Transfer Death Form

What is the Transfer Death?

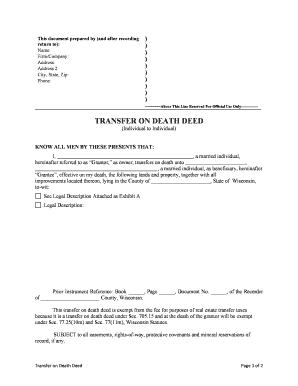

The Transfer Death document, often referred to as the Wisconsin deed of death transfer, is a legal instrument that allows an individual to transfer real estate assets to beneficiaries upon their death without the need for probate. This form is particularly beneficial as it simplifies the process of asset distribution, ensuring that the property passes directly to the designated heirs. The Wisconsin deed of death transfer is designed to be straightforward, enabling property owners to maintain control over their assets while providing clarity on their wishes after passing.

Steps to Complete the Transfer Death

Completing the Wisconsin deed of death transfer involves several key steps to ensure its validity and effectiveness. First, the property owner must fill out the transfer death document accurately, including details such as the property description and the names of the beneficiaries. Next, the form must be signed in the presence of a notary public to authenticate the signatures. After notarization, the completed document should be recorded with the county register of deeds where the property is located. This recording is crucial as it establishes the legal transfer of the property upon the owner's death.

Legal Use of the Transfer Death

The legal framework governing the Wisconsin deed of death transfer is designed to facilitate the seamless transfer of property. Under Wisconsin law, this document must meet specific requirements to be considered valid. It must clearly state the intent to transfer the property upon death, include the legal description of the property, and identify the beneficiaries. Additionally, compliance with state laws regarding notarization and recording is essential to uphold the document's enforceability in a court of law.

Key Elements of the Transfer Death

Several key elements must be included in the Wisconsin deed of death transfer to ensure its effectiveness. These elements include:

- Grantor Information: The full name and address of the property owner transferring the asset.

- Beneficiary Details: Names and addresses of the individuals receiving the property.

- Property Description: A detailed description of the property being transferred, including its legal description.

- Signature and Notarization: The grantor's signature, along with notarization to validate the document.

State-Specific Rules for the Transfer Death

Each state has specific regulations governing the use of transfer death documents. In Wisconsin, it is essential to adhere to the state’s legal requirements, which include proper execution, notarization, and recording of the deed. Additionally, Wisconsin law allows property owners to revoke or modify the transfer death document at any time before their death, provided that the changes are executed in accordance with state laws. Understanding these state-specific rules is vital for ensuring that the transfer is conducted legally and effectively.

Examples of Using the Transfer Death

Utilizing the Wisconsin deed of death transfer can be beneficial in various scenarios. For instance, a homeowner wishing to pass their family residence to their children can use this document to ensure a smooth transition without the complications of probate. Similarly, individuals with investment properties can designate beneficiaries to inherit these assets directly, simplifying the estate management process. These examples highlight the versatility and practicality of the transfer death document in estate planning.

Quick guide on how to complete transfer death

Complete Transfer Death easily on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, as you can access the correct form and securely store it digitally. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents quickly without delays. Handle Transfer Death on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to modify and eSign Transfer Death effortlessly

- Obtain Transfer Death and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or conceal sensitive information with specialized tools that airSlate SignNow offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and eSign Transfer Death and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Wisconsin deed and why is it important?

A Wisconsin deed is a legal document that transfers ownership of real estate in the state of Wisconsin. It's important because it serves as proof of title and ensures that property rights are clearly conveyed. Understanding how to execute a Wisconsin deed correctly is essential for avoiding legal issues in property transactions.

-

How can airSlate SignNow help with creating a Wisconsin deed?

airSlate SignNow provides a user-friendly platform that simplifies the process of creating a Wisconsin deed. With customizable templates and easy drag-and-drop features, you can create legally compliant deeds quickly and efficiently. This saves time and reduces the risk of errors associated with traditional methods.

-

What are the costs associated with using airSlate SignNow for Wisconsin deeds?

airSlate SignNow offers competitive pricing plans that cater to different business needs, allowing you to manage your Wisconsin deed processes affordably. Plans often include unlimited document signing and various integrations, making it a cost-effective solution for your legal document needs. Check our pricing page for more details on specific plans and features.

-

Can I eSign a Wisconsin deed with airSlate SignNow?

Yes, airSlate SignNow allows users to eSign Wisconsin deeds securely and legally. All electronic signatures created through our platform comply with state and federal regulations, ensuring that your documents are valid and enforceable. This feature streamlines the signing process, making it easier for all parties involved.

-

Are there any integrations available with airSlate SignNow for Wisconsin deed processing?

airSlate SignNow offers integrations with various productivity and management tools, enhancing the efficiency of Wisconsin deed processing. You can connect with applications like Google Drive, Salesforce, and more to streamline document management and signing workflows. These integrations help you manage your deeds effectively within your existing systems.

-

What security measures does airSlate SignNow implement for Wisconsin deeds?

Security is a top priority for airSlate SignNow, especially for sensitive documents like Wisconsin deeds. We implement advanced encryption protocols to protect your information during transmission and storage. Additionally, all signing activities are logged for auditing purposes, providing transparency and peace of mind.

-

Can multiple parties eSign a Wisconsin deed using airSlate SignNow?

Absolutely! airSlate SignNow allows multiple parties to electronically sign a Wisconsin deed simultaneously or sequentially. This feature facilitates collaboration among stakeholders and speeds up the transaction process, ensuring that all necessary signatures are collected without hassle.

Get more for Transfer Death

- Subcontractors demand for statement notice to owner by corporation or llc district of columbia form

- Owners statement individual district of columbia form

- Quitclaim deed from husband and wife to husband wife and an individual district of columbia form

- Springing general and durable power of attorney district of columbia form

- District of columbia company search form

- Dc notice 497301526 form

- Deed of distribution personal representative to an individual district of columbia form

- District of columbia llc form

Find out other Transfer Death

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document