Illinois Form REG 1Fill Out and Use This PDF

What is the Illinois Form REG 1?

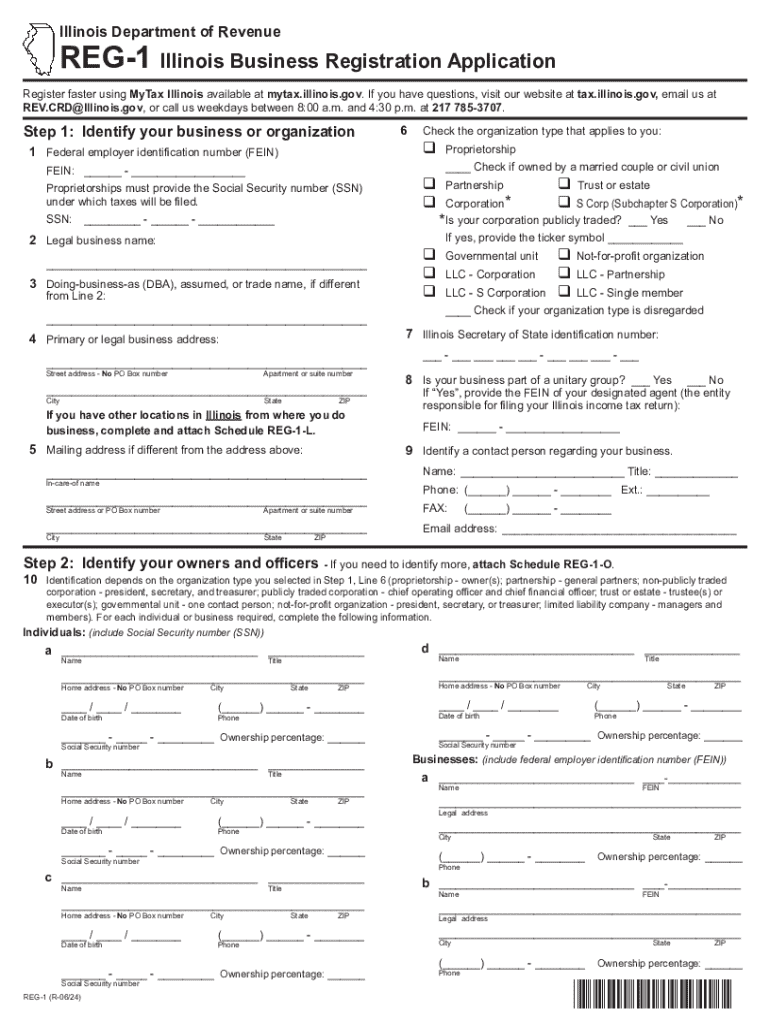

The Illinois Form REG 1 is a business registration application used by entities looking to register for various tax obligations in the state of Illinois. This form is essential for businesses that need to obtain a sales tax identification number, which allows them to collect sales tax from customers. The REG 1 form is applicable to various business structures, including corporations, partnerships, and sole proprietorships.

Steps to Complete the Illinois Form REG 1

Completing the Illinois Form REG 1 involves several key steps:

- Begin by entering your business name and address accurately to ensure correct identification.

- Provide the type of business entity, such as LLC, corporation, or partnership.

- Include the owner's information, including Social Security number or federal employer identification number.

- Indicate the specific tax types for which you are registering, such as sales tax or income tax.

- Review all information for accuracy before submission to avoid processing delays.

How to Obtain the Illinois Form REG 1

The Illinois Form REG 1 can be obtained through the Illinois Department of Revenue's website. It is also available at local government offices and can be requested by mail. For convenience, businesses can fill out the form online and submit it electronically, which streamlines the registration process.

Form Submission Methods

There are multiple methods for submitting the Illinois Form REG 1:

- Online: Businesses can complete and submit the form electronically through the Illinois Department of Revenue's online portal.

- Mail: The completed form can be printed and mailed to the appropriate address provided on the form.

- In-Person: Businesses may also choose to submit the form in person at designated state offices.

Key Elements of the Illinois Form REG 1

Understanding the key elements of the Illinois Form REG 1 is crucial for accurate completion:

- Business Information: This section requires the legal name and address of the business.

- Owner Information: Details about the owner or responsible party must be provided, including contact information.

- Tax Types: Specify the types of taxes the business will be responsible for collecting or paying.

- Signature: The form must be signed by the owner or an authorized representative to validate the submission.

Eligibility Criteria

To use the Illinois Form REG 1, businesses must meet certain eligibility criteria. This includes being a legal entity operating within the state of Illinois and intending to engage in taxable activities. Additionally, businesses must provide valid identification information, such as a Social Security number or federal employer identification number, to complete the registration process.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the illinois form reg 1fill out and use this pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Form REG 1?

The Illinois Form REG 1 is a registration form used by businesses to register for various taxes in the state of Illinois. This form is essential for ensuring compliance with state tax regulations and is a crucial step for any business operating in Illinois.

-

How can airSlate SignNow help with the Illinois Form REG 1?

airSlate SignNow simplifies the process of completing and submitting the Illinois Form REG 1 by allowing users to eSign and send documents securely. Our platform ensures that your registration forms are filled out correctly and submitted on time, reducing the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the Illinois Form REG 1?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solution provides access to features that streamline the completion and submission of the Illinois Form REG 1, making it a valuable investment for your business.

-

What features does airSlate SignNow offer for managing the Illinois Form REG 1?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for the Illinois Form REG 1. These tools enhance efficiency and ensure that your registration process is smooth and compliant with state requirements.

-

Can I integrate airSlate SignNow with other software for the Illinois Form REG 1?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to manage the Illinois Form REG 1 alongside your existing tools. This integration helps streamline your workflow and enhances productivity.

-

What are the benefits of using airSlate SignNow for the Illinois Form REG 1?

Using airSlate SignNow for the Illinois Form REG 1 offers numerous benefits, including time savings, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled efficiently, allowing you to focus on growing your business.

-

How secure is airSlate SignNow when handling the Illinois Form REG 1?

airSlate SignNow prioritizes security and compliance, ensuring that your Illinois Form REG 1 and other documents are protected with advanced encryption and secure storage. You can trust that your sensitive information is safe while using our platform.

Get more for Illinois Form REG 1Fill Out And Use This PDF

Find out other Illinois Form REG 1Fill Out And Use This PDF

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now