Form 1041ME Income Tax Return *2309100* 00 2023-2026

Understanding the Form 1041ME Income Tax Return

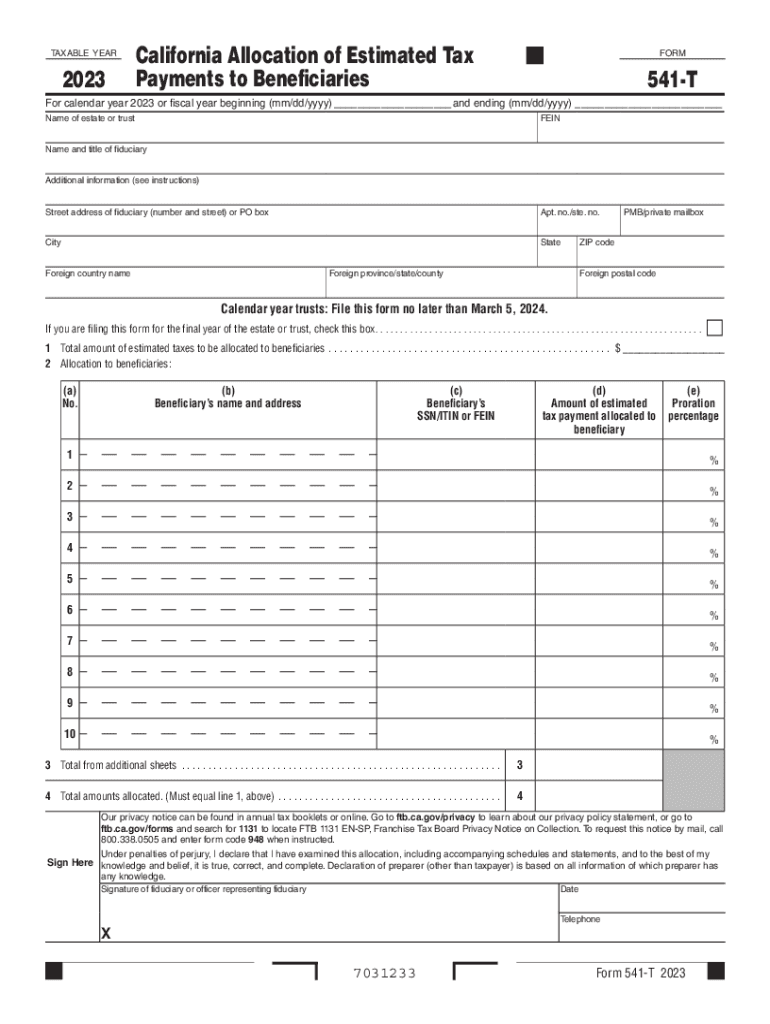

The Form 1041ME is an essential document for income tax reporting in California. It is specifically designed for estates and trusts that generate income. This form allows fiduciaries to report income, deductions, gains, and losses, ensuring compliance with state tax laws. Understanding its purpose is crucial for proper tax management and to avoid penalties.

How to Complete the Form 1041ME Income Tax Return

Completing the Form 1041ME involves several key steps. First, gather all necessary financial documents related to the estate or trust, including income statements and expense receipts. Next, accurately fill out the form, providing detailed information about income sources, deductions, and distributions to beneficiaries. It is important to follow the instructions carefully to ensure all sections are completed correctly.

Obtaining the Form 1041ME Income Tax Return

The Form 1041ME can be obtained through various channels. It is available on the official California tax authority website, where you can download and print it. Additionally, physical copies may be available at local tax offices or libraries. Ensure you have the most current version of the form to comply with any recent changes in tax regulations.

Key Elements of the Form 1041ME Income Tax Return

Several key elements must be included when filling out the Form 1041ME. These include the fiduciary's name and address, the estate or trust's identification number, and a breakdown of income and deductions. It is also important to report any distributions made to beneficiaries, as this information impacts both the fiduciary and the beneficiaries' tax obligations.

Filing Deadlines for the Form 1041ME Income Tax Return

Filing deadlines for the Form 1041ME are crucial to avoid penalties. Generally, the form must be filed by the fifteenth day of the fourth month following the close of the tax year. For estates or trusts that operate on a calendar year, this means the deadline typically falls on April 15. It is advisable to keep track of these dates and file early to ensure compliance.

Penalties for Non-Compliance with the Form 1041ME

Failure to file the Form 1041ME on time or providing inaccurate information can result in significant penalties. These may include fines based on the amount of tax owed or a percentage of the unpaid tax. Additionally, continued non-compliance can lead to further legal consequences. It is essential to take the necessary steps to file accurately and on time.

Create this form in 5 minutes or less

Find and fill out the correct form 1041me income tax return 2309100 00

Create this form in 5 minutes!

How to create an eSignature for the form 1041me income tax return 2309100 00

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is California allocation in the context of airSlate SignNow?

California allocation refers to the method of distributing resources or documents within the state of California using airSlate SignNow. This feature allows businesses to efficiently manage their document workflows, ensuring compliance with local regulations while enhancing productivity.

-

How does airSlate SignNow support California allocation for businesses?

airSlate SignNow provides tools that streamline the California allocation process by enabling users to send, sign, and manage documents electronically. This not only saves time but also reduces the risk of errors associated with manual processes, making it an ideal solution for businesses operating in California.

-

What are the pricing options for airSlate SignNow related to California allocation?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses focusing on California allocation. These plans are designed to be cost-effective, ensuring that companies can access essential features without overspending, making it a smart investment for document management.

-

What features does airSlate SignNow offer for California allocation?

Key features of airSlate SignNow that enhance California allocation include customizable templates, automated workflows, and secure eSignature capabilities. These features help businesses streamline their document processes, ensuring that all allocations are handled efficiently and securely.

-

Can airSlate SignNow integrate with other tools for California allocation?

Yes, airSlate SignNow seamlessly integrates with various third-party applications, enhancing its functionality for California allocation. This allows businesses to connect their existing tools and systems, creating a cohesive workflow that simplifies document management and allocation processes.

-

What are the benefits of using airSlate SignNow for California allocation?

Using airSlate SignNow for California allocation offers numerous benefits, including increased efficiency, reduced paperwork, and improved compliance. By digitizing the allocation process, businesses can focus on their core operations while ensuring that all documents are handled in accordance with California regulations.

-

Is airSlate SignNow suitable for small businesses focusing on California allocation?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses focusing on California allocation. Its user-friendly interface and affordable pricing make it an ideal choice for small enterprises looking to optimize their document workflows.

Get more for Form 1041ME Income Tax Return *2309100* 00

Find out other Form 1041ME Income Tax Return *2309100* 00

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter