Tax Year 504 K 1 Fiduciary Beneficiary's Information

What is the Tax Year 504 K-1 Fiduciary Beneficiary's Information

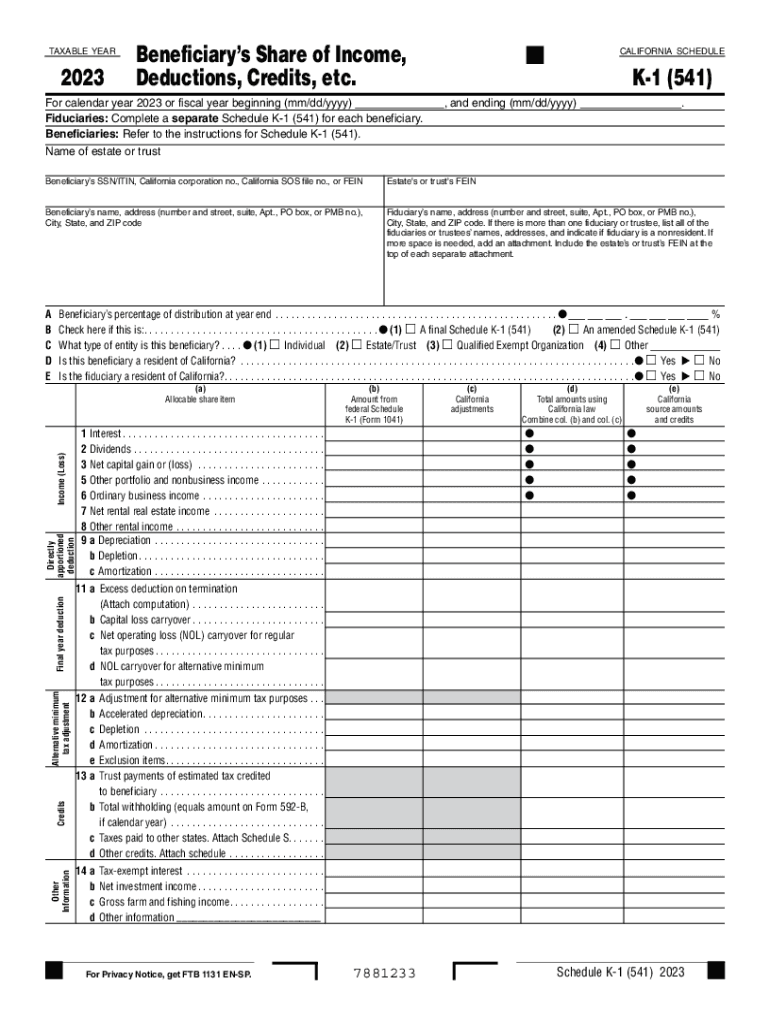

The Tax Year 504 K-1 form is a crucial document used to report income, deductions, and credits from a trust or estate to its beneficiaries. This form provides essential information about the fiduciary's financial activities during the tax year. Beneficiaries receive this form to accurately report their share of the trust's income on their individual tax returns. Understanding the details included in the K-1 form is vital for beneficiaries to ensure compliance with tax regulations.

How to use the Tax Year 504 K-1 Fiduciary Beneficiary's Information

To effectively use the Tax Year 504 K-1 form, beneficiaries should first review the information provided, which includes the income allocated to them, deductions, and credits. This information must be reported on their personal tax returns, typically on IRS Form 1040. It is important for beneficiaries to cross-reference the K-1 data with their other income sources to ensure accurate reporting. Consulting with a tax professional can also help clarify any uncertainties regarding the form's implications on their overall tax liability.

Steps to complete the Tax Year 504 K-1 Fiduciary Beneficiary's Information

Completing the Tax Year 504 K-1 form involves several key steps:

- Gather all necessary financial documents related to the trust or estate.

- Fill in the beneficiary's personal information, including name, address, and taxpayer identification number.

- Report the income, deductions, and credits as specified in the K-1 form.

- Ensure that all entries are accurate and reflect the beneficiary's share of the trust's financial activities.

- Submit the completed form along with the beneficiary's individual tax return by the appropriate deadline.

Key elements of the Tax Year 504 K-1 Fiduciary Beneficiary's Information

Key elements of the Tax Year 504 K-1 form include:

- Beneficiary Information: This section includes the beneficiary's name, address, and taxpayer identification number.

- Income Allocations: Details of the income distributed to the beneficiary, including ordinary income, capital gains, and other types of income.

- Deductions and Credits: Information on any deductions or credits that the beneficiary is entitled to claim based on the trust's activities.

- Trust or Estate Information: Identification of the trust or estate, including its name and taxpayer identification number.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Year 504 K-1 form are critical for compliance. Typically, the form must be issued to beneficiaries by March 15 of the following tax year. Beneficiaries should then include the K-1 information in their tax returns, which are generally due by April 15. It is essential to be aware of these dates to avoid penalties and ensure timely filing.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and submission of the Tax Year 504 K-1 form. Beneficiaries should refer to IRS publications and instructions related to fiduciary tax returns for detailed information. Adhering to these guidelines helps ensure accurate reporting and compliance with federal tax laws.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax year 504 k 1 fiduciary beneficiarys information

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to ca k?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and eSign documents efficiently. With its user-friendly interface, it simplifies the signing process, making it an ideal choice for those looking for a cost-effective ca k solution.

-

How much does airSlate SignNow cost for ca k users?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of ca k users. Whether you are a small business or a large enterprise, you can find a plan that fits your budget while providing all the essential features for document management.

-

What features does airSlate SignNow offer for ca k?

airSlate SignNow includes a variety of features designed for ca k, such as customizable templates, real-time tracking, and secure cloud storage. These features enhance the signing experience and ensure that your documents are handled efficiently and securely.

-

Can I integrate airSlate SignNow with other tools for ca k?

Yes, airSlate SignNow offers seamless integrations with popular applications, making it a versatile choice for ca k. You can connect it with CRM systems, cloud storage services, and other business tools to streamline your workflow and improve productivity.

-

What are the benefits of using airSlate SignNow for ca k?

Using airSlate SignNow for ca k provides numerous benefits, including increased efficiency, reduced turnaround time for document signing, and enhanced security. These advantages help businesses save time and resources while ensuring compliance with legal standards.

-

Is airSlate SignNow secure for ca k transactions?

Absolutely! airSlate SignNow prioritizes security for ca k transactions by employing advanced encryption and authentication measures. This ensures that your documents are protected from unauthorized access and that your data remains confidential.

-

How can I get started with airSlate SignNow for ca k?

Getting started with airSlate SignNow for ca k is easy. Simply sign up for an account, choose a pricing plan that suits your needs, and start uploading your documents. The intuitive interface will guide you through the process of sending and signing documents in no time.

Get more for Tax Year 504 K 1 Fiduciary Beneficiary's Information

Find out other Tax Year 504 K 1 Fiduciary Beneficiary's Information

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word