Form 8453 C California E File Return Authorization for

What is the Form 8453 C California E file Return Authorization For

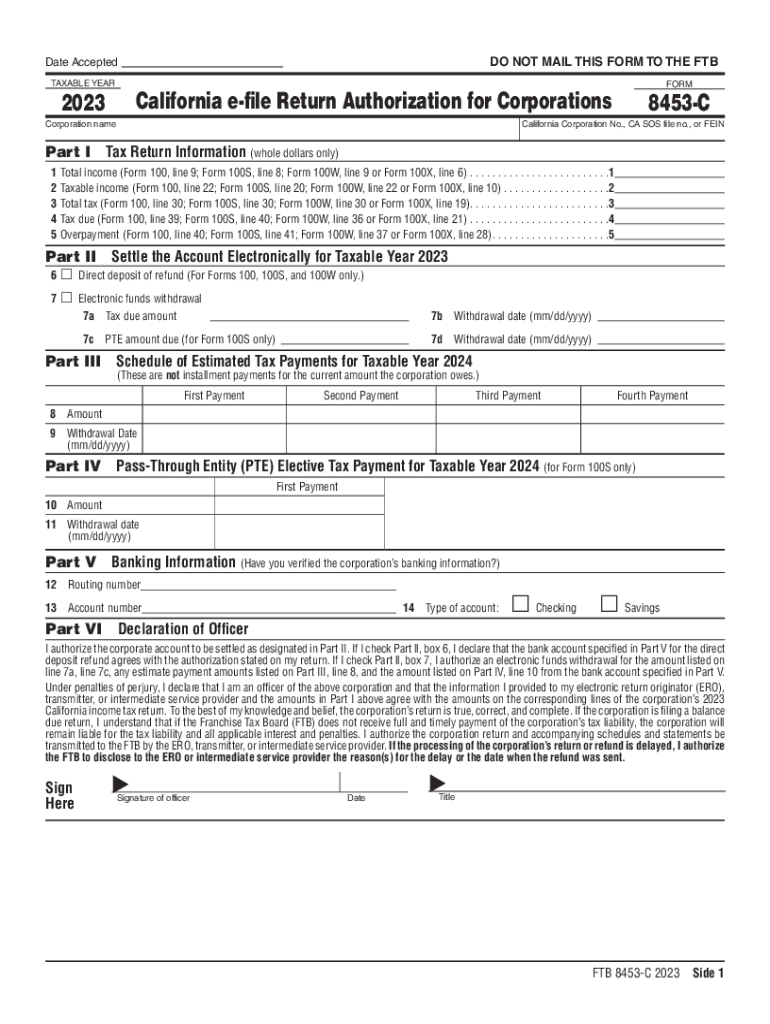

The Form 8453 C California E file Return Authorization For is a crucial document used by taxpayers to authorize the electronic filing of their California tax returns. This form serves as a declaration that the taxpayer has reviewed their return and agrees to its submission via electronic means. It is specifically designed for use with California state tax returns, ensuring compliance with state regulations while streamlining the filing process.

How to use the Form 8453 C California E file Return Authorization For

To use the Form 8453 C, taxpayers must complete it after preparing their California tax return. The form requires the taxpayer's signature, which can be provided electronically if using approved e-filing software. Once signed, the form must be submitted alongside the e-filed tax return to the California Franchise Tax Board. This process confirms that the taxpayer has authorized the electronic submission and agrees to the information contained in the return.

Steps to complete the Form 8453 C California E file Return Authorization For

Completing the Form 8453 C involves several straightforward steps:

- Gather necessary information, including your California tax return details.

- Access the Form 8453 C through your e-filing software or the California Franchise Tax Board website.

- Fill in the required fields, including your name, Social Security number, and the tax year.

- Review the information for accuracy to ensure compliance.

- Sign the form electronically if using e-filing software, or print it for manual signing.

- Submit the signed form along with your e-filed return.

Legal use of the Form 8453 C California E file Return Authorization For

The legal use of the Form 8453 C is essential for ensuring that electronic submissions of tax returns comply with California state law. By signing this form, taxpayers affirm that they have reviewed their tax return and authorize its submission. This legal authorization protects both the taxpayer and the e-filing provider, as it establishes a formal agreement regarding the submission of sensitive tax information.

Key elements of the Form 8453 C California E file Return Authorization For

Several key elements must be included when completing the Form 8453 C:

- Taxpayer Information: Full name, Social Security number, and address.

- Tax Year: The specific year for which the return is being filed.

- Signature: An electronic or handwritten signature to authorize the return.

- Declaration: A statement affirming the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8453 C align with the overall deadlines for California tax returns. Typically, individual taxpayers must file their returns by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is important for taxpayers to stay informed about any changes to these dates to avoid penalties for late filing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8453 c california e file return authorization for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8453 C California E file Return Authorization For?

Form 8453 C California E file Return Authorization For is a document that allows taxpayers to authorize the electronic filing of their California tax returns. This form is essential for ensuring that your e-filed return is submitted correctly and securely.

-

How does airSlate SignNow facilitate the use of Form 8453 C California E file Return Authorization For?

airSlate SignNow provides an intuitive platform that simplifies the signing and submission process for Form 8453 C California E file Return Authorization For. Users can easily upload, eSign, and send the form, ensuring compliance with California tax regulations.

-

What are the pricing options for using airSlate SignNow with Form 8453 C California E file Return Authorization For?

airSlate SignNow offers flexible pricing plans that cater to various business needs. Whether you are a small business or a large enterprise, you can find a plan that allows you to efficiently manage Form 8453 C California E file Return Authorization For at a cost-effective rate.

-

Are there any integrations available for Form 8453 C California E file Return Authorization For?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, making it easy to manage Form 8453 C California E file Return Authorization For alongside your other financial documents. This integration streamlines your workflow and enhances productivity.

-

What are the benefits of using airSlate SignNow for Form 8453 C California E file Return Authorization For?

Using airSlate SignNow for Form 8453 C California E file Return Authorization For offers numerous benefits, including enhanced security, faster processing times, and improved accuracy. The platform ensures that your documents are handled efficiently, reducing the risk of errors.

-

Is airSlate SignNow user-friendly for filing Form 8453 C California E file Return Authorization For?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate the platform. You can quickly learn how to manage Form 8453 C California E file Return Authorization For without any technical expertise.

-

Can I track the status of my Form 8453 C California E file Return Authorization For with airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your Form 8453 C California E file Return Authorization For. You will receive notifications when the document is viewed, signed, or completed, ensuring you stay informed throughout the process.

Get more for Form 8453 C California E file Return Authorization For

- Chapter 2 persons subject to tax and exemptionstngov form

- Form it 638 start up ny tax elimination credit tax year

- Use whole dollar amounts form

- Form mo 1040 missouri department of revenue

- Iowa alternative minimum taxiowa department of revenue form

- New york form it 238 claim for rehabilitation of historic

- Tax filing extensions for paper and electronically submitted form

- Form ct 605 claim for ez investment tax credit and ez

Find out other Form 8453 C California E file Return Authorization For

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document