California Form 541 2002

What is the California Form 541

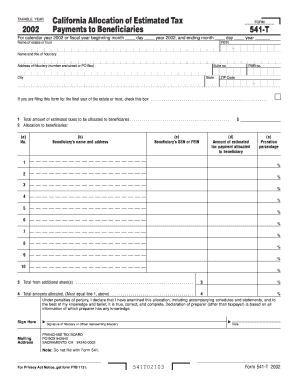

The California Form 541 is a tax return form specifically designed for fiduciaries, such as estates and trusts, to report income, deductions, and tax liabilities to the California Franchise Tax Board. This form is essential for ensuring compliance with state tax laws and accurately reporting financial activities related to the management of an estate or trust. The form captures various types of income, including interest, dividends, and capital gains, and allows fiduciaries to claim deductions for expenses incurred in the administration of the estate or trust.

How to use the California Form 541

Using the California Form 541 involves several key steps. First, gather all necessary financial documents, including income statements and records of expenses related to the estate or trust. Next, fill out the form accurately, ensuring that all income sources and deductions are reported. It is important to follow the instructions provided with the form to avoid errors. Once completed, the form must be signed by the fiduciary and submitted to the California Franchise Tax Board by the appropriate deadline.

Steps to complete the California Form 541

Completing the California Form 541 requires careful attention to detail. Here are the steps to follow:

- Collect all relevant financial documents, such as bank statements, investment records, and receipts for deductible expenses.

- Begin filling out the form by entering the fiduciary's information, including name, address, and taxpayer identification number.

- Report all sources of income received by the estate or trust, ensuring accuracy in amounts and categories.

- List all allowable deductions, such as administrative expenses, taxes paid, and distributions to beneficiaries.

- Calculate the total income and deductions to determine the taxable income.

- Sign and date the form, confirming that the information provided is truthful and complete.

- Submit the completed form to the California Franchise Tax Board by the specified filing deadline.

Legal use of the California Form 541

The legal use of the California Form 541 is governed by state tax laws. To be considered valid, the form must be completed in accordance with the instructions provided by the California Franchise Tax Board. This includes ensuring that all required signatures are present and that the form is submitted by the appropriate deadlines. Compliance with these regulations helps avoid penalties and ensures that the fiduciary meets their legal obligations in managing the estate or trust.

Filing Deadlines / Important Dates

Filing deadlines for the California Form 541 are critical to avoid penalties. Typically, the form is due on the fifteenth day of the fourth month following the close of the taxable year. For estates and trusts operating on a calendar year basis, this means the form is generally due by April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is advisable to check for any specific changes or extensions that may apply each tax year.

Form Submission Methods (Online / Mail / In-Person)

The California Form 541 can be submitted through various methods, providing flexibility for fiduciaries. The form can be filed online through the California Franchise Tax Board's e-filing system, which offers a secure and efficient way to submit tax returns. Alternatively, fiduciaries may choose to mail the completed form to the designated address provided in the instructions. In-person submission is also an option at designated Franchise Tax Board offices, although this may require an appointment. Each method has its own processing times and requirements, so it is important to choose the one that best suits your needs.

Quick guide on how to complete california form 541

Complete California Form 541 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage California Form 541 on any platform using the airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The easiest way to modify and eSign California Form 541 seamlessly

- Locate California Form 541 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your updates.

- Choose your preferred method to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form navigation, or errors that necessitate printing additional document copies. airSlate SignNow meets your needs in document management with just a few clicks from any device of your preference. Modify and eSign California Form 541 and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california form 541

Create this form in 5 minutes!

How to create an eSignature for the california form 541

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the franchise tax board form 541?

The franchise tax board form 541 is a tax return specifically designed for fiduciaries. This form is used to report the income of estates and trusts in California, ensuring compliance with state tax regulations.

-

How can airSlate SignNow help with the franchise tax board form 541?

AirSlate SignNow streamlines the process of filling out and submitting the franchise tax board form 541 by allowing users to eSign and send documents securely. This simplifies compliance and helps ensure that all necessary signatures are collected promptly.

-

Are there any costs associated with using airSlate SignNow for the franchise tax board form 541?

AirSlate SignNow offers a variety of pricing plans that cater to different business needs, including options for users who need to complete the franchise tax board form 541. By utilizing SignNow, businesses can save on traditional printing and mailing costs.

-

What features does airSlate SignNow offer for eSigning the franchise tax board form 541?

AirSlate SignNow provides features like customizable templates, real-time collaboration, and mobile access, making it easy to eSign the franchise tax board form 541 from anywhere. These capabilities help expedite the completion process and enhance document management.

-

Is airSlate SignNow secure for handling sensitive documents like the franchise tax board form 541?

Yes, airSlate SignNow employs advanced encryption and security protocols to protect sensitive documents, including the franchise tax board form 541. This gives users confidence that their information is safe during the signing process.

-

Can airSlate SignNow integrate with other software for filing the franchise tax board form 541?

AirSlate SignNow integrates seamlessly with various third-party applications, enhancing your workflow when preparing the franchise tax board form 541. By connecting with accounting software, users can streamline data entry and document management.

-

What are the benefits of using airSlate SignNow for the franchise tax board form 541?

Using airSlate SignNow for the franchise tax board form 541 provides benefits like enhanced efficiency, reduced turnaround time, and ease of document access. These advantages help businesses manage their tax documentation more effectively.

Get more for California Form 541

Find out other California Form 541

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online