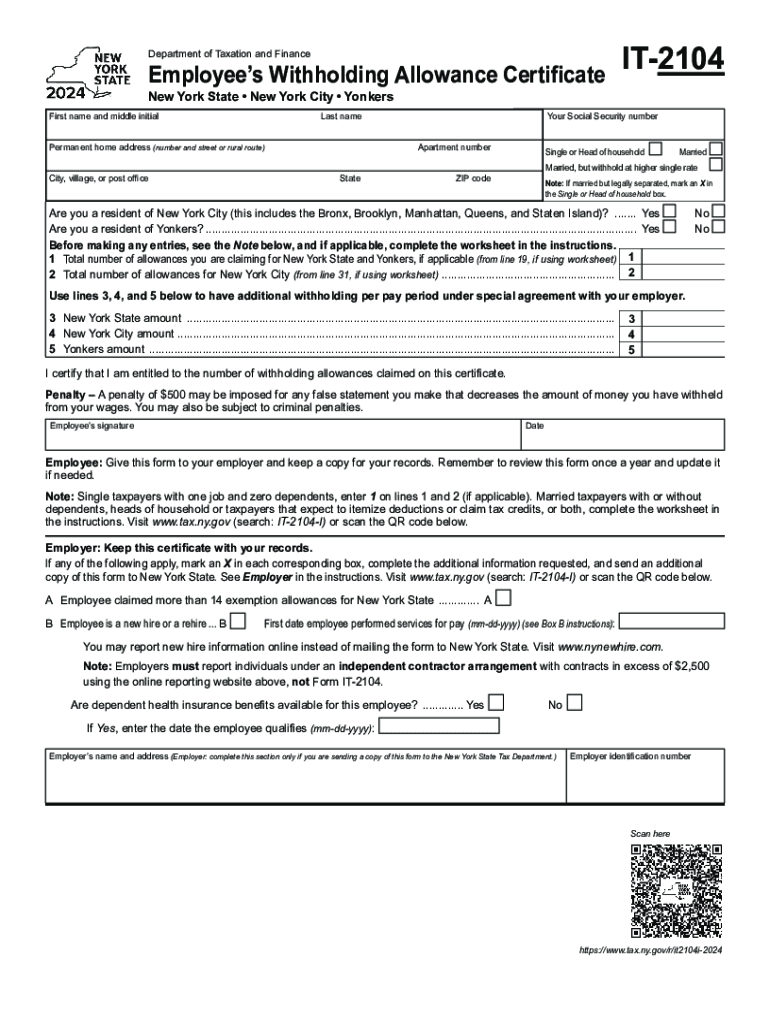

The Form IT 2104 is the Employee's Withholding Allowance Certificate used in New York State. This form is essential for employees to communicate their withholding allowances to their employers. By filling out this form, employees can determine the amount of state income tax that should be withheld from their paychecks. It is particularly important for those who have a single job, as it directly affects the amount of tax withheld based on their personal financial situation.

How to use the Form IT 2104 Employee's Withholding Allowance Certificate Tax Year

To effectively use the Form IT 2104, employees should first understand their tax situation, including any deductions or credits they may qualify for. Once they have this information, they can accurately complete the form. The completed form should then be submitted to their employer, who will use it to adjust the withholding on their paychecks. It is advisable to review and update the form whenever there are significant changes in personal circumstances, such as marriage or the birth of a child.

Steps to complete the Form IT 2104 Employee's Withholding Allowance Certificate Tax Year

Completing the Form IT 2104 involves several straightforward steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate your filing status and the number of allowances you are claiming.

- If applicable, provide information on any additional amounts you want withheld.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to your employer for processing.

Key elements of the Form IT 2104 Employee's Withholding Allowance Certificate Tax Year

The key elements of the Form IT 2104 include personal identification information, filing status, and the number of allowances claimed. Understanding these elements is crucial for ensuring accurate withholding. The number of allowances directly impacts the tax withheld; more allowances mean less tax withheld, while fewer allowances result in more tax being withheld. Additionally, there is a section for employees to request extra withholding if desired.

Legal use of the Form IT 2104 Employee's Withholding Allowance Certificate Tax Year

The legal use of the Form IT 2104 is governed by New York State tax laws. Employers are required to use this form to determine the correct amount of state income tax to withhold from employees' wages. Employees must ensure that the information they provide is truthful and accurate, as providing false information can lead to penalties. It is essential to keep a copy of the submitted form for personal records and future reference.

Eligibility Criteria

Eligibility to use the Form IT 2104 is generally based on employment status and residency in New York State. All employees who receive wages and are subject to New York State income tax withholding can complete this form. It is particularly relevant for individuals who have only one job and wish to optimize their tax withholding based on their personal financial situation. Understanding eligibility helps ensure compliance with state tax regulations.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 2104 employees withholding allowance certificate tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the it 2104 single one job feature in airSlate SignNow?

The it 2104 single one job feature in airSlate SignNow allows users to streamline their document signing process. This feature ensures that all necessary signatures are collected efficiently, making it ideal for businesses that require quick turnaround times. With this functionality, you can manage multiple documents with ease.

-

How does airSlate SignNow pricing work for the it 2104 single one job?

AirSlate SignNow offers flexible pricing plans that cater to various business needs, including the it 2104 single one job. You can choose from monthly or annual subscriptions, which provide access to all features, including eSigning and document management. This ensures that you get the best value for your investment.

-

What are the key benefits of using airSlate SignNow for the it 2104 single one job?

Using airSlate SignNow for the it 2104 single one job provides numerous benefits, including increased efficiency and reduced turnaround times. The platform simplifies the signing process, allowing users to focus on their core business activities. Additionally, it enhances document security and compliance.

-

Can I integrate airSlate SignNow with other tools for the it 2104 single one job?

Yes, airSlate SignNow offers seamless integrations with various tools and platforms, enhancing the it 2104 single one job experience. You can connect it with CRM systems, cloud storage services, and other applications to streamline your workflow. This integration capability ensures that your document management is cohesive and efficient.

-

Is airSlate SignNow user-friendly for the it 2104 single one job?

Absolutely! AirSlate SignNow is designed with user experience in mind, making it easy to navigate for the it 2104 single one job. The intuitive interface allows users of all skill levels to quickly learn how to send and eSign documents without extensive training. This accessibility is a key advantage for businesses.

-

What types of documents can I manage with the it 2104 single one job in airSlate SignNow?

With the it 2104 single one job in airSlate SignNow, you can manage a wide variety of documents, including contracts, agreements, and forms. The platform supports multiple file formats, ensuring that you can handle all your essential paperwork efficiently. This versatility is crucial for businesses with diverse documentation needs.

-

How secure is airSlate SignNow for the it 2104 single one job?

AirSlate SignNow prioritizes security, especially for the it 2104 single one job. The platform employs advanced encryption and compliance measures to protect your documents and data. This commitment to security ensures that your sensitive information remains confidential and secure throughout the signing process.

Get more for Form IT 2104 Employee's Withholding Allowance Certificate Tax Year

- Dormogovforms5091request for motor vehicle records with personal information

- Employee s wisconsin withholding exemption certificatenew hire form

- Eia revised down global oil production forecasts for 2023short term energy outlook us energy informationeia revised down global

- Form 1099 s rev january 2022 proceeds from real estate transactions

- Missouri form mo 1041 missouri fiduciary income returninstructions for form 1041 and schedules a b g j and kmissouri form mo

- Missouri form mo crp certification of rent paid 2020missouri form mo crp certification of rent paid 2020missouri form mo ptc

- Form mo 1040v 2022 individual income tax payment voucher

- Form 2210 2022 underpayment of estimated tax by individuals

Find out other Form IT 2104 Employee's Withholding Allowance Certificate Tax Year

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online