California Form FTB Pub 1005 Adjustments to IRA, Pension

What is the California Form FTB Pub 1005 Adjustments To IRA, Pension

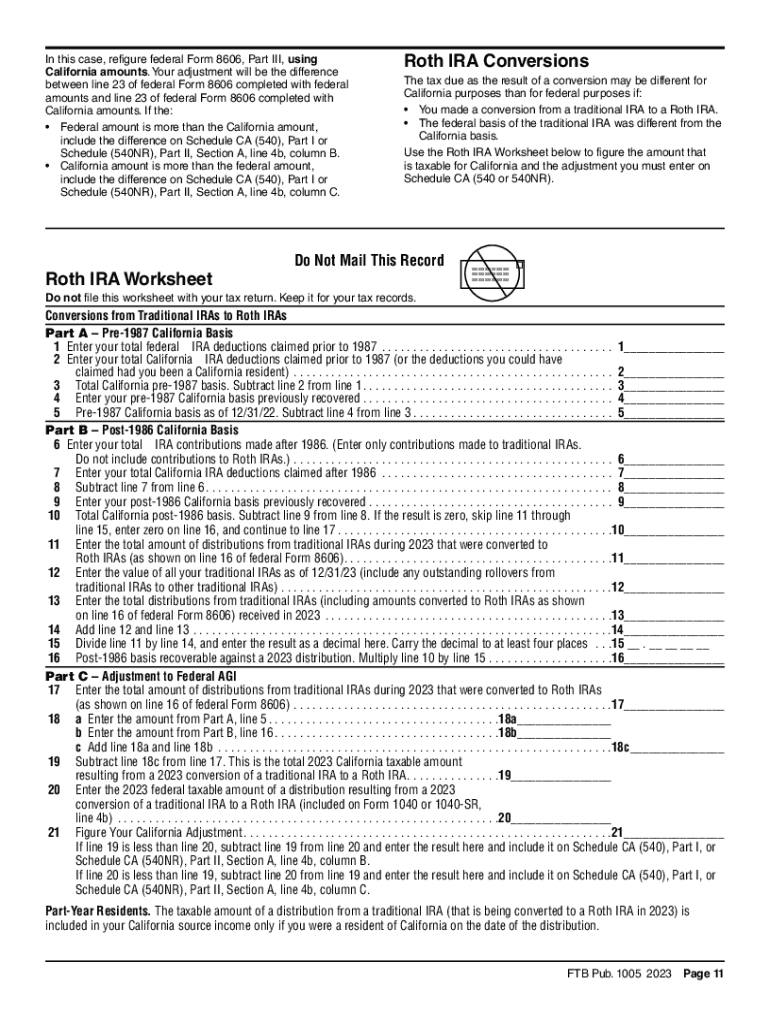

The California Form FTB Publication 1005 provides guidelines for making adjustments related to Individual Retirement Accounts (IRAs) and pensions for California taxpayers. This publication outlines the specific adjustments that may be necessary when reporting income from pensions and annuities on state tax returns. It is particularly relevant for individuals who have received distributions from retirement accounts or pensions, as it helps clarify how these amounts should be treated for California state tax purposes.

How to use the California Form FTB Pub 1005 Adjustments To IRA, Pension

To effectively use the California Form FTB Publication 1005, taxpayers should first review the publication to understand the types of adjustments applicable to their pension or IRA distributions. The form serves as a reference for determining which amounts are taxable and which may be exempt from taxation under California law. Taxpayers can utilize this information to accurately report their income on their California state tax returns, ensuring compliance with state tax regulations.

Steps to complete the California Form FTB Pub 1005 Adjustments To IRA, Pension

Completing the California Form FTB Publication 1005 involves several key steps:

- Review the publication to understand the relevant adjustments for your specific situation.

- Gather necessary documentation, including your pension or IRA distribution statements.

- Determine the taxable and non-taxable portions of your distributions based on the guidelines provided.

- Fill out your California state tax return, incorporating the adjustments as outlined in the publication.

- Keep a copy of the completed form and any supporting documents for your records.

Key elements of the California Form FTB Pub 1005 Adjustments To IRA, Pension

Key elements of the California Form FTB Publication 1005 include:

- Definitions of taxable and non-taxable distributions from IRAs and pensions.

- Examples illustrating how to calculate the taxable amount of distributions.

- Guidance on specific situations, such as rollovers and conversions.

- Instructions for reporting adjustments on your California state tax return.

Eligibility Criteria

Eligibility for utilizing the California Form FTB Publication 1005 primarily depends on whether you have received distributions from an IRA or pension. Taxpayers must have a valid California tax identification number and must be filing a California state tax return. Additionally, the adjustments outlined in the publication apply to various taxpayer scenarios, including retirees and individuals receiving annuities.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines related to the California Form FTB Publication 1005. Typically, California state tax returns are due on April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be mindful of any changes to deadlines that may arise due to special circumstances, such as natural disasters or legislative changes.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california form ftb pub 1005 adjustments to ira pension

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is FTB Publication 1005?

FTB Publication 1005 is a guide provided by the California Franchise Tax Board that outlines the requirements for reporting income and deductions for California residents. It is essential for individuals and businesses to understand this publication to ensure compliance with state tax laws.

-

How can airSlate SignNow help with FTB Publication 1005 compliance?

AirSlate SignNow offers a streamlined solution for sending and eSigning documents related to FTB Publication 1005. By using our platform, businesses can ensure that all necessary forms are completed accurately and submitted on time, reducing the risk of errors and penalties.

-

What features does airSlate SignNow provide for managing FTB Publication 1005 documents?

AirSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are crucial for managing FTB Publication 1005 documents. These tools help users efficiently handle their tax-related paperwork while maintaining compliance with state regulations.

-

Is airSlate SignNow cost-effective for small businesses dealing with FTB Publication 1005?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses managing FTB Publication 1005. Our pricing plans are flexible and cater to various business sizes, ensuring that even small enterprises can access essential eSigning features without breaking the bank.

-

Can I integrate airSlate SignNow with other software for FTB Publication 1005 management?

Absolutely! AirSlate SignNow offers integrations with popular accounting and tax software, making it easier to manage FTB Publication 1005 documents. This seamless integration allows users to streamline their workflow and enhance productivity when handling tax-related tasks.

-

What are the benefits of using airSlate SignNow for FTB Publication 1005?

Using airSlate SignNow for FTB Publication 1005 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and stored securely, giving you peace of mind during tax season.

-

How does airSlate SignNow ensure the security of FTB Publication 1005 documents?

AirSlate SignNow prioritizes the security of your documents, including those related to FTB Publication 1005. We utilize advanced encryption and secure cloud storage to protect sensitive information, ensuring that your data remains confidential and compliant with regulations.

Get more for California Form FTB Pub 1005 Adjustments To IRA, Pension

- Cbm writing prompts pdf form

- Layby form template

- Future generali motor claim satisfaction voucher download form

- Bachpan play school admission form pdf

- Form 12bb download excel

- Fillable online cjis 8102s sex offender registration form

- The family court of the state of delaware in and f form

- Sample ex parte motion for custody 100902101 form

Find out other California Form FTB Pub 1005 Adjustments To IRA, Pension

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors