ATT S CORP CALCULATION of FEDERAL TAXABLE INCOME Form

Understanding the ATT S Corp Calculation of Federal Taxable Income

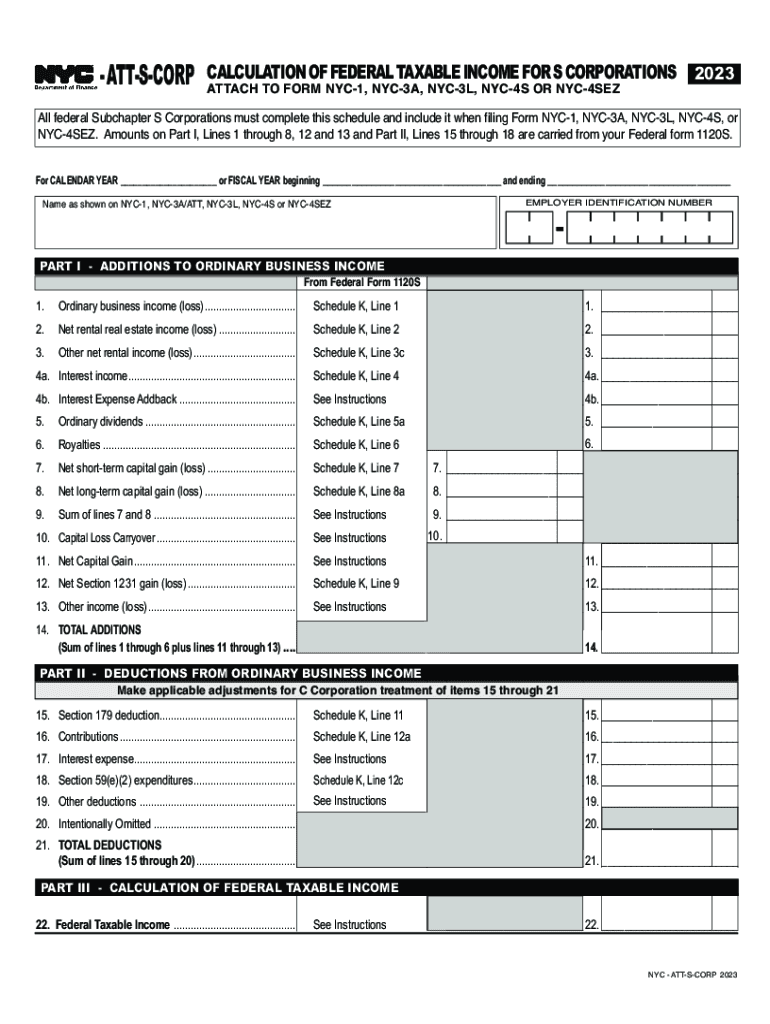

The ATT S Corp Calculation of Federal Taxable Income is a crucial component for businesses operating as S corporations. This calculation determines the amount of income that is subject to federal taxation. It includes various income sources, deductions, and credits that impact the overall taxable income. Understanding this calculation is essential for accurate tax reporting and compliance.

Steps to Complete the ATT S Corp Calculation of Federal Taxable Income

Completing the ATT S Corp Calculation involves several key steps:

- Gather financial records, including income statements and expense reports.

- Identify all sources of income, such as sales revenue and investment income.

- Document allowable deductions, including business expenses and losses.

- Calculate the total income by summing all income sources.

- Subtract total deductions from total income to arrive at the federal taxable income.

Key Elements of the ATT S Corp Calculation of Federal Taxable Income

Several key elements play a vital role in the ATT S Corp Calculation:

- Gross Income: This includes all income received by the corporation before any deductions.

- Deductions: These are expenses that can be subtracted from gross income, such as salaries, rent, and utilities.

- Tax Credits: Certain credits can reduce the overall tax liability, impacting the final taxable income.

- Net Income: The result after deductions and credits are applied to the gross income.

Filing Deadlines for the ATT S Corp Calculation

Timely filing is essential for compliance with tax regulations. The typical deadline for filing the ATT S Corp Calculation is March 15 for calendar year taxpayers. If additional time is needed, businesses can file for an extension, but they must still pay any taxes owed by the original deadline to avoid penalties.

Required Documents for the ATT S Corp Calculation

To accurately complete the ATT S Corp Calculation, several documents are necessary:

- Income statements detailing all revenue sources.

- Expense reports listing all deductions.

- Previous tax returns for reference.

- Any applicable tax forms related to credits and deductions.

IRS Guidelines for the ATT S Corp Calculation

The IRS provides specific guidelines for the ATT S Corp Calculation, ensuring compliance with federal tax laws. These guidelines detail how to report income, claim deductions, and apply for credits. It is important for businesses to stay informed about any changes in tax laws that may affect their calculations.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the att s corp calculation of federal taxable income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how can it help with NYC income loss?

airSlate SignNow is a powerful eSignature solution that enables businesses to send and sign documents efficiently. By streamlining document workflows, it can help mitigate the impact of NYC income loss by reducing operational costs and improving turnaround times.

-

How does airSlate SignNow address the challenges of NYC income loss?

With airSlate SignNow, businesses can minimize delays in document processing, which is crucial during times of NYC income loss. The platform's automation features help ensure that contracts and agreements are executed quickly, allowing businesses to maintain cash flow.

-

What pricing plans does airSlate SignNow offer for businesses facing NYC income loss?

airSlate SignNow offers flexible pricing plans designed to accommodate businesses of all sizes, especially those dealing with NYC income loss. These plans provide essential features at competitive rates, ensuring that companies can manage their expenses effectively.

-

What features does airSlate SignNow provide to support businesses during NYC income loss?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage. These tools are essential for businesses experiencing NYC income loss, as they enhance efficiency and reduce the time spent on document management.

-

Can airSlate SignNow integrate with other tools to help manage NYC income loss?

Yes, airSlate SignNow seamlessly integrates with various business applications, including CRM and accounting software. This integration is vital for businesses facing NYC income loss, as it allows for better data management and streamlined operations.

-

What are the benefits of using airSlate SignNow for businesses affected by NYC income loss?

Using airSlate SignNow can signNowly benefit businesses affected by NYC income loss by improving efficiency and reducing costs. The platform's user-friendly interface and robust features help teams collaborate effectively, ensuring that critical documents are processed without delay.

-

Is airSlate SignNow secure for handling sensitive documents related to NYC income loss?

Absolutely, airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. This ensures that sensitive documents related to NYC income loss are protected, giving businesses peace of mind while managing their operations.

Get more for ATT S CORP CALCULATION OF FEDERAL TAXABLE INCOME

Find out other ATT S CORP CALCULATION OF FEDERAL TAXABLE INCOME

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word