for Personal Loans Secured or Unsecured 2007-2026

Understanding Personal Loans: Secured vs. Unsecured

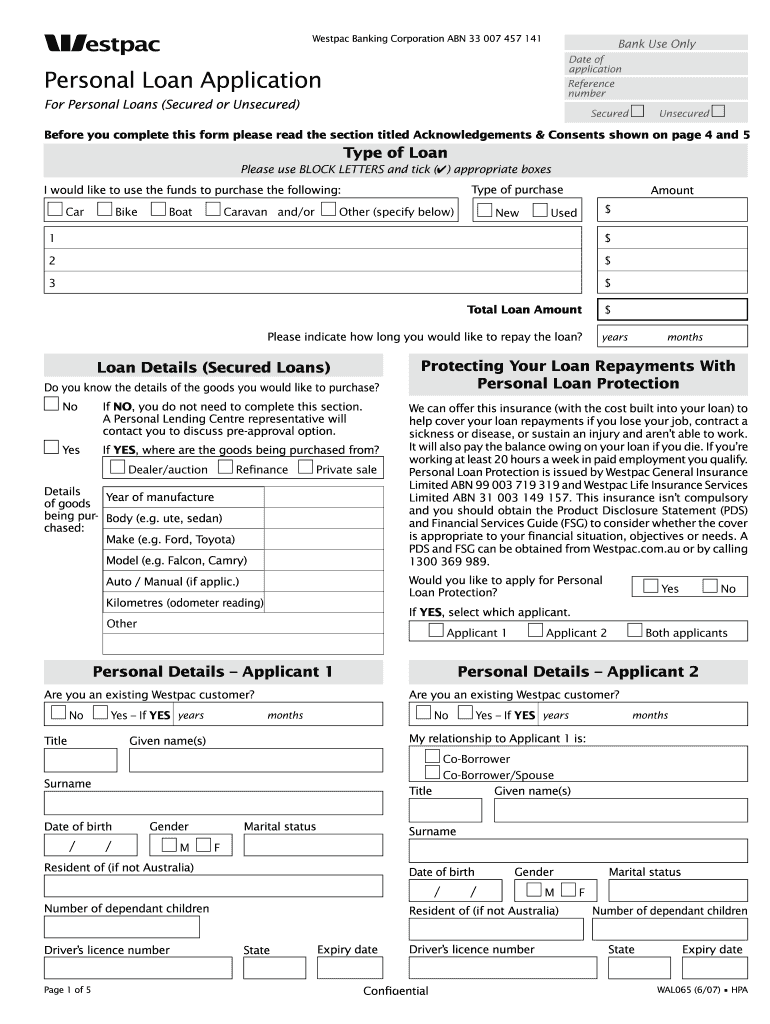

Personal loans can be categorized into secured and unsecured types. A secured personal loan requires collateral, such as a car or savings account, which the lender can claim if the borrower defaults. This type of loan often comes with lower interest rates due to the reduced risk for the lender. On the other hand, an unsecured personal loan does not require collateral, making it more accessible but typically associated with higher interest rates. Borrowers must demonstrate creditworthiness to qualify for unsecured loans.

Steps to Complete the Westpac Loan Application Form

Completing the Westpac loan application form involves several key steps. First, gather all necessary documentation, including proof of identity, income statements, and any existing debts. Next, accurately fill out the application form, ensuring all information is complete and truthful. After submitting the form, monitor your application status through the Westpac online portal or customer service. It is essential to provide any additional information requested promptly to avoid delays in processing.

Legal Considerations for the Westpac Loan Application

The Westpac loan application form must comply with various legal requirements to be considered valid. This includes adhering to federal and state regulations regarding lending practices. For instance, lenders must provide clear terms regarding interest rates, repayment schedules, and any fees associated with the loan. Additionally, the use of electronic signatures must meet the standards set by the ESIGN Act and UETA to ensure that the application is legally binding.

Required Documents for the Westpac Loan Application

To successfully complete the Westpac loan application, certain documents are typically required. These may include:

- Proof of identity (e.g., driver's license or passport)

- Proof of income (e.g., pay stubs or tax returns)

- Credit history information

- Details of existing debts and liabilities

- Any additional documentation requested by Westpac

Having these documents ready can streamline the application process and improve the chances of approval.

Eligibility Criteria for the Westpac Loan Application

Eligibility for the Westpac loan application varies based on several factors. Generally, applicants must be at least eighteen years old, a U.S. citizen or permanent resident, and possess a stable source of income. Lenders will also assess credit scores and debt-to-income ratios to determine financial stability. Meeting these criteria is crucial for securing a loan and obtaining favorable terms.

Application Process and Approval Time for Westpac Loans

The application process for a Westpac loan typically involves submitting the completed loan application form along with the required documentation. Once submitted, the lender will review the application, which may take anywhere from a few hours to several days, depending on the complexity of the application and the lender's workload. Applicants will receive notification of approval or denial, along with details regarding loan terms, shortly after the review process is complete.

Quick guide on how to complete for personal loans secured or unsecured

Effortlessly Prepare For Personal Loans Secured Or Unsecured on Any Device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents swiftly and without delays. Manage For Personal Loans Secured Or Unsecured on any device with the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to Edit and eSign For Personal Loans Secured Or Unsecured with Ease

- Locate For Personal Loans Secured Or Unsecured and click Get Form to initiate the process.

- Employ the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive details with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you want to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing additional copies. airSlate SignNow fulfills all your document management needs in a few clicks from a device of your choice. Edit and eSign For Personal Loans Secured Or Unsecured and guarantee effective communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the for personal loans secured or unsecured

The best way to create an electronic signature for your PDF file online

The best way to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

How to generate an eSignature straight from your mobile device

The way to create an electronic signature for a PDF file on iOS

How to generate an eSignature for a PDF document on Android devices

People also ask

-

What is the Westpac loan application form?

The Westpac loan application form is a document required by Westpac to process your loan request. It includes personal details, financial information, and loan requirements. Completing the form accurately helps speed up the application process.

-

How do I fill out the Westpac loan application form?

To fill out the Westpac loan application form, start by gathering your personal and financial information. Then, follow the instructions provided on the form, ensuring all sections are completed. airSlate SignNow can assist you in signing and submitting your completed application securely.

-

What are the benefits of using airSlate SignNow for the Westpac loan application form?

Using airSlate SignNow for the Westpac loan application form allows for easy eSigning and document management. Our platform ensures that your application is securely signed and submitted, enhancing the overall efficiency of your loan process. Plus, it's user-friendly and cost-effective.

-

Are there any fees associated with the Westpac loan application form?

While completing the Westpac loan application form, there may be specific fees related to the loan itself, such as application fees or processing fees. It's essential to review Westpac's fee schedule ahead of time. Utilizing airSlate SignNow can help manage document-related costs effectively.

-

Can I track the status of my Westpac loan application form?

Yes, you can track the status of your Westpac loan application form. Once submitted, Westpac usually provides updates on your application progress via email or through their online banking portal. Keeping an eye on your email notifications can help ensure you stay informed.

-

Does airSlate SignNow integrate with Westpac's loan services?

Yes, airSlate SignNow integrates seamlessly with various financial services, including those provided by Westpac for loan applications. This integration allows users to streamline their workflow, making it easier to complete and submit the Westpac loan application form with ease.

-

What documents do I need to provide alongside the Westpac loan application form?

When submitting the Westpac loan application form, you typically need to provide proof of income, identification, and possibly other financial statements. These documents help Westpac assess your financial situation. airSlate SignNow makes it easy to attach and send all necessary documentation securely.

Get more for For Personal Loans Secured Or Unsecured

- Pr 1808 statement of informal administration wisconsin

- Under oath i verify form

- Pr 1816 statement of personal representative to close form

- Pr 1817 affidavit of service probate wisconsin court form

- Formal administration wisconsin court system circuit court

- Probate court instructions estate ampamp trustozaukee county form

- Simplified probate in floridasummary administration form

- Summary settlement wisconsin court system circuit court form

Find out other For Personal Loans Secured Or Unsecured

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure