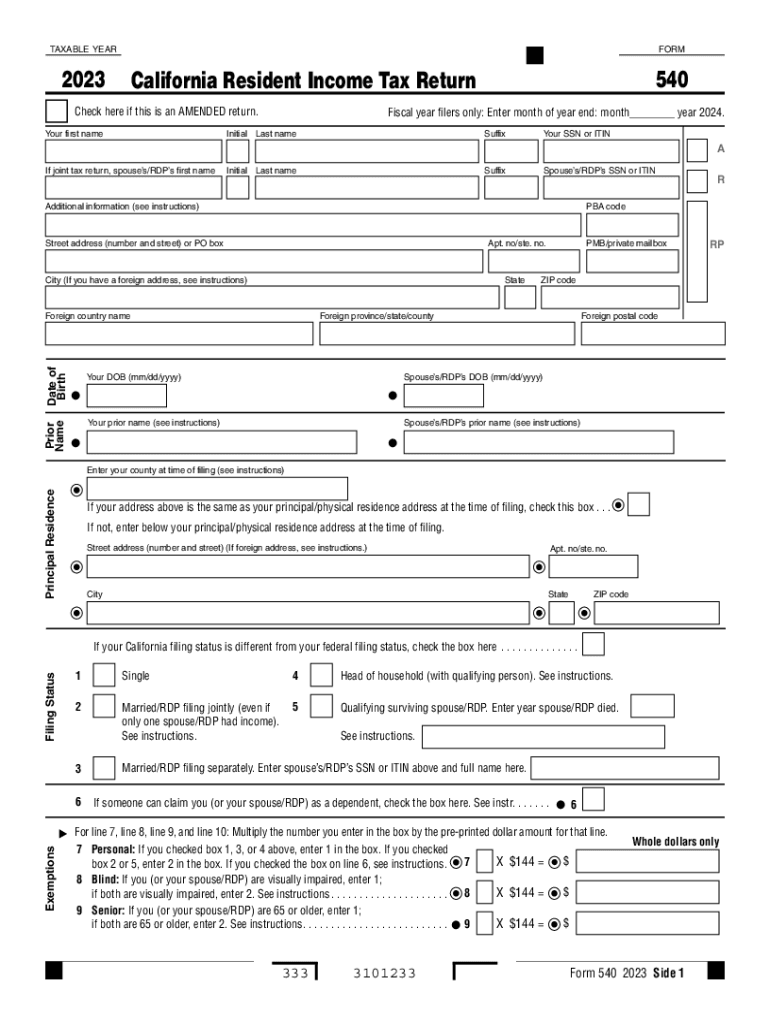

Form 540 California Resident Income Tax Return Form 540 California Resident Income Tax Return

Understanding the Form 540 California Resident Income Tax Return

The Form 540 is the primary document used by California residents to report their income and calculate their state tax liability. This form is essential for individuals who meet the residency requirements and have earned income within the state. It encompasses various income sources, including wages, business income, and investment earnings. Completing this form accurately is crucial to ensure compliance with California tax laws and to avoid potential penalties.

Steps to Complete the Form 540

Completing the Form 540 involves several key steps:

- Gather necessary documents, such as W-2s, 1099s, and records of other income.

- Determine your filing status, which affects your tax rate and deductions.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income in the designated sections.

- Calculate your deductions and credits to determine your taxable income.

- Compute your total tax liability and any payments already made.

- Sign and date the form before submission.

How to Obtain the Form 540

The Form 540 can be obtained through various channels. It is available for download on the California Franchise Tax Board's official website, ftb.ca.gov. Additionally, physical copies can be requested by contacting the California Franchise Tax Board directly. Many tax preparation offices also provide this form as part of their services during tax season.

Filing Deadlines and Important Dates

It is essential to be aware of the filing deadlines for the Form 540 to avoid penalties. Typically, the deadline for submitting the form is April 15 of each year, aligning with the federal tax filing deadline. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also consider any extensions that may be applicable.

Required Documents for Filing Form 540

To complete the Form 540 accurately, several documents are required:

- W-2 forms from employers to report wages.

- 1099 forms for other income sources, such as freelance work or interest.

- Records of any deductions, such as mortgage interest statements or charitable contributions.

- Identification documents, including your Social Security number.

Legal Use of the Form 540

The Form 540 must be used in accordance with California tax laws. It is legally binding and serves as an official declaration of your income and tax obligations to the state. Failing to complete the form accurately may result in penalties, interest on unpaid taxes, or legal action from the California Franchise Tax Board. It is advisable to seek assistance if you are unsure about any part of the form.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 540 california resident income tax return form 540 california resident income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the relationship between airSlate SignNow and ftb ca gov?

airSlate SignNow offers a seamless solution for businesses needing to manage documents related to ftb ca gov. Our platform allows users to eSign and send documents efficiently, ensuring compliance with California tax regulations. This integration simplifies the process of submitting necessary forms to ftb ca gov.

-

How does airSlate SignNow help with document management for ftb ca gov?

With airSlate SignNow, businesses can easily organize and manage documents required by ftb ca gov. Our user-friendly interface allows for quick access to templates and previous submissions, streamlining the process of preparing documents for submission. This efficiency can save time and reduce errors when dealing with ftb ca gov requirements.

-

What are the pricing options for airSlate SignNow when dealing with ftb ca gov documents?

airSlate SignNow offers competitive pricing plans tailored to meet the needs of businesses handling ftb ca gov documents. Our plans are designed to be cost-effective, providing essential features without breaking the bank. You can choose from various subscription options based on your document volume and feature requirements.

-

What features does airSlate SignNow provide for eSigning documents related to ftb ca gov?

airSlate SignNow includes robust eSigning features that comply with legal standards, making it ideal for documents related to ftb ca gov. Users can create, send, and track documents with ease, ensuring that all signatures are captured securely. This functionality enhances the overall efficiency of managing tax-related documents.

-

Can airSlate SignNow integrate with other tools for managing ftb ca gov submissions?

Yes, airSlate SignNow integrates seamlessly with various tools and platforms that can assist in managing submissions to ftb ca gov. This includes CRM systems, cloud storage solutions, and accounting software. These integrations help streamline workflows and ensure that all necessary documents are easily accessible.

-

What benefits does airSlate SignNow offer for businesses dealing with ftb ca gov?

Using airSlate SignNow provides numerous benefits for businesses interacting with ftb ca gov. Our platform enhances productivity by reducing the time spent on document preparation and submission. Additionally, the secure eSigning process ensures compliance and reduces the risk of errors in important tax documents.

-

Is airSlate SignNow user-friendly for those unfamiliar with ftb ca gov processes?

Absolutely! airSlate SignNow is designed with user experience in mind, making it accessible even for those unfamiliar with ftb ca gov processes. Our intuitive interface guides users through document creation and eSigning, ensuring that everyone can navigate the system with ease. Training resources are also available to assist new users.

Get more for Form 540 California Resident Income Tax Return Form 540 California Resident Income Tax Return

- Form bt 191 change of officer member or partner notification

- Commonwealth of massachusetts office of the comptroller form

- About form 1120 pol us income tax return for certainfederal form 1120 pol us income tax return for certainform1120 pol us

- Otc form 797 ampquotaffidavit of nonuse in lieu of liability insuranceampquot

- I864w form

- Florida hotel tax exempt form pdf

- Metlife change of ownership form 6721

- Tanzania passport application form pdf

Find out other Form 540 California Resident Income Tax Return Form 540 California Resident Income Tax Return

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer

- Send Sign Document Myself

- Send Sign Document Secure

- Send Sign Document iOS

- Send Sign Document iPad

- How To Send Sign Document

- Fax Sign PDF Online

- How To Fax Sign PDF